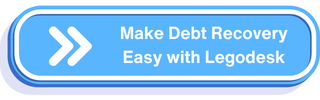

10 Ways To Make Debt Recovery Easier!

We know how difficult it is to try and recover debts from people who do not seem willing or able. Clients and consumers get late in their accounts for a variety of reasons. Clients can fall behind on payments and prohibit you from collecting money, whether it’s due to ill health, lost work, or a bad customer service experience. Every year, governments, healthcare providers, energy corporations, credit card companies, and enterprises of all sorts owe billions of dollars. Because of obsolete debtor information, debtors failing to connect with you, or a lack of technology and tools to simplify your efforts to contact debtors and offer them numerous opportunities to pay what they owe you, recovering debt income may not always be straightforward.

We’ve compiled a list of X ways to make debt recovery easier to assist you to collect as much debt revenue as possible. The following suggestions will assist you and your team in learning new revenue-generating tactics, with suggestions organized to help you discover the information you need quickly.

1. Obtain accurate customer identification information

Collect information such as a copy of the customer’s driver’s license, a phone number, a workplace, and contact info for references when they sign up for utility services. Having this information makes it easy to hunt down clients who have fallen behind on their payments. If the delinquent customer has ‘disappeared,’ you can call references in one of the worst scenarios.

2. Write a formal demand letter to delinquent customers

For any debt collection case, you should always have a solicitor draught a legal demand letter on your behalf. As a debt collector, you must follow certain regulations. A formal demand letter should include a description of the services at issue, the date(s) of service, a demand for the total amount owing, payment instructions, a particular payment deadline, and specific repercussions for nonpayment. Never add any threats or punishments that you do not plan to execute entirely. Lenders should deliver a demand letter certified mail with a return receipt request, and any invoices or other related documentation as attachments.

3. Make use of all your options

Is it conceivable to participate in both debt collection and refund presentment simultaneously? Yes, lenders can start client collections before filing a refund dispute to avoid debt growth.

It is feasible to participate in both at the same time since debt collection is more correctly regarded as a legal concern, whereas debt collections are connected to industry rules as determined by banks. If a lender is successful in fighting a refund, the issuing bank will return the funds to them. With collections, the lender will obtain a legally binding order requiring the client to settle the debt.

4. Balance debt collection with customer retention

The threat of disconnection is such a consequence that might be employed to recover outstanding debts, implying that lenders have the option of being more aggressive than they are today. Non-household clients, on the other hand, have the option of choosing their service provider, therefore initiatives must be properly balanced with client service and maintenance efforts. Threatening disconnection might easily lead to important clients migrating to another provider; consequently, a gentler rehabilitation strategy may be preferable in most circumstances. Lenders must weigh the long-term benefits of increased collections rates against the short-term benefits of increased collections rates.

Read the Strategies for Debt: Debt Recovery Strategies for Different Types of Debt

5. Define the debtor’s rights and obligations as early as possible

Effective debt collection methods ensure that parties’ rights and obligations are clearly stated from the beginning in any written conditions of trade, credit applications, or invoices.

This makes it easier to take recovery action at a later date and assures that the creditor firm is in a strong position to claim payment.

6. Take care when making collection decisions

Collecting past-due accounts is a tricky balancing act. On the one hand, a company can rarely afford to be careless when it comes to collection calls and demand letters. To keep loyal clients, however, lenders should evaluate any external events, such as economic conditions, that may impair a customer’s short-term ability to pay and, where possible, make adjustments to the credit policy. Furthermore, a lender should consider the expense (in terms of funds) of any collection attempts against the actual amount that may be recovered when selecting how to collect on an overdue account.

7. Set a rate of interest for your debtors

You might be surprised to learn that when you add interest or financing charges to your current bills, not only will the settlement be done faster, but you’ll also get the interest payment. It is common knowledge that most businesses will pay interest-bearing invoices first and defer payment of non-interest-bearing invoices until collection efforts have begun. A majority of businesses use a rolling line of credit. Your client can gain interest on the money owed to them by not settling the unpaid bill.

8. Get in touch with late-paying customers as soon as possible

One good technique is to contact clients as soon as their account becomes problematic since you’ll have a larger selection of options for dealing with the issue before late penalties and interest charges mount.

A company that specializes in mortgage collections, for example, contacts clients as soon as they are three days late with a transaction. This allows them to assess the client’s financial condition and intentions, as well as consider solutions like folding late payments into the bill or waiving specific costs. This organization creates and maintains a positive relationship with its clients by acting quickly, avoiding future problems and losses.

