How legal tech is shaping the future of NBFCs

Legal technology for NBFCs, also known as “legal tech,” refers to the use of technology to improve and automate legal work. This includes document management and e-discovery to online legal research and contract review. In recent years, this tech has gained significant attention in the financial sector, particularly in non-banking financial companies (NBFCs).

NBFCs, which include companies like microfinance institutions, peer-to-peer lending platforms, and other financial services providers, play a critical role in the global economy. However, these companies are often subject to a complex web of regulations, and compliance with these regulations can be time-consuming and costly. Legal technology for NBFCs to navigate this complexity by automating compliance processes, streamlining operations, and reducing the risk of fraud.

For example, legal tech can automate contract review, making it easier for NBFCs to ensure that their agreements comply with local laws and regulations. Additionally, legal tech can monitor transactions in real-time, helping NBFCs identify and prevent fraudulent activity.

Role of legal tech in streamlining NBFC operations and compliance

The role of legal tech in simplifying processes and compliance for non-banking financial companies (NBFCs) is significant.

One of the critical ways legal tech such as Legodesk can streamline operations for NBFCs is through smart contracts. Smart contracts are digital, self-executing contracts that can be programmed to enforce an agreement’s terms. This can significantly reduce the time and effort required to review and execute contracts, allowing NBFCs to focus on other business areas.

Legal tech solutions can also help NBFCs comply with regulations by automating compliance checks. For example, legal tech can automatically review transactions and identify any that may violate rules. This can help NBFCs identify and address compliance issues before they become significant problems.

In addition, legal technology for NBFCs can help manage their customer data and ensure compliance with data protection laws, such as GDPR and HIPAA, by automating the process of obtaining consent, storage, and sharing personal data.

Moreover, legal tech can help NBFCs reduce the risk of errors and improve efficiency by automating many of the manual processes traditionally associated with compliance and operations. This can lead to cost savings and improved productivity.

Legodesk is an excellent example of a legal tech company that aids NBFCs in achieving more. With a unique legal notice tracking feature, banks and NBFCs can use the Legodesk platform to send and manage default notices.

Legal tech is crucial in streamlining operations and compliance for NBFCs by automating repetitive and time-consuming tasks, reducing the risk of errors, and increasing efficiency. This allows NBFCs to focus on growing their business and better serving their customers. As legal tech continues to evolve, we will likely see even more innovative solutions to help NBFCs streamline their operations and meet regulatory requirements efficiently and cost-effectively.

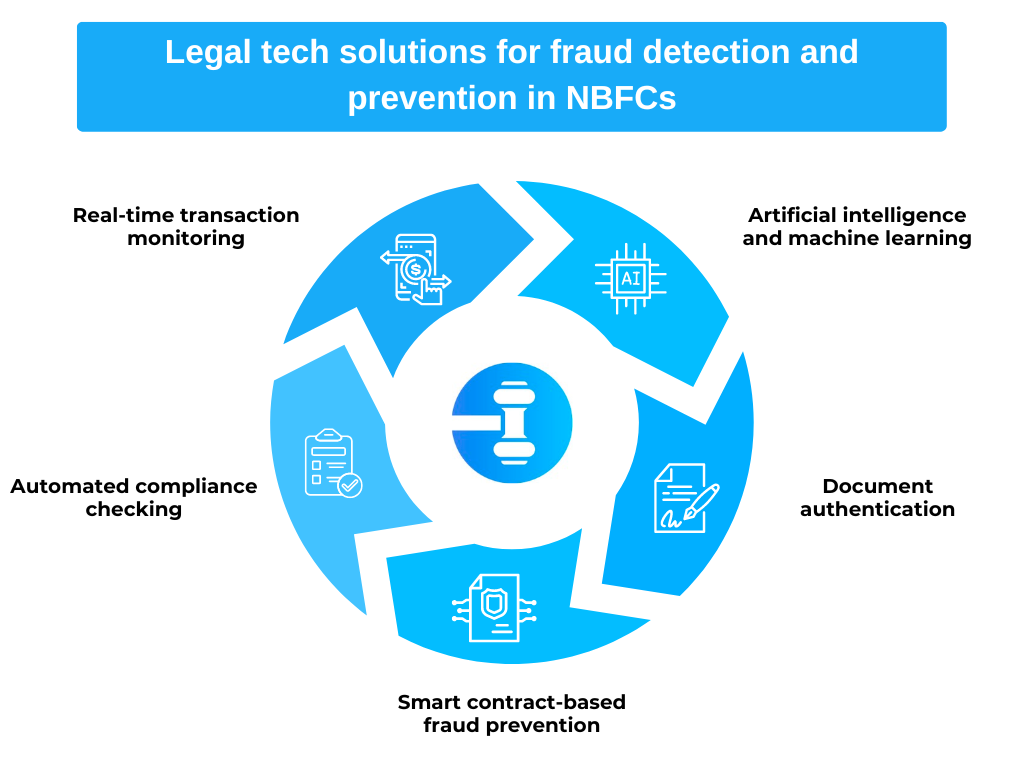

Legal tech solutions for fraud detection and prevention in NBFCs

Legal technology can detect and prevent fraud in non-banking financial companies (NBFCs). Several legal tech solutions can be used to detect and prevent fraud in NBFCs, including:

Real-time transaction monitoring:

Legal technology for NBFCs can monitor transactions in real time, helping NBFCs identify and prevent fraudulent activity. This can include identifying suspicious patterns of behavior or transactions that are out of the ordinary and alerting NBFCs to potential fraud.

Artificial intelligence and machine learning:

Legal tech can use AI and machine learning to analyze large amounts of data and identify potential fraud. These technologies can learn from past fraud examples and use this knowledge to detect and prevent future fraud.

