Starting a Business? Ensure Legal Compliance with Easy Steps

Starting a Business? Ensure Legal Compliance with Easy Steps

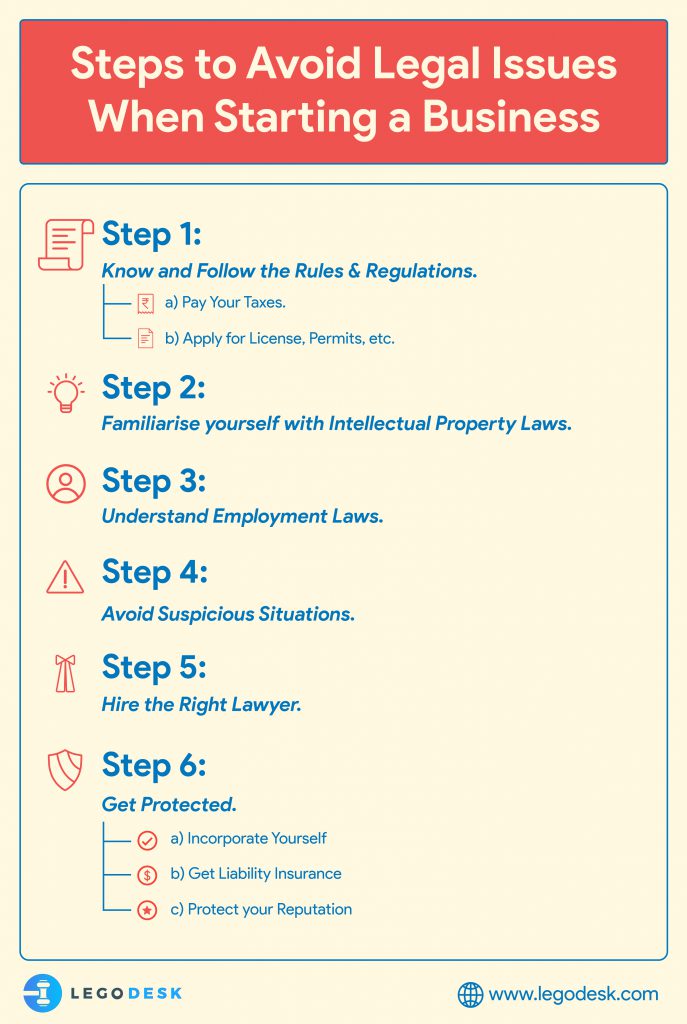

Many people aspire to start their own business, but succeeding in the competitive marketplace is easier said than done. Many business owners jump into this competitive marketplace without doing enough research when it comes to covering their legal bases. If there’s one thing you need to do when starting your business, it’s making sure you are operating within the boundaries of the law. Now more than ever, businesses need to understand the law in order to protect their bottom line and avoid actions that would result in a closeout. On that note, here are a few steps to keep in mind to avoid legal problems when starting a new business.

Looking for a legal counsel? Find the best one by registering with Legodesk. Sign up now!!!

Step 1: Know and Follow the Rules & Regulations

a) Pay Your Taxes.

Every business owner is legally required to pay taxes. This includes income tax, self-employment taxes, and for some businesses, sales tax. It’s wise to hire an accountant or tax advisor to make sure you are compliant with all tax laws. Accounting software can also help you figure when to file taxes and what forms you need to fill out. You must also comply with any Environmental Laws that may apply to you. These are things that shouldn’t come as an afterthought, considering the implications for non-compliance. Educating yourself about these laws goes a long way, so be sure to learn as much as you can about legal structures and corporate governance.

Read Also – Village Accountant

b) Apply for License, Permits, etc.

Depending on your type of business and where it’s located, you might need specific business licenses and permits from your country, state, or city. Money Service Business Registration provide services such as currency exchange, money transmission, check cashing, and virtual currency transactions. Licenses, permits, and registrations come in many variations. Examples include local business licenses, building permits, health safety-related permits, permits for home-based businesses, fire permits, industry-related permits (like running a legal practice, hospitality, construction, or manufacturing business), liquor licenses, and more. The possibilities are many, so make sure to do thorough research—perhaps with the help of your counsel—on what you need to be compliant with the law in your area.

Step 2: Familiarise yourself with Intellectual Property Laws

Intellectual property or IP laws are a tricky subject, to begin with. Nonetheless, it’s one aspect of business law that entrepreneurs shouldn’t take lightly, considering the fact that IP infringement has cost businesses lakhs and crores of rupees in damages. Trademark and copyright violations aren’t something that can or should be shrugged off, so every budding entrepreneur should take time to ensure that the name they’ve chosen for their business isn’t already trademarked. If you launch a new company and begin advertising your operations without checking if your name is already taken, you could receive a cease and desist form or even a subpoena in the mail.

