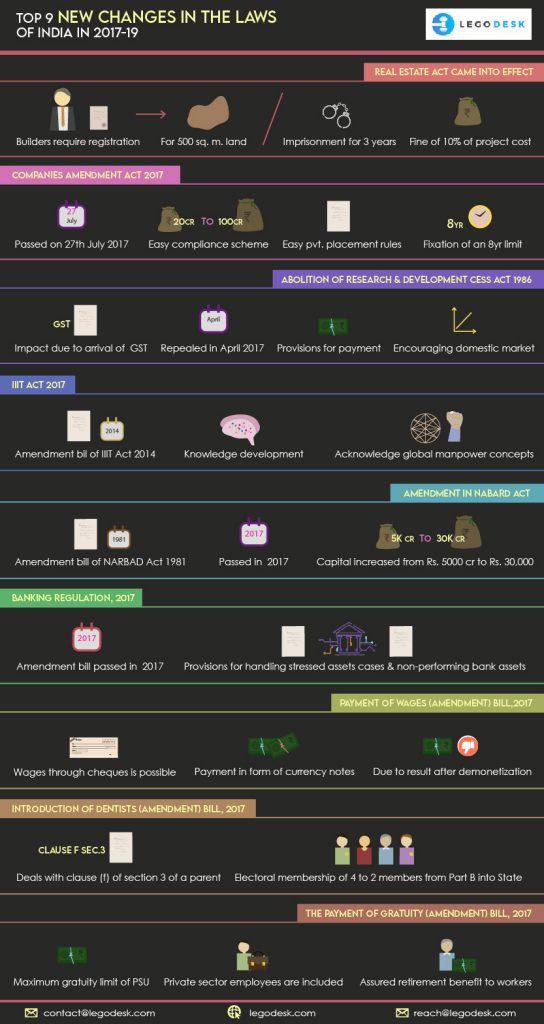

Top 9 New Changes in the Laws of India in 2017-19

Change is the constant agent in life which makes us realize that yes we are alive and we are moving along the hands of the clock. Similarly, when the changes are made in the existing laws, it simply indicates the constantly working operations of the legislature.

In legal terms, when a bill is passed by the houses of parliament then it becomes an act and when it comes to implementation, it becomes a law. Considerably any change made in the existing law, whether it be addition, subtraction or improvisation of any existing law, it is termed as the amendment.

Here are the top 9 changes in law made by the Indian legislature since the beginning of 2017 to the ending months of the year.

1. Real estate act came into effect

The act topping our list will be the one related to the manipulative activities happening in the world of real estate which leads to the scams and exploitation of the potential buyers who dream of having their own homes. Indian parliament cleared the act in the month of March last year, under which every state was asked to set up a regulatory body, Real Estate Regulatory Authority (RERA) to monitor and form the rules and guidelines for the real estate operational practices.

The act demands a mandatory registration by builders, developing a project of land exceeding 500 square meters and that too before any promotional and advertising practices. Failure of which will result in a maximum imprisonment of 3 years or fine of up to 10% of the total cost of the project.

2. Companies amendment act 2017

Indian parliament’s Lok Sabha on 27th July 2017, passed the amendments for Companies Act Bill, 2016.

The act is aiming to remove the complexities in the law of 2013 so that the improved and easy business operations can be achieved with the strengthened corporate governance.

The amendments came up with the concepts for the easy compliance scheme to Rs 100 crore from Rs 20 crore, which will continuously provide eligibility to more companies for simple compliance regime. Additionally, the bill paves a way to easy rules for the private placement of securities with the fixation of an eight-year limit when the past accounts are opened against the early regimes.

3. Abolition of research and development cess act 1986

Because of the arrival of GST in India’s economy’s taxation policies, numerous impactful changes took place. Research and development cess act 1986, got repealed after the proposal of the Indian finance minister- Arun Jaitley’s in the month of April 2017.

The act was the main legislation providing the provisions for the imposition of the levy on the payments made on import and exports of India. Specifically, the import and export of the technical goods or technology encouraging the commercial development of domestic markets and economy of India.