Document authentication:

Legal tech can authenticate documents, such as ID cards and passports, to ensure they are genuine. This can help NBFCs prevent fraud by detecting fake documents.

Innovative contract-based fraud prevention:

Intelligent contracts can prevent fraud by automating compliance checks and ensuring that the terms of an agreement are met.

Automated compliance checking:

Legal tech can automate compliance checks, such as KYC, AML, and CFT, helping NBFCs identify potentially fraudulent activities.

In summary, legal tech can play a vital role in detecting and preventing fraud in NBFCs by automating compliance checks, monitoring transactions in real-time, authenticating documents, and using AI and machine learning to analyze data. As legal tech continues to evolve, we will likely see even more innovative solutions that will help NBFCs detect and prevent fraud.

The future of legal tech in NBFCs and its potential to drive growth and innovation

The legal tech industry is rapidly growing and can potentially drive growth and innovation in NBFCs (non-banking financial companies). The tech uses technology to automate, streamline, and improve various processes and services.

One central area where legal tech can drive growth and innovation in NBFCs is compliance. Legal tech tools such as automated document review and contract management can help NBFCs comply more efficiently and effectively with regulations. This can not only reduce the risk of non-compliance but also free up resources that can be used to focus on growth and innovation.

Another area where legal tech can drive growth and innovation in NBFCs is risk management. Legal tech tools such as predictive analytics and machine learning can help NBFCs better identify and manage risks associated with their operations. This can help them make better business decisions and reduce the impact of risks on their operations. Tools such as data visualization and natural language processing can help NBFCs make sense of large amounts of data and extract valuable insights that can be used to drive growth and innovation.

Overall, legal tech can drive growth and innovation in NBFCs by helping them stay compliant, manage risks, and make better use of data. As the legal tech industry continues to evolve and mature, we expect to see more NBFCs embracing legal tech to drive growth and innovation in their operations.

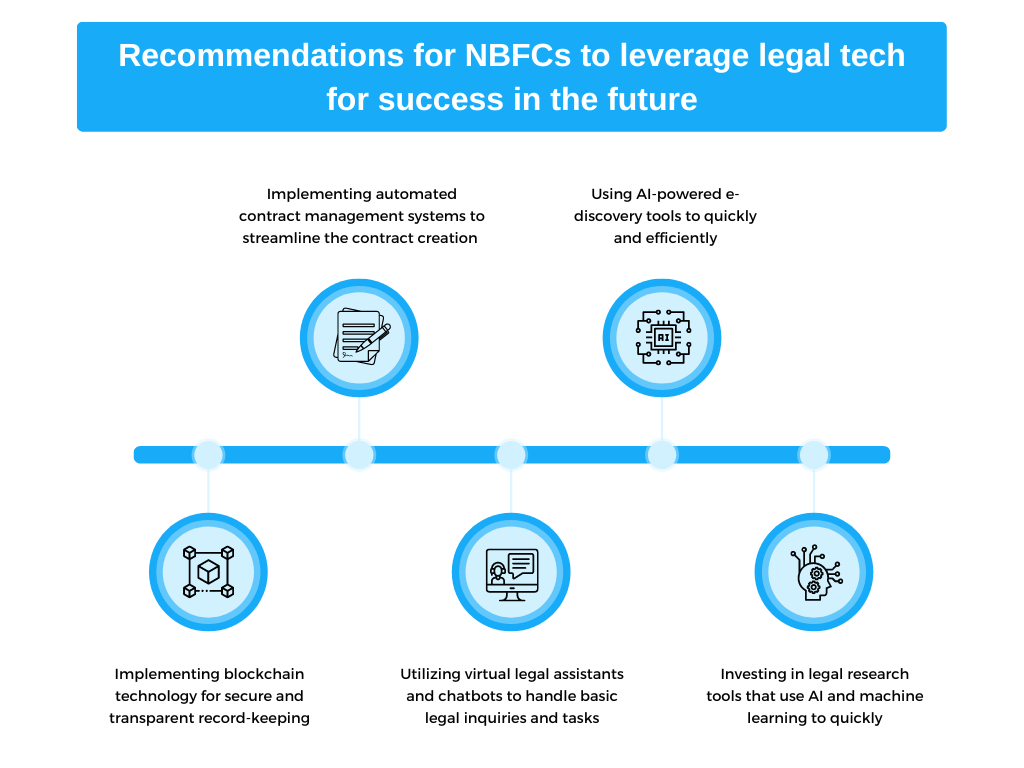

Recommendations for NBFCs to leverage legal tech for success in the future

NBFCs (Non-Banking Financial Companies) can leverage legal tech to improve their operations and ensure compliance with regulations. Some specific recommendations include the following:

- Implementing automated contract management systems to streamline the contract creation and review process, reduce errors, and ensure compliance with laws and regulations.

- I am using AI-powered e-discovery tools to quickly and efficiently review large amounts of data, such as litigation or regulatory investigations.

- We are implementing blockchain technology for secure and transparent record-keeping, as well as for brilliant contract execution.

- We are utilizing virtual legal assistants and chatbots to handle basic legal inquiries and tasks, such as document generation and client communication, freeing up time and resources for more complex matters.

- It invests in legal research tools that use AI and machine learning to quickly and accurately identify relevant legal precedents and statutes.

NBFCs should invest in legal technology to minimize compliance risk, increase efficiency, and improve the overall customer experience.

In conclusion, legal technology for NBFCs offers a wide range of solutions that can help to improve their operations and compliance with regulations. By implementing automated contract management systems, using AI-powered e-discovery tools, utilizing blockchain technology, implementing virtual legal assistants and chatbots, and investing in legal research tools, NBFCs can minimize compliance risk, increase efficiency, and improve the overall customer experience. The NBFCs should consider these recommendations and support legal technology to stay competitive.