Peer-to-Peer Lending: Overview & Legalities

(P2P) or Peer-to-peer lending is a system through which people, hitherto unknown to each other, can directly borrow money from one another. P2P platforms act as the aggregator between borrowers and lenders. These platforms carry out essential due diligence and credit checks on borrowers. They allow lenders to choose suitable borrowers to lend money.

Moreover, the platforms also assist lenders by segregating borrowers into different risk profiles; based on credit score and income bracket. The loans given out are mostly unsecured personal loans of small ticket size (less than 1 lakh) for very short tenures.

Regulation in India

The P2P lending in India is regulated by the Master Directions for NBFC Peer to Peer Lending Platform issued by the RBI in 2017.

1. “Peer-to-Peer Lending Platform” means an intermediary providing the services of loan facilitation via online medium or otherwise to the participants defined as an individual, a body of individuals, a HUF, a firm, a society or any artificial body, whether incorporated or not.

2. Only an NBFC (Non-Banking Financial Company) can register as a P2P lender with the permission of RBI. The NBFC should obtain a certificate of registration from the RBI.

3. The company should have a minimum net worth of ₹2 crores.

4. The NBFC-P2P has to undertake due diligence on the borrowers and lenders. It is obligated to undertake credit assessment and risk profiling of the borrowers and disclose the same to their prospective lenders.

5. They must require the prior and explicit consent of the borrowers and lenders to access their credit information.

6. The platform must submit information on transactions and borrowers to credit bureaus.

7. It is the responsibility of the NBFC-P2P to undertake documentation of loan agreements and other related documents, provide assistance in the disbursement and repayments of loan amount and render services for recovery of loans originated on the platform.

8. The NBFC-Peer-to-Peer has to maintain a minimum Leverage Ratio of 2. (Leverage ratio refers to outside liabilities of an NBFC-P2P Platform divided by its owned funds. Customers’ funds lent/borrowed by using the platform is not reckoned as outside liability of the platform).

9. The NBFC-P2Ps are restricted from accepting deposits, lending its fund, providing any credit guarantee, trading in securities, allowing the international flow of funds, and trading of any products except loan-specific insurance products.

10. The transfer of funds in the P2P platform will be through the mechanism of escrow accounts operated by a bank promoted trustee. The P2P should maintain two escrow accounts, one for receiving the funds from lenders, and another for collections from borrowers. The P2P shall not deal in cash transactions.

11. The interest rate should be in annualized percentage rate format.

12. The NBFC-P2P is responsible for the actions of its service providers, including recovery agents.

13. It has to process all data concerning its activities and participants and maintain storage of the data on hardware located within India.

14. The NBFC P2P has to maintain utmost confidentiality with respect to the transactions as undertaken through the platform and maintain a grievance redressal mechanism at all times for the internal as well as outsourced activities.

Furthermore, certain limits have been placed in the regulations by RBI to diversify the risk of investors.

1. All lenders shall submit a declaration to P2P platforms that they have understood all the risks associated with lending transactions and that the P2P platform does not assure return of principal/payment of interest.

2. An investor/lender cannot lend more than ₹50 lakh in aggregate to all borrowers across Peer-to-peer platforms.

3. If an investor lends more than ₹10 lakh, they have to submit a net worth certificate of minimum ₹50 lakh from a practising chartered accountant to the P2P platform.

4. An investor cannot lend more than ₹50,000 to a single borrower.

5. A single borrower cannot borrow more than ₹10 lakh in aggregate across all P2P platforms.

6. The maximum tenure of these loans cannot exceed 36 months or 3 years.

Loan Defaults

Peer-to-peer loan portfolios do have non-performing assets (NPAs). As long as the NPAs can be absorbed by the NBFC or fintech within the spread (the difference between the lending rate and borrowing rate), the lender’s return does not get affected. According to Liquiloans, a leading P2P lending platform, gross NPAs ranged from 0.4- 0.6% in the 2021 financial year.

If a borrower is unable to make their loan payments, the lender may have to take steps to recover the unpaid amount. This can involve working with the borrower to come up with a plan to catch up on missed payments, or it may involve more aggressive measures such as legal action. It is important for both borrowers and lenders to understand the terms of their loan agreement and the options available for loan recovery in the event of default.