9. Develop a risk-based collection policy

You’ll also have to establish rules for dealing with risk-based collections. Many factors can occur during the procedure that will influence how you should handle it. When a client has experienced a personal tragedy, your staff may need to contact them in a different way. You might also run into problems with customer excuses, clients who can’t be reached, and other challenges and roadblocks that aren’t expected to be part of a collections officer’s routine. To address the matter as efficiently as possible, you must put up methods and policies for your personnel. Your staff should follow them when these difficulties arise.

Read Also – Loan recovery made easy with legal platforms

10. Automate debt collection process

Lenders can minimize the lost revenue due to failed transactions and bad debt with automated debt collection software. It can also warn firms of potential collection issues early on, giving them the chance to address them. Data reveals that collecting past due invoices becomes increasingly difficult as they get older. Payment declines cause attrition, but automated debt recovery software reduces it.

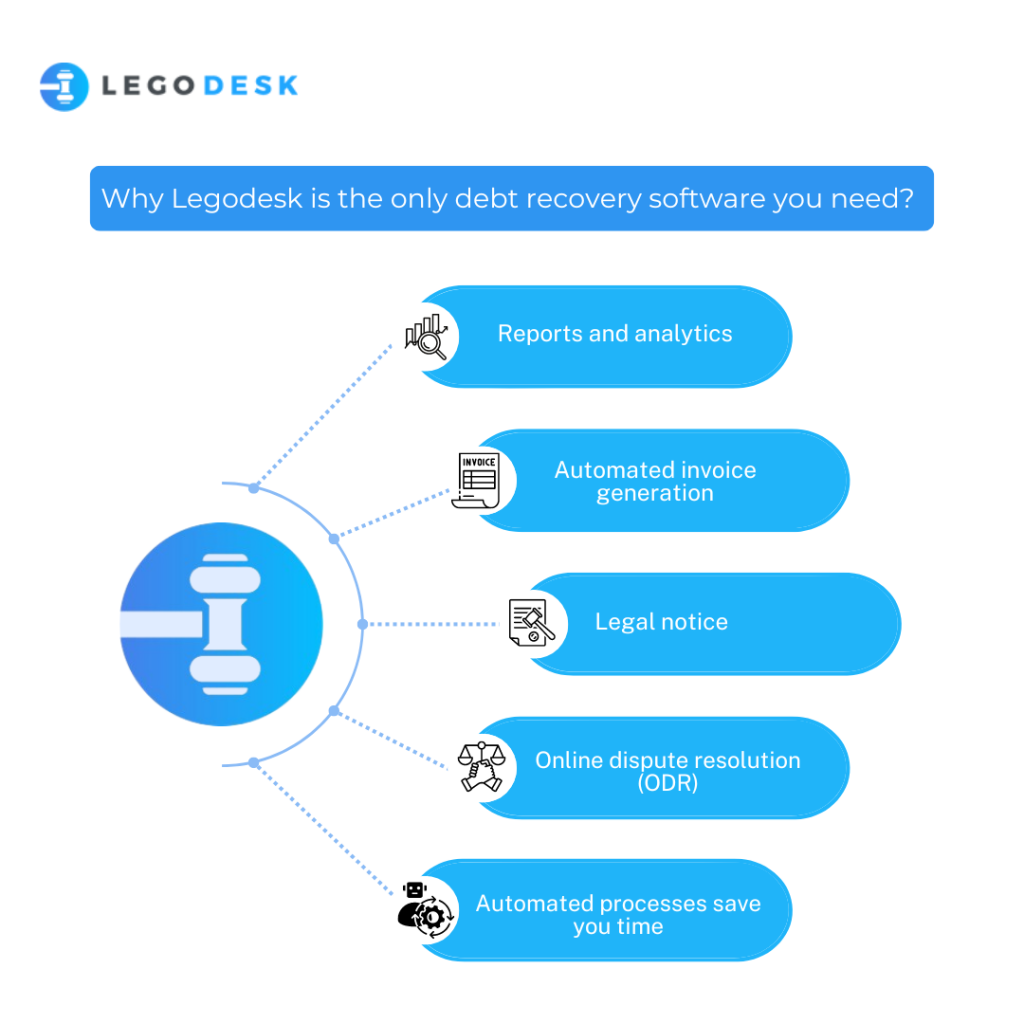

Why Legodesk is the ideal tool for debt recovery?

