Unveiling the Key Credit Score Factors: A Guide for Businesses, Fintechs, and Banks

Credit scoring models are critical tools used by lenders, financial institutions, and even fintech companies to evaluate the creditworthiness of borrowers. This section will explore the commonly used models such as FICO, VantageScore, and specialized industry-specific models. We’ll delve into the components that these models take into account, such as payment history, credit utilization, length of credit history, and more. By gaining a deeper understanding of these models, readers will be better equipped to navigate the credit landscape and make informed financial choices.

The Significance of Credit Scores

Credit scores are pivotal in the world of finance, influencing lending decisions, interest rates, and financial opportunities. This section elucidates the profound importance of credit scores for individuals, businesses, and financial institutions. It explores how credit scores serve as a barometer of financial health and impact various aspects of economic life, from securing loans to obtaining favorable insurance rates and even influencing job opportunities.

Credit Score Demystified

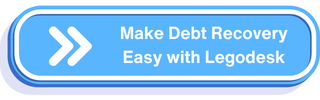

Credit scores are numerical representations of an individual’s or business’s creditworthiness, and they are generated based on a variety of factors. This section is dedicated to unraveling the essential components that contribute to credit scores, providing a detailed exploration of each factor:

- Payment History: The most significant factor in most credit scoring models, payment history tracks whether you’ve paid your bills on time. Late payments, defaults, or accounts in collections can significantly lower your credit score.

- Credit Utilization: This factor measures how much of your available credit you’re using. High credit card balances relative to your credit limit can negatively impact your score.

- Length of Credit History: The age of your credit accounts matters. A longer credit history typically results in a higher score, as it provides a more extended track record for assessing your financial responsibility.

- Types of Credit: Credit scoring models consider the mix of credit accounts you have, such as credit cards, loans, mortgages, and retail accounts. A diverse mix can positively influence your score.

- Credit Inquiries: Each time you apply for new credit, a hard inquiry is made on your credit report. Multiple inquiries in a short period can have a detrimental effect on your score, as it may suggest financial instability.

- Public Records: This includes bankruptcies, tax liens, and civil judgments. These negative public records can have a significant and long-lasting impact on your credit score.

- Derogatory Marks: These encompass any negative notations on your credit report, such as late payments, charge-offs, or accounts in collections.

- Recent Activity: Recent changes in your credit history, such as opening new accounts or closing old ones, can impact your credit score, sometimes in the short term.

- Available Credit: Your total available credit and the proportion of it that you’re using, known as credit utilization, are considered. Maintaining a low credit utilization ratio is generally favorable.

- Payment Patterns: Consistency in making on-time payments over an extended period reflects positively on your credit score, while erratic payment patterns can raise concerns.

