Rectification Deed – All You Need to Know

What is Deed of Rectification

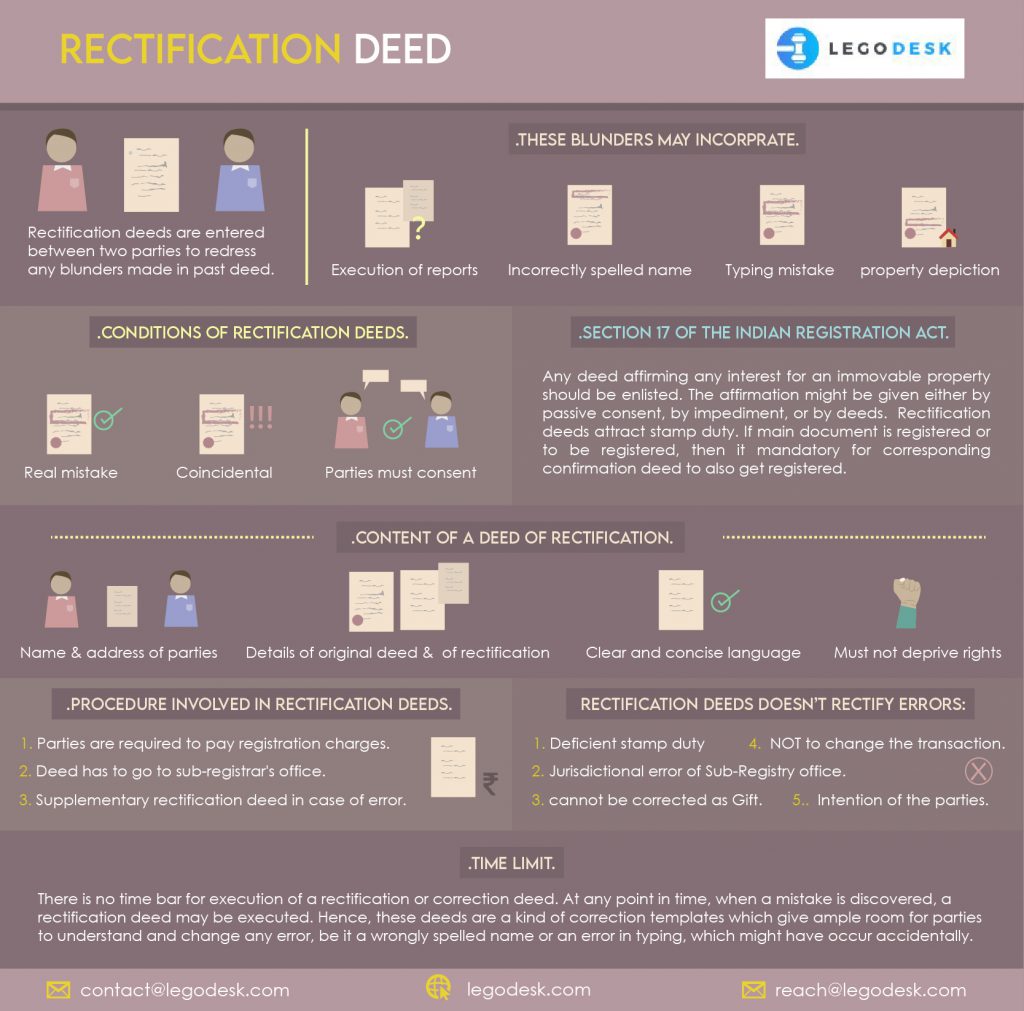

Amendment or Confirmation deeds are otherwise called Rectification deeds. They are entered between two parties to redress any blunders made in a past deed. These blunders may incorporate a typing mistake, an incorrectly spelled name, a blunder in the property depiction, or some other mistake in the execution of the reports. These oversights can be later redressed through a Rectification or Confirmation deed.

Read Also: Promissory Note Meaning in India

Following are the conditions under which rectification deeds are made

(a) The mistake must be real.

(b) It must be coincidental, not deliberate.

(c) All the parties must consent to the rectification thereof.

Section 17 of the Indian Registration Act, 1908

The Indian Registration Act, 1908 governs Rectification deeds. As indicated by Section 17 of the Act, any deed affirming any interest for an immovable property should be enlisted. The affirmation might be given either by passive consent, impediment, or deeds. Rectification deeds attract stamp duty. If the main document is registered or to be registered, then it mandatory for the corresponding confirmation deed to also get registered.