4. IIIT act 2017

The year 2017 paved the way for the implementation of the Indian Institutes of Information Technology (Amendment) Bill, 2017 when both the parliamentary houses passed it. The Lok Sabha passed it earlier and it involves the amendment bill of IIIT Act 2014.

The act provides the national importance reference to the certain technology-based Indian institutions. Aiming at the development of advanced and elaborated knowledge in the technical field, it acknowledges the concept of globally standardized manpower for the information technology industries.

5. Amendment in NABARD Act

By the medium of the voice vote, the legislature has passed the National Bank for Agriculture and Rural Development (Amendment) Bill, 2017 which seeks the amendment in the NABARD Act 1981.

As the name suggests, NABARD is the one organization providing credit facilities into the agricultural as well as potential industrial and industrial specifically in the rural areas of India. And talking about the amendment made, the bill has led the union government to increase the capital from Rs. 5000 crores to Rs. 30,000 crores.

Additionally, an allowance has been given to the union government to increase it by the same rate as it has increased now with the consultation of RBI, only if necessary.

6. Banking Regulation (Amendment) Bill, 2017

In the month of August, the voice vote at Lok Sabha has also passed the Banking Regulation (Amendment) Bill, 2017 replacing the Banking Regulation (Amendment) Ordinance, 2017. The amendment aims to insert some provision to the Banking Regulation Act, 1949 which was

- Provisions for handling stressed assets cases

- Provisions for handling non-performing assets of banks

The bill has initiated the insolvency proceedings enabling the Central government to authorize the Reserve Bank of India (RBI) so that it can further guide the banking companies to resolve the above-mentioned cases under the Code of insolvency and bankruptcy, 2016. It has further empowered RBI to issue directions to banks regarding resolutions of stressed assets timely.

7. Payment of Wages (Amendment) Bill, 2017 February 7, 2017

Wages through cheques or by the means of crediting the accounts of workers by employers is now possible as during the month of February, the Payment of Wages (Amendment) Bill, 2017 by the legislation as the replacement of the Ordinance promulgated by the President in December 2016

In the earlier scenario, the parent act provided the given mode of wage payments by the employer to the worker with the requirement of written authorization. Now THE ACT permits the employer to by the following means and that too without any written authorization

- cheque

- Crediting them Into the worker’s bank account

- in the form of coins or currency notes

Apparently, the act aims at improving the need for obtaining the written authorization for the payment of wages in prior.

The amendment is the result of the aftermath of the demonetization policy due to which the employers had to face the cash crunch and facing difficulty in paying in cash to their workers.

See more- Family Law

8. introduction of Dentists (Amendment) Bill, 2017

The approval of the introduction of Dentists (Amendment) Bill, 2017 by the union cabinet in 2017 subject to the amendment in the Dentists Act, 1948 so that the redundancy can be reduced with the help of certain modifications.

It basically deals with the introduction of certain provisions for the Membership of Dental Council of India under clause (f) of section 3 of a parent.

Further, it required electoral membership of 4 to 2 members from Part B into the State/Joint State Dental Councils. Whereas the recent provision lost its relevance as in order to reduce the redundancy, provisions like these do not exist anymore allowing the representation as a choice but not a mandatory action anymore.

9. The Payment of Gratuity (Amendment) Bill, 2017

At last, the employees have something to pay attention to as the Union Cabinet has given its approval to the introduction of the Payment of Gratuity (Amendment) Bill, 2017 making amendments to Payment of Gratuity Act, 1972. The Amendment leads to the appraisal in the maximum gratuity limit of PSU (Private Sector Undertakings) and Autonomous Organizations under Government. The employees of the private sector are also included, who are uncovered under the Central Civil Services (Pension) Rules, 1972.

The parent act of 1972, plays an important role as social security legislation for the workforce earning wages by working in the industries, factories and establishments. Its enactment provided the secured work environment with the assured retirement benefits to the permanent employees, even if that retirement is an outcome of any sort of physical disablement or impairment of vital body part.

Try our Debt Resolution solutions today Request a Demo