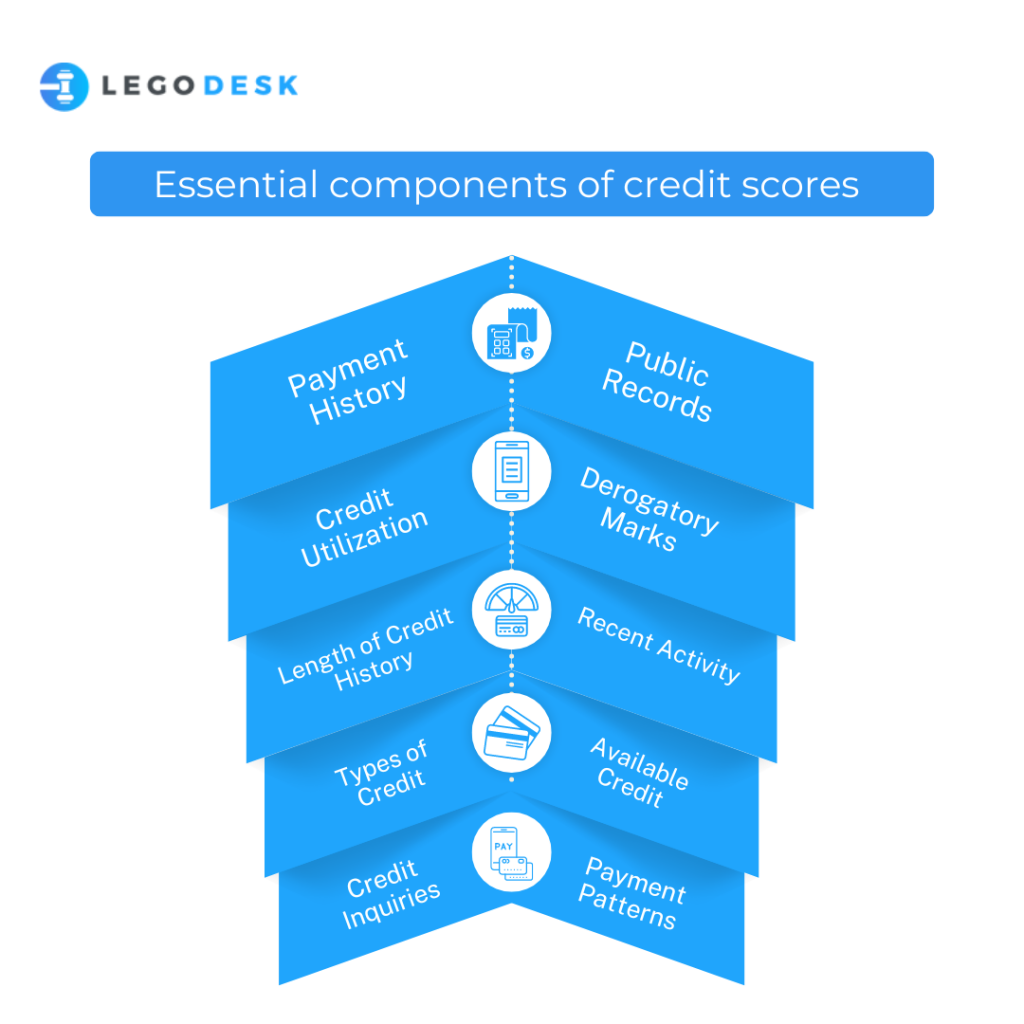

Impact of Credit Scores on Lending Decisions

1. Loan Approvals:

Credit scores are a primary determinant in whether a borrower’s loan application is approved or denied. Lenders use credit scores as a quick and objective way to assess the risk associated with lending money. Borrowers with higher credit scores are generally more likely to have their loan applications approved, while those with lower scores may face difficulties in obtaining credit.

2. Interest Rates:

Credit scores also heavily influence the interest rates borrowers are offered. Lenders use credit scores to assess the level of risk a borrower represents. Those with excellent credit scores typically qualify for lower interest rates, which can translate into significant savings over the life of a loan. Conversely, borrowers with lower scores may be offered loans with higher interest rates to compensate for the perceived risk.

3. Loan Terms:

Credit scores can impact the terms of a loan, including the loan amount and repayment period. Borrowers with higher credit scores are more likely to qualify for larger loan amounts and more favorable repayment terms. On the other hand, those with lower scores may have access to smaller loans and shorter repayment periods.

4. Credit Limits:

For credit cards and revolving credit accounts, credit scores are used to determine the credit limit assigned to the borrower. Higher scores often result in higher credit limits, allowing individuals to access more credit.

5. Mortgage Approval:

When applying for a mortgage, credit scores are a crucial factor. They can affect the approval process and the type of mortgage available. Borrowers with lower scores get subprime or higher-cost mortgage options, while those with excellent scores can access prime mortgage rates.

6. Insurance Premiums:

Some insurance companies use credit scores to assess risk and determine insurance premiums. Lower credit scores can lead to higher premiums for auto, home, or even health insurance.

7. Rental Applications:

Landlords may consider credit scores when evaluating rental applications. Lower scores may lead to a higher security deposit requirement or even rental application rejections.

8. Employment Opportunities:

In some industries and positions, employers may review credit reports as part of the hiring process. While they don’t see your credit score, a poor credit history can raise concerns about an applicant’s financial responsibility.

9. Utility Services:

Utility companies, such as electricity and gas providers, may check credit scores when setting up new service accounts. Lower scores might require a higher deposit to establish service.