This can also happen if you are doing your business using another Company’s technology. Always read the fine print of the contracts and ensure that there aren’t any restrictions or commercialization limitations.

Step 3: Understand Employment Laws

Understanding employment laws is also essential since labor disputes can cause you to lose a substantial amount in terms of liabilities. But the worst that could happen is when your business reputation gets tainted. Not many people would like to work with a business that doesn’t take care of its employees. It is important that you know the right actions to take when it comes to handling labor issues and know about the legal consequences of firing an employee.

It is also important that you have well-written offer letters with non-competes, mutual agreement to arbitrate clauses, and other protective addendums of the employees you hire, from the very beginning. Make sure to keep counter-signed copies on file and formally document reviews and disciplinary write-ups. Diligence upfront will save you a lot of time and money in the future.

Further, it is also advisable to create a company handbook and make sure everyone in the company is aware and understands your company’s legal liabilities just as well as you do—as a business owner, you could be liable for anything your employees do while representing your organization.

Step 4: Avoid Suspicious Situations

Avoiding conflicts of interest and suspicious employees might also seem self-evident and yet many small business owners fall prey to unscrupulous employees, contractors, or even clients. Do your research. When hiring employees. Conduct background checks and perform screening. Audit your finances quarterly. Require your clients and customers to pay you in a timely fashion, and get all your contracts in writing. Ask for legal advice from a Financial Advisor and tax attorney and ensure that your books are in order. You will not only keep away from trouble but might also be in a position to get hidden tax-breaks.

Step 5: Hire the Right Lawyer

Every business needs a good lawyer to call upon when things inevitably go wrong. In this day and age, it’s only a matter of time until you’re dealing with a lawsuit, and when the subpoenas arrive you’re going to want solid legal expertise to rely on. Thoroughly vet the lawyers in your area and don’t be afraid to ask them why they’re the best choice for your business. You can even ask for recommendations from your business partners. That way, you can hire the right person to form your legal team.

Looking for a legal counsel? Find the best one by registering with Legodesk. Sign up now!!!

Step 6: Get Protected

As your small business becomes more successful, it also becomes more vulnerable. There are many potential disasters that can harm your business, and you need to be prepared to defend yourself as you grow. Protect your small business from technological and financial threats as well as threats to its reputation by being prepared and vigilant about prevention strategies. Here are 3 ways you can protect your business.

a) Incorporate Yourself

Many business owners operate as sole proprietorships. While this is one of the easiest and least expensive paths to starting a small business, it also carries serious financial risks. If a company in a sole proprietorship is sued, the owner’s personal assets could easily be lost in the resulting settlement or judgment. That’s why incorporating is a good idea. Establishing your small business as an LLP or private limited company or OPC will protect your personal assets. If the worst should happen and your business goes under, your life won’t go with it.

b) Get Liability Insurance

General Liability Insurance is perhaps the most important time of insurance covers any business can have, as it keeps you safe from generic claims of wrongdoing and will ensure you can keep the lights on should you be sued. Some additional insurance coverages to consider include:

-

Workman Compensation Insurance

The policy covers the statutory liability of an employer for death or bodily injuries caused to employees due to accidents arising out of and during the course of employment.

-

Errors & Omissions Insurance (E&O)

It is a form of liability insurance. It protects companies against the full costs of a claim made by a client against a professional who provides advice or a service such as a consultant, financial adviser, insurance agent, or a lawyer.

-

Directors and Officers Liability Insurance (D&O)

It is a form of insurance coverage intended to protect individuals from personal losses if they are sued as a result of serving as a director or an officer of a business or other type of organization.

-

Commercial Umbrella Insurance

It can extend your business’ liability coverage. For example, if a liability claim exceeds the limits of your liability policy, your commercial umbrella insurance can help pay the remaining costs of the claim.

Talk to your insurance agent about what is appropriate for your small business. Each business has different needs.

c) Protect your Reputation

Be careful what you say and do online! Social media has become a cornerstone of doing business. Use social media responsibly. Keep your tone inviting and civil online. Get the right message out to potential clients/customers. Hire or assign a trusted person to act as a representative of the social media platforms of your business. Have a plan in place to establish and protect your online reputation.

Conclusion

Not every entrepreneur venturing into a new business can see the legal trouble coming from a mile away. Starting a company means lots of surprises, but a lawsuit shouldn’t be one. It’s better to be prepared for the worst-case-scenarios so you are always in a position to protect yourself and handle any situation that comes your way.

Looking for a legal counsel? Find the best one by registering with Legodesk. Sign up now!!!