Legal Options in case of Default

In India, there are a few legal options that a lender can pursue if a borrower fails to pay back a peer-to-peer (P2P) loan. Some of the most common options include:

- Demand notice: The lender can send a legal notice to the borrower, demanding payment of the outstanding loan amount. This is typically the first step in the legal process and gives the borrower an opportunity to make the payment before legal action begins.

- Civil suit: If the borrower does not respond to the demand notice or is unable to make the payment, the lender can file a civil suit in a court of law. The court will hear both sides of the case and make a ruling on the matter.

- Recovery proceedings: In case the court finds in favor of the lender and the borrower is unable to pay the loan amount in full, the lender can initiate recovery proceedings to recover the money owed. This can include property or bank account attachment, and sale of assets.

- Criminal proceedings: In some cases, if the borrower has cheated or defrauded the lender, the lender can file a criminal complaint with the police and initiate criminal proceedings.

It is important to note that the framework for recovery and legal action would be as per the agreement and terms between the lender and the borrower. In case there is no specific agreement, then general civil and criminal laws of the country would be applicable.

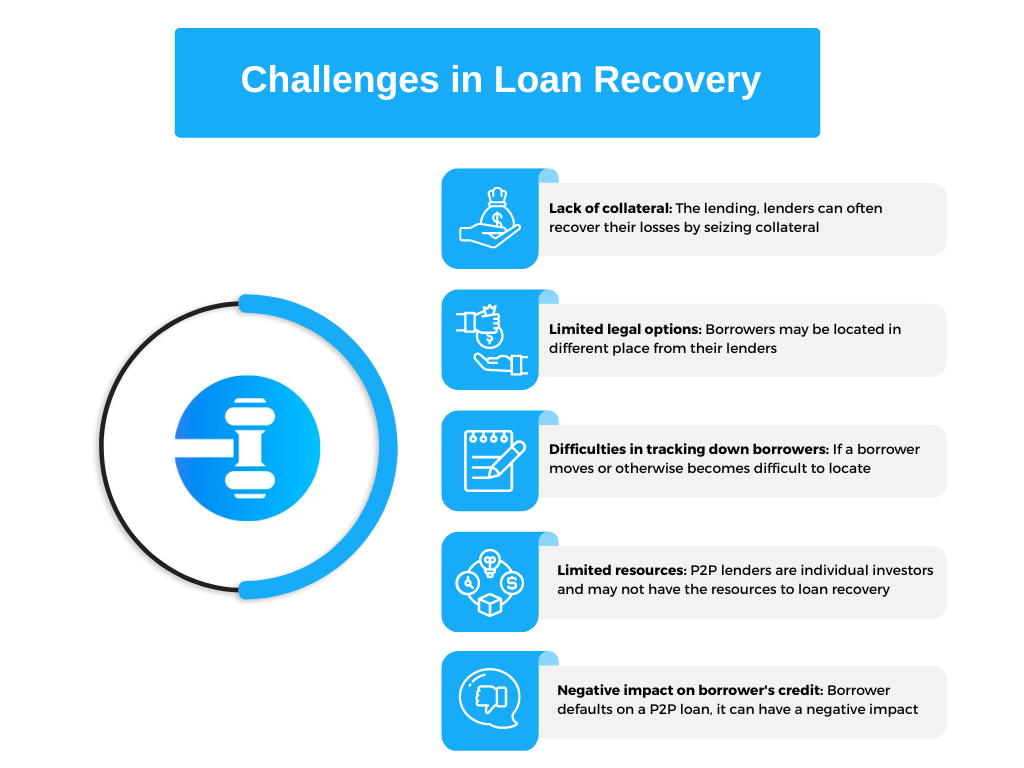

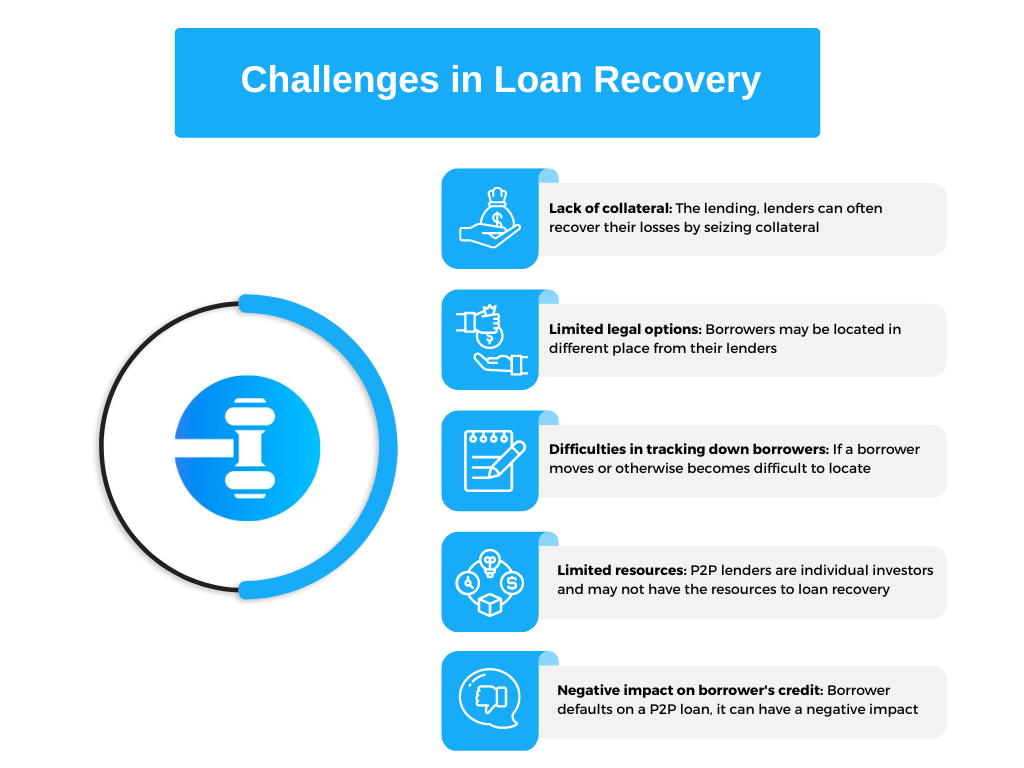

Challenges in Loan Recovery

There can be a number of challenges involved in loan recovery in the peer-to-peer lending space. Some of these challenges include:

- Lack of collateral: In traditional lending, lenders can often recover their losses by seizing collateral (e.g., a car or a house) if a borrower defaults on their loan. However, P2P loans do not require collateral, which can make recovery more difficult.

- Limited legal options: In some cases, borrowers may be located in different states or countries from their lenders, which can make it more difficult to pursue legal action to recover unpaid loans.

- Difficulties in tracking down borrowers: If a borrower moves or otherwise becomes difficult to locate, it can be challenging for lenders to recover their loans.

