Loan Loss Provisioning – The Latest RBI Guidelines

The RBI is expected to release a new set of guidelines for loan loss provisioning.

It has already released a discussion paper that expands on its views about the existing rules and the need for change along with proposing a new approach. RBI has already received comments from various stakeholders on questions posed by the discussion paper. The financial industry is currently waiting for further action on the issue.

In this guide, we’d like to cover the basics of loan loss provisioning and the latest RBI guidelines along with why the RBI has felt a need for change.

What is Loan Loss Provisioning?

Loan loss provisioning is a process undertaken by financial institutions to anticipate and prepare for potential losses resulting from loans that may default or become delinquent. It involves setting aside funds from a bank’s earnings to cover expected losses on loans that are deemed to be at risk of default.

The purpose of loan loss provisioning is to ensure that banks have adequate reserves to absorb potential losses and maintain financial stability. By setting aside funds for expected loan losses, financial institutions can mitigate the impact of defaults on their balance sheets and protect depositors’ funds.

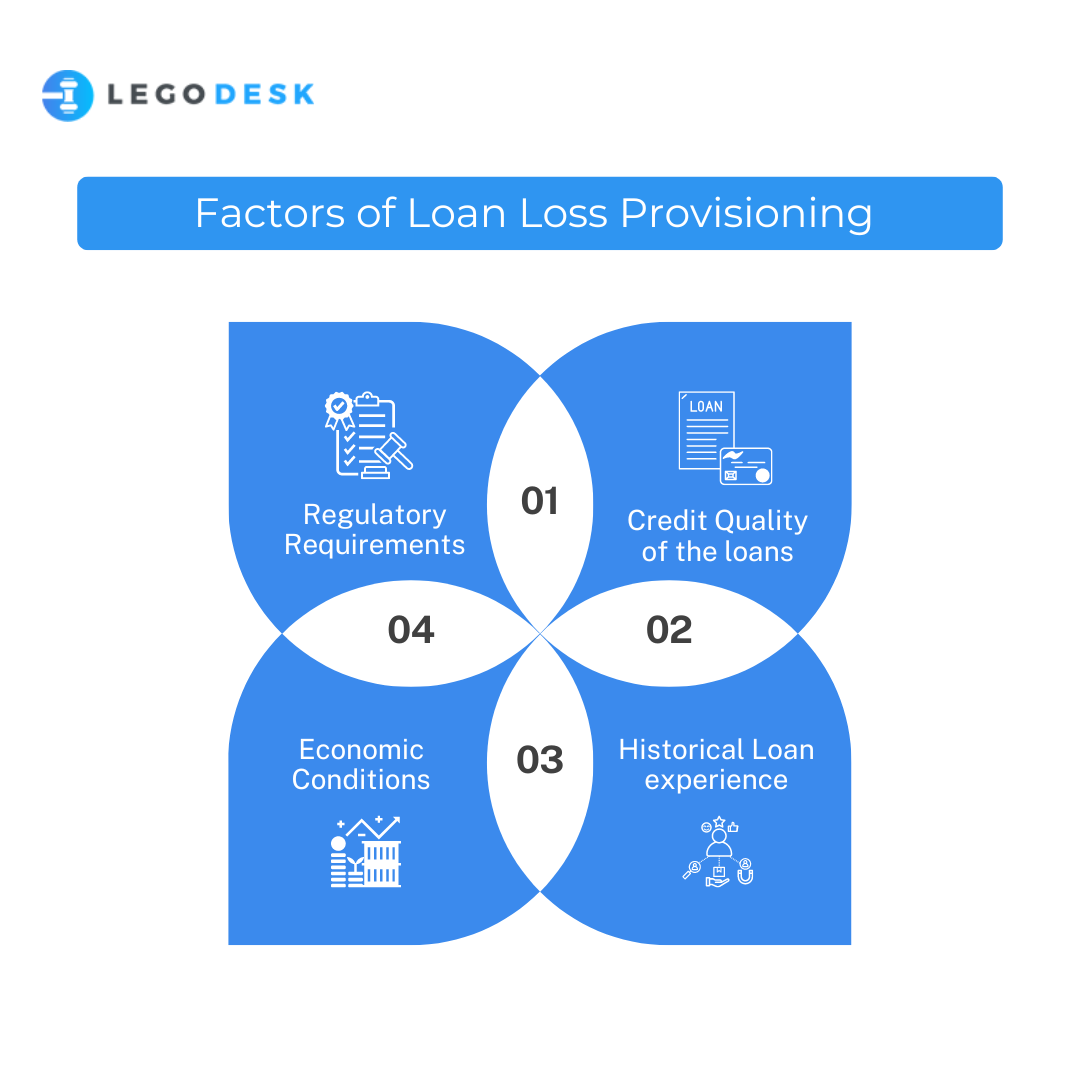

The amount of loan loss provisioning is based on various factors, including the credit quality of the loans, historical loss experience, economic conditions, and regulatory requirements. Banks typically use statistical models and risk assessments to estimate potential losses and determine the appropriate level of provisioning.

Existing Regulations on Loan Loss Provisioning

The current regulations on loan loss provisioning in India are based on an “incurred-loss” approach. This approach involves banks making provisions for their losses after they have already occurred.

In the existing context in India, banks are required to make a provision of 15% in case the loan is secured and a provision of 25% in case the loan is unsecured.

However, this provisioning occurs after the loan has already been classified as a non-performing asset by the bank. Further, a loan is classified as a non-performing asset 90 days after a default has occurred. This means that there is a significant lag between the issue occuring and the resolution of the issue at the hands of the bank.

A default usually occurs several months after the borrower has started to face financial difficulties. This adds to the credit risk faced by the bank. By the time the bank makes a provision for the loss, it is already too late to avoid the risk.

This approach has largely been the standard across the world, but regulators are now feeling that there is a need for change to the loan loss provisioning norms.

RBI Discussion Paper

The inadequacy of the incurred loss approach has prompted the “Basel Committee on Banking Supervision” to determine a new “forward-looking” approach to tackle loan losses.

Essentially, the new approach will require banks and other credit institutions to estimate the expected loan losses that are likely to occur in the future. This marks a significant shift from the current approach of “curing” the losses rather than “preventing” the losses.

