Demystifying the FLDG Guidelines for NBFCs: A Comprehensive Insight

The recent decision by the Reserve Bank of India (RBI) to permit Default Loss Guarantee (DLG) arrangements in digital lending has opened up a significant opportunity for India’s fintech sector. These new guidelines provide clarity and guidelines on lending arrangements between fintechs, banks, and Non-Banking Financial Companies (NBFCs), allowing fintechs to showcase their underwriting capabilities and establish trust with traditional financial institutions.

The implementation of DLG arrangements is expected to have wide-ranging effects, including increased credit penetration, the promotion of innovative fintech lending models, and the facilitation of deeper partnerships between banks, NBFCs, and fintechs.

In this article, we will delve into the details of the RBI’s Framework for the Lending and Deposit-taking Activities of NBFCs (FLDG) guidelines, analyzing their impact on India’s rapidly expanding fintech industry.

Examining RBI’s FLDG Guidelines

The release of the First Loss Default Guarantee (FLDG) guidelines by the RBI marks a pivotal moment for fintechs in India. These guidelines introduce the concept of FLDG programs, which involve sharing credit risk between fintechs, banks, and NBFCs. Under the guidelines, fintechs provide a guarantee on a certain percentage of the default loan portfolio of registered entities, such as banks and NBFCs.

The FLDG framework sets forth several key provisions.

- Firstly, there is a cap of 5% on the FLDG arrangement, ensuring that the total default guarantee provided by fintechs to their lending partners does not exceed this threshold.

- Additionally, FLDGs can only be established between an RBI-regulated entity and a Lending Service Provider (LSP), or between two regulated entities through an outsourcing agreement. The RBI emphasizes the importance of timely resolution of defaults, allowing FLDGs to be invoked within a maximum overdue period of 120 days.

- To ensure the reliability of the guarantees, the RBI mandates that fintechs provide a hard guarantee, which can take the form of cash deposits, bank guarantees, or fixed deposits held with a scheduled commercial bank.

- Furthermore, LSPs are required to disclose on their websites the number of portfolios and the corresponding amounts covered by FLDGs. Irrespective of the FLDG cover at the portfolio level, regulated entities bear the responsibility of identifying individual loans as non-performing assets (NPAs) and making appropriate provisions accordingly.

Consequences for India’s Fintech Industry

The FLDG guidelines bring a sigh of relief to fintechs, providing them with much-needed clarity and creating a more conducive environment for collaboration with regulated entities. The fintech industry in India is poised to experience several positive outcomes as a result of these guidelines:

Strengthened credit penetration

The introduction of the FLDG framework by the RBI is expected to boost credit penetration in India significantly. This will lead to increased funding opportunities for digital lending fintechs and facilitate the provision of financial services to previously underserved individuals and businesses, thereby promoting financial inclusion.

Innovation in fintech lending models

The clarified guidelines surrounding FLDG arrangements will encourage fintechs to innovate and introduce new lending models that were previously put on hold due to regulatory uncertainties. This will result in a diversification of fintech lending offerings, stimulating further growth and development in the sector.

Deeper partnerships and collaborations

The FLDG scheme opens doors for deeper partnerships and collaborations between banks, NBFCs, and fintechs. Regulated entities will be motivated to establish robust frameworks and comply with the guidelines, leading to the growth of collaborative digital lending initiatives and the forging of mutually beneficial alliances.

Boost for MSMEs and financial inclusion

The FLDG guidelines bring renewed hope for the Micro, Small, and Medium Enterprises (MSME) sector, which often faces challenges due to limited access to capital. With regulated entities being more willing to provide inclusive micro-sized loans, fintechs will be quick to augment their offerings and develop robust underwriting platforms. This will help bridge the credit gap for MSMEs and facilitate their participation in the formal financial system.

Enhanced transparency

The requirement for LSPs to disclose FLDG arrangements on their websites will foster transparency within the lending ecosystem. This increased transparency will enable stakeholders to make more informed decisions, build trust, and contribute to a healthier lending environment.

