The Impact of MSME Credit on Cash Flow Management

MSME loans are a popular type of loan that are meant for Micro, Small, and Medium-sized Enterprises (MSME). These loans can be used for a variety of purposes and are offered to companies who need financial assistance.

There are a number of benefits to obtaining MSME credit. First, it can help SMEs to access capital that they may not be able to get from other sources. Second, it can help SMEs to improve their cash flow and financial stability. Third, it can help SMEs to grow their businesses and create jobs.

If you are an SME owner who is considering applying for MSME credit, there are a few things you should keep in mind. First, you will need to have a good credit score. Second, you will need to be able to provide the lender with a business plan and financial statements. Third, you will need to be able to repay the loan on time.

One of the most popular uses of an MSME loan is that it can help with cash flow management. Almost every business has dealt with cash flows at one point or another. Cash flow issues arise when the monthly inflows of the business are not enough to meet the monthly outflows.

In such circumstances, an MSME loan can be highly useful to cover the shortfall.

Let’s dive into the various ways MSME loans can help with cash flow management. We’ll also cover some of the challenges faced by MSMEs when trying to obtain such a loan.

The Importance of Cash Flow Management

Cash flow is the lifeblood of any business. It is the movement of money in and out of a business. Without proper cash flow management, a business can quickly run into financial difficulties.

There are several reasons why cash flow management is important:

- It helps to ensure that a business has enough money to cover its expenses.

- It can help to identify potential problems early on.

- It can help to improve a business’s credit rating.

- It can help to attract investors.

There are several things that businesses can do to improve their cash flow management:

- Track their cash flow closely.

- Create a budget and stick to it.

- Collect payments on time.

- Negotiate better terms with suppliers.

- Consider taking out a loan or line of credit.

Cash flow management is essential for the success of any business. By taking the time to manage their cash flow effectively, businesses can avoid financial problems and improve their chances of success.

- Automate your payments. This will help you to avoid late payments and penalties.

- Negotiate early payment discounts with your suppliers. This can help you to save money on your expenses.

- Invest in a cash flow forecasting tool. This will help you to predict your cash flow needs and make sure that you have enough money to cover your expenses.

- Consider hiring a financial advisor. They can help you to develop a cash flow management plan that is tailored to your specific needs.

By following these tips, businesses can improve their cash flow management and avoid financial problems.

How MSME Loans Aid Cash Flow Management

Working Capital

Every business needs working capital in order to function. This working capital ensures that a business has the funds which are necessary for the business to meet its day to day financial requirements.

The working capital can be used for meeting payroll requirements, for paying for rent and utilities, for paying for inventory, and so on. An MSME loan can go a long way in case the inflows of the business are not enough to match the monthly outflow.

Expansion and Growth

While MSME loans are often used for working capital, they can also be used for taking the business to the next level. Businesses are always on the lookout for opportunities so that they can capitalize on them.

In such circumstances, the business may need additional capital for its planned growth and expansion. This is where an MSME loan can come in and help a business grow its operations.

Bridge Financing

Another positive impact of MSME loans can be playing the role of bridge financing.

MSMEs often face a gap between the timing of outflows (like raw material purchases) and inflows (customer payments). Bridge loans help cover these gaps, ensuring the business can continue operating smoothly while waiting for payments from clients.

Inventory Management

Any business which is involved in the sale of goods will need proper inventory management. Inventory management allows for the business to keep sufficient inventory to meet potential sales requirements. However, there are situations in which a business needs inventory, however, it does not have sufficient funds to pay for the inventory at the time of purchase. In such situations, the impact of the MSME loan can be positive since it can be paid in installments at a later date.

Handling Seasonal Fluctuations

Some businesses are inherently seasonal in nature. These businesses experience significantly higher sales during certain parts of the year rather than throughout the year. For such a business, it can be difficult to obtain the necessary inflows during the lean months.

An MSME loan can work wonders in tidying over the business during the lean months so that it can perform well during the season. The MSME loan can also be structured in such a way that the payments can be made according to the seasonal fluctuations that the business faces.

Debt Consolidation

A business may have more than one loan depending on the complexity of its operations. There may be different loans owed to different lenders at different interest rates with different timelines. In such circumstances, it can be difficult for a business to have ready funds for paying each of the loans on time.

As a stopgap solution to the issue, a business can opt for an MSME loan that can work to consolidate its debt so that it becomes more manageable for the business.