Improving Credit Scores: Tips for Individuals and Businesses

Tips for individuals and businesses looking to improve their credit scores:

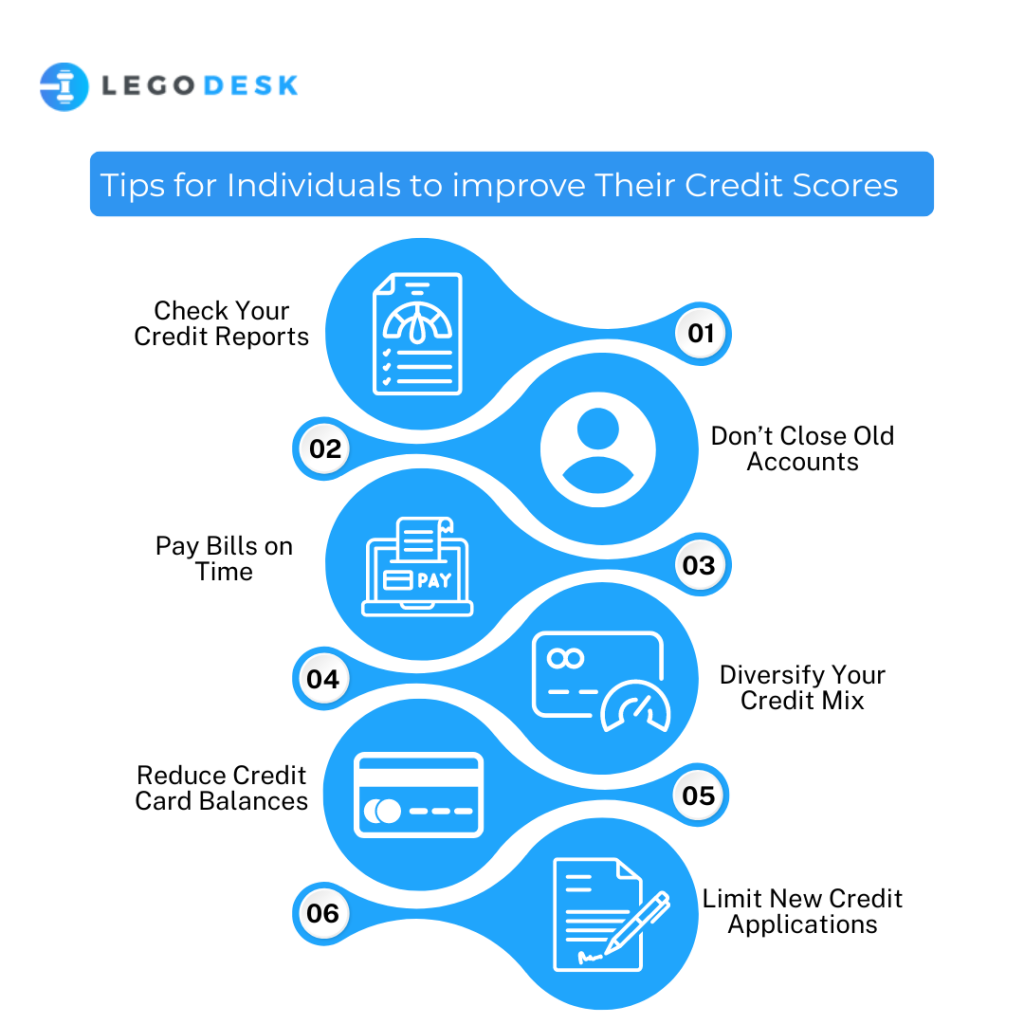

For Individuals:

- Check Your Credit Reports: Start by obtaining free copies of your credit reports from the major credit bureaus (Equifax, Experian, and TransUnion). Review these reports for errors, inaccuracies, or fraudulent activity. Dispute and correct any discrepancies promptly.

- Pay Bills on Time: Consistently making on-time payments is one of the most significant factors in improving your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

- Reduce Credit Card Balances: High credit card balances relative to your credit limit can negatively impact your credit score. Aim to keep your credit card utilization below 30% of your available credit limit. Pay down high-interest debts first.

- Don’t Close Old Accounts: The length of your credit history matters. Closing old credit accounts can shorten your credit history, which may lower your credit score. Keep older accounts open, even if you don’t use them frequently.

- Diversify Your Credit Mix: A healthy mix of different types of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score. However, don’t open new credit accounts unnecessarily, as each application can result in a hard inquiry, which may temporarily lower your score.

- Limit New Credit Applications: Be selective when applying for new credit. Frequent credit inquiries can signal financial instability to creditors. Apply for credit only when necessary and when you’re confident in approval.