Legodesk is a cloud-based legal management software that is aimed to make the lives of legal practitioners easier. Legodesk’s innovative platform contains one-of-a-kind debt recovery software that simplifies loan recovery. With debt collection software like Legodesk in place, you can keep better records and avoid wasting time chasing bills. You’ll also improve communication between the agency and your clients, which will lead to increased loyalty and repeat business.

Read Also – Invoice management for Law firms

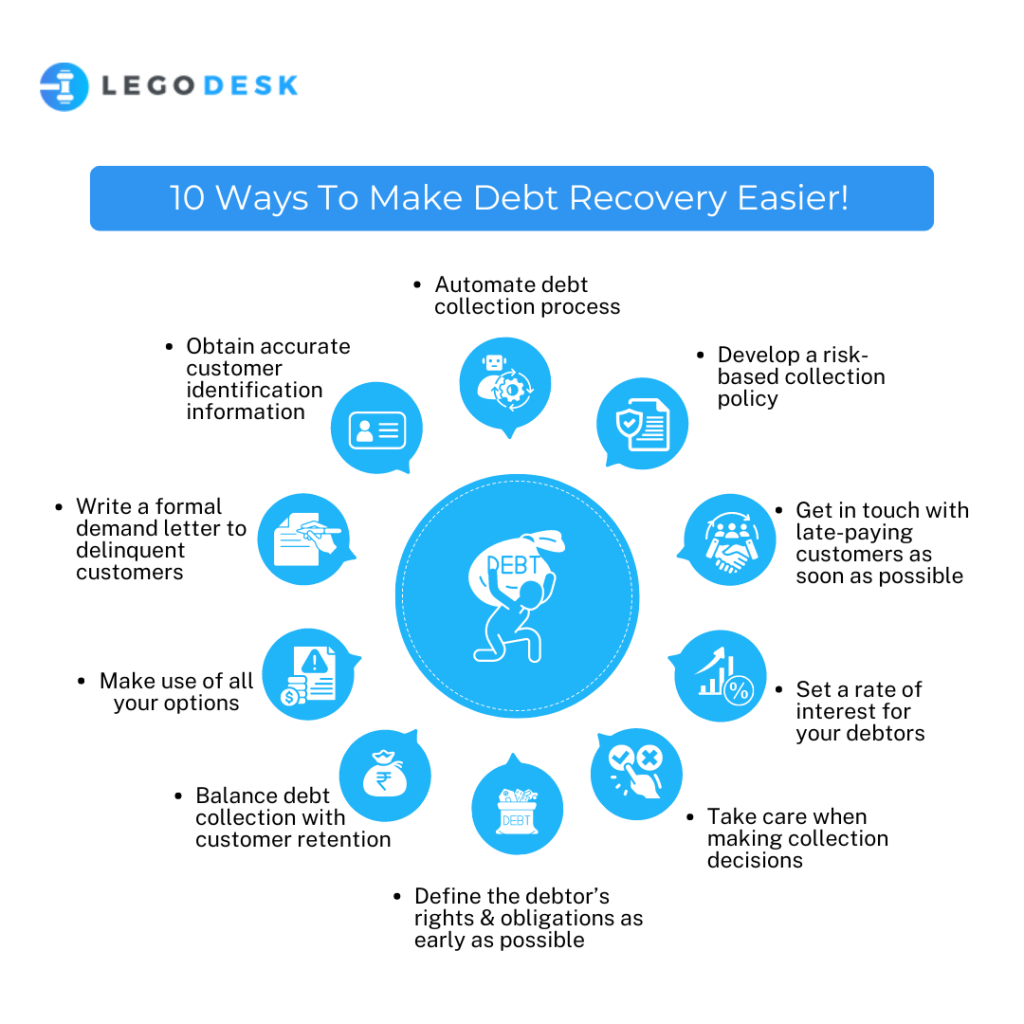

5 Reasons why Legodesk is the only debt recovery software you need

- Reports and analytics

- Automated invoice generation

- Legal notice

- Online dispute resolution (ODR)

- Automated processes save you time

Legodesk provides a full loan lifecycle management solution through its debt recovery software. Also, covering the cracks in the loan recovery process. Therefore, legal professionals can improve operational efficiency through automation and lesser staff involvement. It also has cheap operating costs, which makes it much more appealing to lending firms to use it!