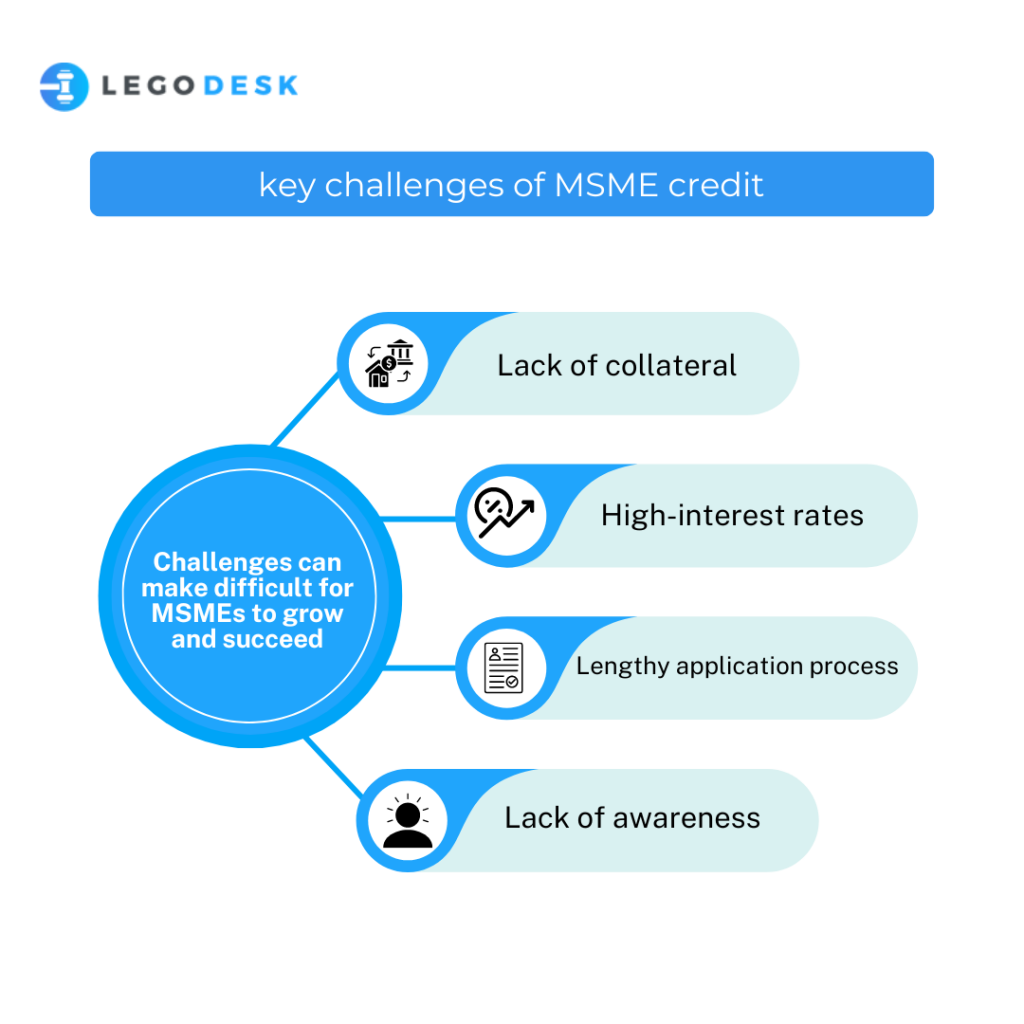

Challenges Faced by MSMEs in Obtaining Loans

High Interest Rates

One of the biggest challenges that MSMEs face when attempting or considering an MSME loan is the high interest rate that is charged by lenders. An MSME loan can be secured or it can be unsecured.

The interest rate for an unsecured loan can be much higher than that of a secured loan. Further, other factors also play a role in the final interest rate offered to the borrower such as the credit score, payment history, relationship with the lender and so on.

In case the factors play an unfavorable role for the borrower, the interest rate can be formidable and a deterrent to the borrower from availing the loan.

Stringent Eligibility Criteria

Lenders need to be highly careful with who they provide loans to. This is because the occurrence of non-performing assets can pose a significant challenge to the operations of a lender. Hence, it is always the lenders goal to lend to reputable businesses which have strong financial health. However, this can pose a problem for businesses which have solid potential but are currently facing a downturn.

It can be hard for the business to meet the eligibility criteria set by the bank. Further, it can also be a challenge in case the lender accedes to sanction the loan but charges a higher interest rate.

Lengthy and Complex Application Process

Banking regulations as well as procedural requirements means that a lender will need a vast array of information on a business before it can pass a loan. This is because the lender needs to be sure of the details of the borrower and the business as a whole before a loan can be sanctioned.

However, this can make the loan application process quite lengthy and complex which can pose a challenge to the borrower.