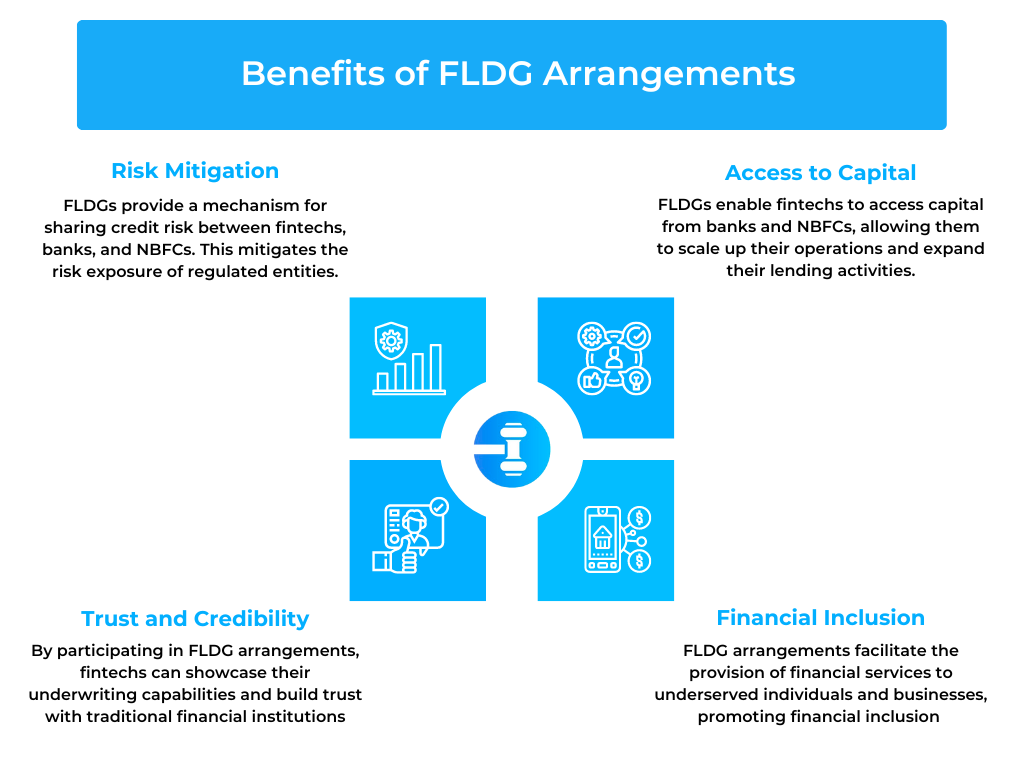

Benefits of FLDG Arrangements

Risk Mitigation

FLDGs provide a mechanism for sharing credit risk between fintechs, banks, and NBFCs. This mitigates the risk exposure of regulated entities and promotes a more secure lending environment.

Trust and Credibility

By participating in FLDG arrangements, fintechs can showcase their underwriting capabilities and build trust with traditional financial institutions. This can enhance their credibility and attract more partnerships and funding opportunities.

Access to Capital

FLDGs enable fintechs to access capital from banks and NBFCs, allowing them to scale up their operations and expand their lending activities. This increased access to capital fuels innovation and growth within the fintech sector.

Financial Inclusion

FLDG arrangements facilitate the provision of financial services to underserved individuals and businesses, promoting financial inclusion and contributing to socio-economic development.

Conclusion

Fintechs occupy a pivotal position in India’s financial landscape, and the introduction of FLDG guidelines positions them at the forefront of driving financial inclusion, expanding access to credit, and bringing underserved segments of the economy under the formal financial umbrella.

With a structured framework in place, fintechs are well-positioned to capitalize on this opportunity and play a crucial role in the growth of transformative financial products and services, as predicted by the Boston Consulting Group, which forecasts a sixfold increase in fintech sector revenues by 2030.