What Lawyers can include in a Cheque Bounce Notice?

The cheque bounce notice is a legal notice sent by an advocate on behalf of his client to recover the unpaid amount of the cheque. It is served in accordance with Section 138 of the Negotiable Instrument Act of 1881. This notice is the information given to the defaulting debtor (i.e., drawer) by the unpaid creditor (i.e., the payee). Information about the returned cheque from the bank. It is intimidation to pay the unpaid amount within 15 days of receiving this notice.

What is cheque bounce or dishonor of cheque?

Cheque is a Negotiable Instrument through which one person agrees to pay a certain due amount to the other person. This means that even if the person cannot pay the amount right now, he has agreed to pay it in the future. Cheque bounce or dishonor of cheque demonstrates the incapacity of the drawer to pay off the amount on the due date or the date agreed upon. It is a criminal offense as per Section 138 of the Negotiable Instrument Act of 1881. This Section protects the rights of unpaid creditors against defaulting debtors.

Check the limitation period before drafting the cheque bounce notice

According to Section 138 of the Negotiable Instrument Act of 1881, few things must be present in a valid notice. If these things are not considered before drafting then it will not come under the purview of Section 138 of the NI Act.

- The payee must present the cheque to the bank within 6 months from its issue date.

- In the case of a post-dated cheque, it must be presented before the expiration of the validity period.

- The notice is to be sent within the limitation period of one month from the date of receiving of cheque return memo from the bank.

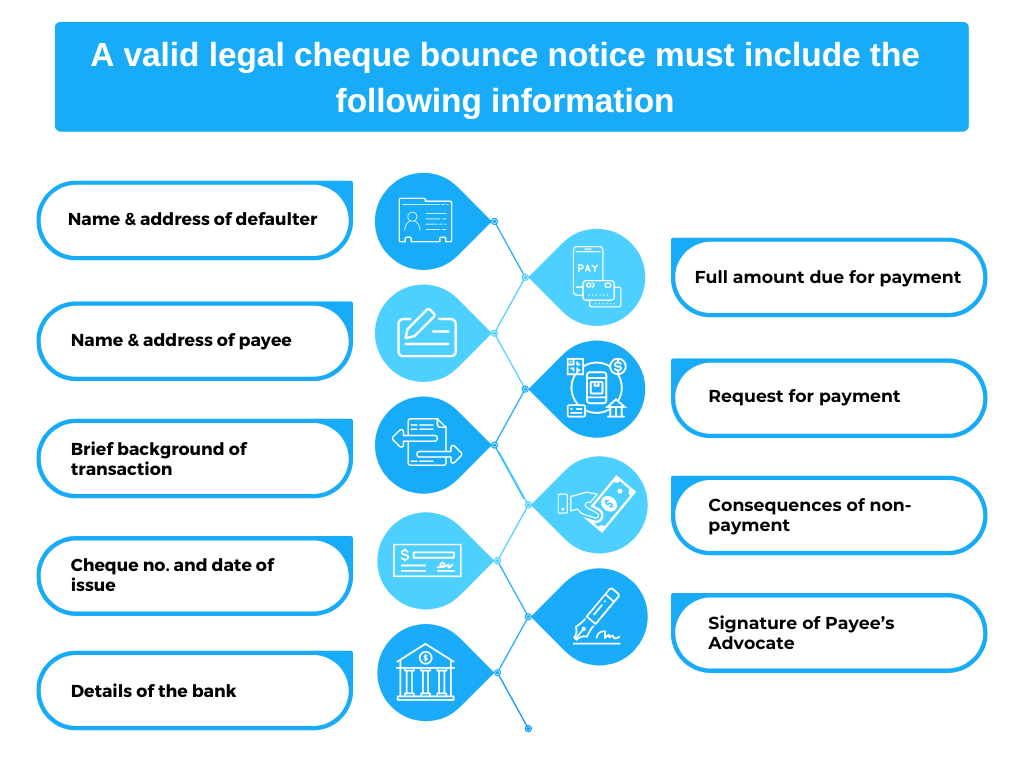

What to include in a valid legal cheque bounce notice?

- Name & address of defaulter (drawer): At the beginning of the cheque bounce the notice address with the full name of defaulting debtor (i.e., drawer). The complete address of the drawer. In case the defaulter is a company, mention the full name of the company along with its office location.

- Name & address of payee: Begin the notice by writing the subject of the notice. In the subject, the lawyer needs to refer to Section 138 of the Negotiable Instrument Act of 1881. In the first clause, mention the name of the unpaid creditor (i.e., payee or your client). Along with the name, and full address, followed by occupation. In case your client is a company gives details of the full name of the company. State the law, which incorporates the company and its registered office location. You can also include a little description of the nature of the business of the company.

- Brief background of transaction: Add a brief history of facts about the transaction between your client and the other party covering what exactly led your client to send this notice today. The transaction background must contain how the communication proceeded between the parties. Mention if it is through email. Description of purchased products during the transaction (if any) or any offered services. The main purpose of this clause is to remind the party about the promise he made for consideration.

- Cheque no. and date of issue: Mention the issued date of the cheque. In the same clause where we are mentioning the background of the transaction. Following the date of the issued cheque, also include the cheque number. Tell the opposite party that on this date, they have agreed to pay the following amount to your client.

- Details of the bank: Mention the bank details pertaining to the default cheque. The details of the bank will include the full name of the bank and the branch of the bank.

- Reason for cheque bounce (as mentioned in the cheque return memo): It is a must for a banker to give the information to a payee about the unpaid cheque within 3 days of the cheque bounce. The bank sent the information in form of a “cheque return memo”. The cheque return memo contains the reason for returning the cheque. Draft a clause mentioning the same reason as stated in the cheque return memo. The clause will also include the specific date on which the bank sent the cheque return memo to the payee.

- Full amount due for payment: In the cheque bounce notice, while addressing the other party, state the full amount that is due to him. It is advisable to write the due figure in both the numeric form and the word form. The main purpose behind writing the amount in both forms is to ensure accuracy. Writing this way helps the reader to focus on each figure more.

- Request for payment of the amount due: After giving the information about the due amount, make a request for the payment in full amount. Also, state that as per Section 138, the other party has 15 days to pay the unpaid amount. 15 days after serving this notice.

- Consequences of non-payment: Mention the consequences of non-payment of the cheque amount as per Section 138 of the Negotiable Instrument Act, 1881. The notice must mention that, after 15 days, if the amount is unpaid, then criminal proceedings will begin.

- Signature of Payee’s Advocate: A cheque bounce notice with no sign of an advocate is a sign of invalid notice. So, it is a must for a lawyer to put his signature and name at the end of the notice. In case the law firm is sending the notice, then add the Law Firm’s full name and address in it. At the end of the notice, it is also advisable to include where you are expecting to get the reply. Mention the valid e-mail address or postal address where you wish to get the reply.

Procedure after drafting cheque bounce notice

After completing the notice, print it on white paper or the Firm’s letterhead and send it to the other party. An advocate can keep one copy of the notice with themselves for future reference. The legal notice can arrive at the defaulters’ address either by post or digital channels.

Try our Debt Resolution solutions today Request a Demo