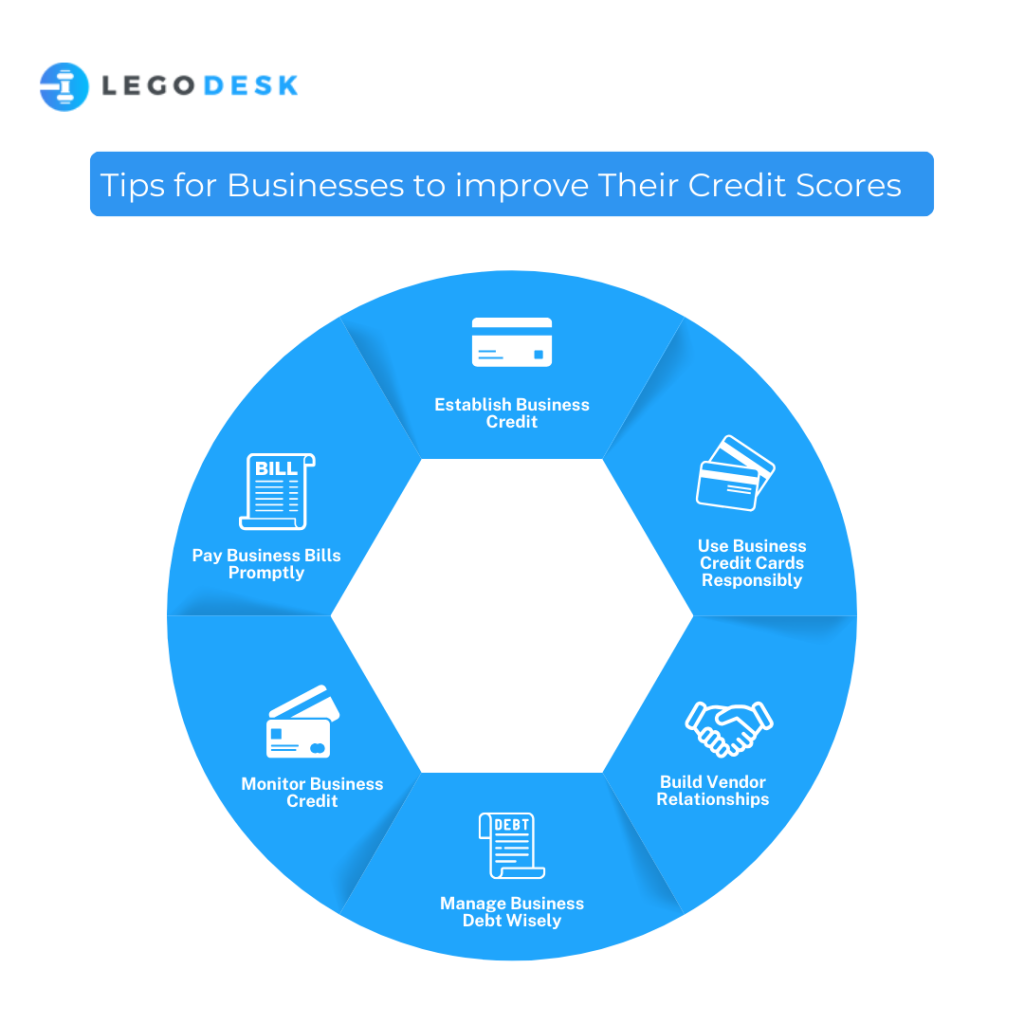

For Businesses:

- Establish Business Credit: Separate your business credit from personal credit by establishing a dedicated business credit profile. This can help protect your personal assets and provide more financing options for your business.

- Pay Business Bills Promptly: Just as individuals should pay bills on time, businesses should do the same. Consistently meeting financial obligations demonstrates reliability and positively impacts business credit.

- Monitor Business Credit: Regularly check your business credit reports from agencies like Dun & Bradstreet, Experian Business, and Equifax Business. Address any inaccuracies or discrepancies promptly.

- Manage Business Debt Wisely: Keep business debt levels in check and avoid overextending your credit. Utilize business credit responsibly to fund growth and expansion.

- Build Vendor Relationships: Establish strong relationships with vendors and suppliers who report payment data to business credit bureaus. Timely payments to vendors can improve your business credit score.

- Use Business Credit Cards Responsibly: Business credit cards can be a valuable tool for managing expenses and building business credit. Pay off balances in full each month to avoid high interest charges.

Conclusion

In summary, improving credit scores is a vital undertaking for individuals and businesses alike, with far-reaching implications for financial well-being and opportunities. By diligently following the provided guidance, both individuals and businesses can build stronger credit profiles, secure better loan terms, and position themselves for a more prosperous financial future. Whether it’s realizing personal financial goals or achieving business growth, the journey to better credit scores begins with responsible financial management and a commitment to financial success.

Try our Debt Resolution solutions today Request a Demo