- Limited resources: Many P2P lenders are individual investors rather than large financial institutions, and may not have the resources to devote to loan recovery efforts.

- Negative impact on borrower’s credit: If a borrower defaults on a P2P loan, it can have a negative impact on their credit score, which can make it more difficult for them to borrow in the future. This may discourage borrowers from working with lenders to come up with a plan to repay their loans.

How Technology Can Help

Legal technology platforms such as Legodesk can play a crucial role in loan recovery in the peer-to-peer lending space. Some of them are:

- Data analysis:

By analyzing data on borrowers’ credit history; P2P lending platforms can predict which borrowers are at risk of defaulting on their loans. This information can predict borrower behavior and spot the warning signs sooner. They can reach out to relevant individuals at an earlier stage to ensure any potential delinquencies are addressed before entering litigation or auctioning of the asset. This makes the targeted recovery efforts more effective. - Automated payment reminders:

P2P platforms can automate emails or text messages to remind borrowers when their loan payments are due. This can help to reduce the number of defaults due to borrowers simply forgetting to make a payment. - Fraud detection:

Advanced algorithms and machine learning techniques can help P2P lending platforms to identify and prevent fraudulent activity, which can help to reduce the number of defaults due to borrowers intentionally avoiding repayment. - Communication tools:

P2P lending platforms can provide lenders with tools to communicate with borrowers and work out repayment plans or negotiate modified terms. - Legal assistance:

Some P2P lending platforms offer legal assistance to lenders who are trying to recover unpaid loans, which can help to streamline the process and increase the chances of a successful recovery.

Conclusion

As peer-to-peer lending offerings become more mainstream, leveraging technological innovations can help accelerate financial growth and inclusion. Other than evolving as a prominent investment avenue, this can be a mighty source to bridge the current credit gap. This can ensure the flow of investments from those with excess to those in need.