Try Your All in one legal practice management software – Sign Up Now!

The content of a Deed of Rectification

a) Name and address of the parties involved.

b) Details of the original deed and description of the rectification to be made.

c) Must have clear and concise in language to avoid future complications.

d) Should not alter the scope of the original document or violate any regulations.

e) Must not deprive the party of their rights.

Read Also – Section 154 of Income Tax Act

The procedure involved in Rectification deeds

The parties must first mutually agree to the deed and then proceed to a duly executed document.

The parties are required to pay rectification deed registration charges and stamp duty as per the laws of the State. Charges are Rs/-100 for each.

The deed then has to go to the sub-registrar’s office where the original deed has been duly registered.

If by any chance there is an error of any kind in the rectification deed, a supplementary rectification deed shall be executed by paying stamp duty and registration charges, provided that the error must be genuine, inadvertent, and not intentional in nature. The parties must agree to the same thereof.

Read Also – Most Common Types of Deeds in India

A rectification deed can rectify only factual errors and not those which involve errors of law such as,

a) Deficient stamp duty

b) A jurisdictional error of the Sub-Registry office

c) The basic character of the transaction e.g. Sale transaction cannot be corrected as Gift

d) It is meant to rectify defects in the original deed NOT to change the nature of the transaction OR Intention of the parties involved

Read Also – Validity of Stamp Papers

In case the parties involved do not agree to the said rectification or amendment of the documents executed, the aggrieved party may file a suit under Section 26 of the Specific Relief Act, 1963. The court, by virtue of its power, can direct the rectification of an instrument if the deed does not express any real intention of the parties.

Format

DEED OF RECTIFICATION

This DEED OF RECTIFICATION is executed at this the day 2004 between

s/o residing at

hereinafter referred to the RECTIFIER/VENDOR which term includes its successors and assigns of the ONE PART;

AND

s/o residing at

hereinafter referred to as PURCHASER which term includes his heirs, executors, administrators, representatives and assigns of the OTHER PART

WHEREAS the property more fully described in the Schedule hereunder was sold by the Rectifier/Vendor in favour of the purchaser herein in and by sale deed dated and registered as Document No. of Book1 volume filed at pages to on the file of the Sub Registrar of hereinafter referred as the Principal Deed.

WHEREAS in the Principal Deed dated in line of page No. and inline

of page the Survey number of the property was wrongly typed as instead of .

WHEREAS this typographical error has come to the knowledge of the above said Purchaser and requested the Rectifier/Vendor to rectify the same.

NOW, THIS DEED OF RECTIFICATION WITNESSETH AS FOLLOWS:

That is the Principal Deed dated in line of page No. and in line of page No. the Survey number of the property conveyed is wrongly typed as is rectified as

by this Deed of Rectification.

That as rectified as aforesaid, the Principal sale Deed shall remain in full force and effect.

That no consideration has been received by the RECTIFIER/VENDOR for executing this Deed of Rectification.

SCHEDULE OF PROPERTY

(As in the Principal Deed)

SCHEDULE OF PROPERTY

(Rectified by this deed of Rectification)

Present Market Value of the Property is Rs.

In Witness whereof the RECTIFIER/VENDOR and the PURCHASER have set their hands on the day and month year first above written in the presence of

WITNESS RECTIFIER/VENDOR

PURCHASER

No Time Limit

There is no time bar for the execution of a rectification or correction deed. At any point in time, when a mistake is discovered, a rectification deed may be executed.

Hence, these deeds are a kind of correction templates which give ample room for the parties to understand and change any error, be it a wrongly spelled name or an error in typing, which might have occurred accidentally.

Try our Debt Resolution solutions today Request a Demo

Thanks for posting this.

Hi…my deed has no title of my name so how to add my name tittle in my deed …..can I register online or go any other??? please approve me .. wait for your reply??thanks

Hi,

I just registered a property. Which was on name of owner and co owner. 1st owner is mother and second owner is her son under age. Now bank ask for court approval for amount disbursement.

How long and how much time/money needed for this?

Any suggestions

Hello sir

I registered my grandpa’s land with given property tax no from panchayat but now they said its not your number and you don’t have any number if you need property tax number apply for new number I dont know what I am going to do please suggest me