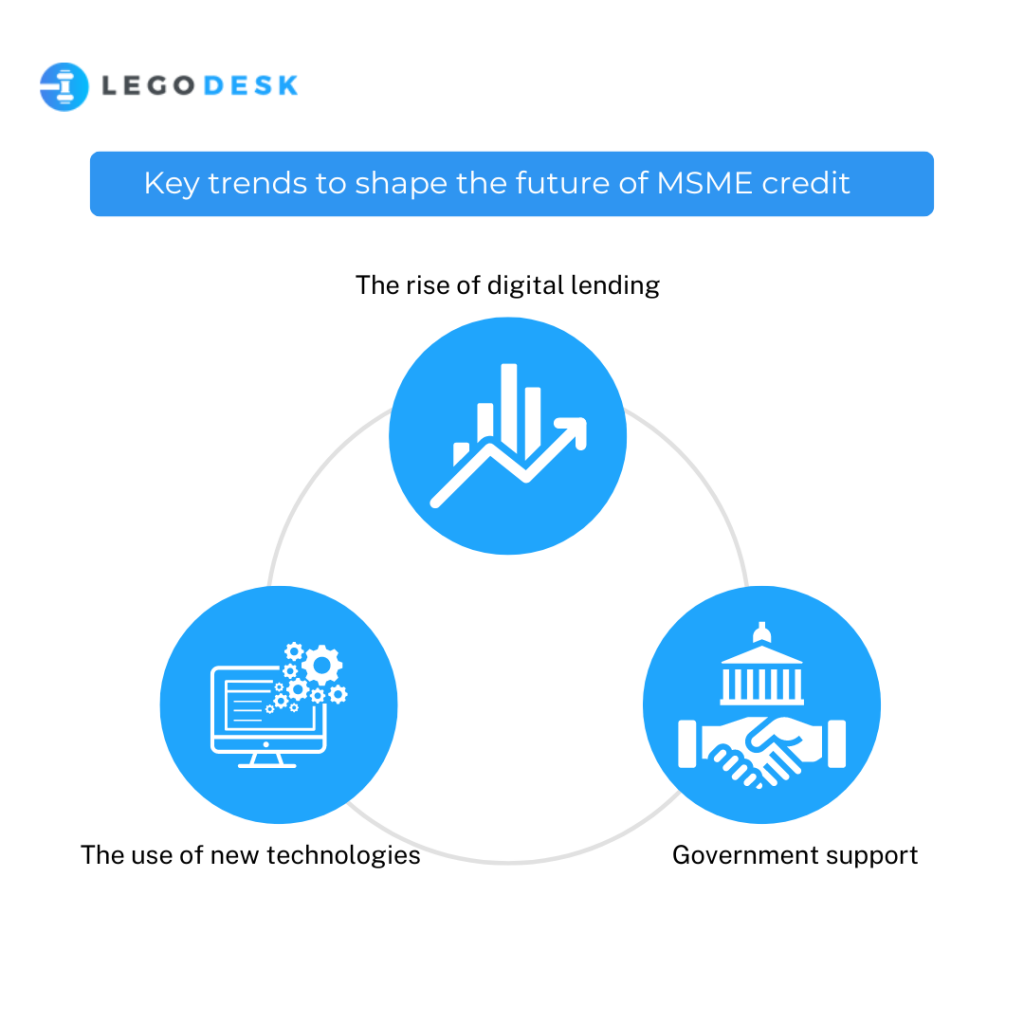

The Future of MSME Credit

The future of MSME credit is bright. With the rise of digital lending and new technologies, it is becoming easier than ever for small businesses to get the financing they need to grow.

In addition, governments around the world are increasingly recognizing the importance of small businesses and are taking steps to support them, including by providing access to credit. As a result, I am confident that the future of MSME credit is very promising.

Here are some of the trends that will shape the future of MSME credit:

- The rise of digital lending: Digital lending platforms are making it easier than ever for small businesses to get the financing they need. These platforms use data and technology to assess the creditworthiness of small businesses, which can help them to get approved for loans even if they have poor credit history or collateral.

- The use of new technologies: New technologies such as blockchain and artificial intelligence are also being used to improve the efficiency and transparency of the lending process. These technologies can help to reduce the cost of lending and make it easier for small businesses to compare loan offers.

- Government support: Governments around the world are increasingly recognizing the importance of small businesses and are taking steps to support them, including by providing access to credit. For example, the US government has launched the Small Business Administration (SBA), which provides loans, grants, and other forms of assistance to small businesses.

These trends are all positive for the future of MSME credit. They will make it easier for small businesses to get the financing they need to grow, which will help to create jobs and boost economic growth.

Wrapping Up

MSME loans are essential for the financial health and growth of MSMEs, aiding in effective cash flow management and business continuity.

However, the sector faces numerous challenges in securing these loans, from stringent collateral requirements to high interest rates and complex application processes. Addressing these challenges requires a concerted effort from financial institutions, policymakers, and support organizations to create an enabling environment that facilitates easier access to finance for MSMEs.

This includes simplifying loan procedures, enhancing financial literacy, offering collateral-free loans, and leveraging technology to bridge the digital gap. By doing so, MSMEs can better manage their cash flows, invest in growth, and contribute more robustly to the economy.

Try our Debt Resolution solutions today Request a Demo