Through the discussion paper, the RBI has proposed that each bank set up its own model for loan loss provisioning which is based on a “forward-looking” approach. The model must be thoroughly validated by either the bank itself or a third party, however, it is the responsibility of the bank to ensure the soundness of the model that it adopts.

The discussion paper has also put forward several questions and answers from Indian credit institutions have been sought based on which new regulations for loan-loss provisioning will be implemented. The window for answers are now closed and the RBI is currently deliberating on the responses.

Potential Benefits of the Forward-Looking Approach

Delays in accounting for losses under the “incurred loss” approach have been found to pose a systemic risk to the banking sector in the past. During the 2008 financial crisis, it was found that the “incurred loss” approach played a part in increasing the dire consequences of the crisis.

This is because while credit risk to the banks was increased significantly, credit institutions could not provision for the expected losses before they had already occurred. Thus, balance sheets were inflated and the banks had to expend large amounts of capital at a time when they most needed to shore up capital. The new loan loss provisioning accounting will help curb this issue.

Overall, the “forward-looking” approach has the potential to remove these drawbacks from the system. It will help prevent systemic risk by helping to solve credit risk much sooner than was possible under the “incurred loss” approach. The actual efficacy of the new approach now depends on the exact processes and models that banks put in place to fight credit risk.

Legodesk Can Also Help Lower Loan Losses

Legodesk is a new-age platform built from the ground up to meet the debt collection needs of credit institutions. We offer a one-stop space where lenders can access their overdue payment data and take corrective action to help recover the dues.

Our various services work in synergy with each other and can help you with contact management, case management, legal notice automation and tracking, and so on. While defaults cannot always be prevented, we recommend shoring up and streamlining the overdue payments follow-up process to ensure the damage is mitigated as far as possible.

Wrapping Up

Loan loss provisioning is an essential process that can help save credit institutions from credit risk. While credit risk is a part and parcel of the lending business, it is possible to minimize the pain felt by credit institutions from non-performing assets.

The proposed changes to loan loss provisioning guidelines mark a new promising chapter in institutional lending processes that can serve the financial sector for decades to come. It is important to note that the new regulations have not been notified yet and the RBI is still in the process of deliberating over the comments that they have received on their discussion paper. Currently, there is no visibility on when the new RBI guidelines for loan losses may be notified by the RBI.