Impact of the CARES Act on Legal Professionals

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) were passed by Congress in the United States to help millions of Americans who were affected by COVID-19’s negative economic impact. It was put into motion to aid small businesses employing millions of people who lost their means of livelihood due to the pandemic. The CARES Act is packed with emergency government grants, unemployment insurance benefits, refundable tax credit, and business tax, and, most importantly, loans for paycheck protection.

Read Also – 7 Questions You Should Ask Before Hiring A Lawyer

Effect of CARES Act on Legal professional- Watch the video here

Impact of CARES Act on Legal Professionals

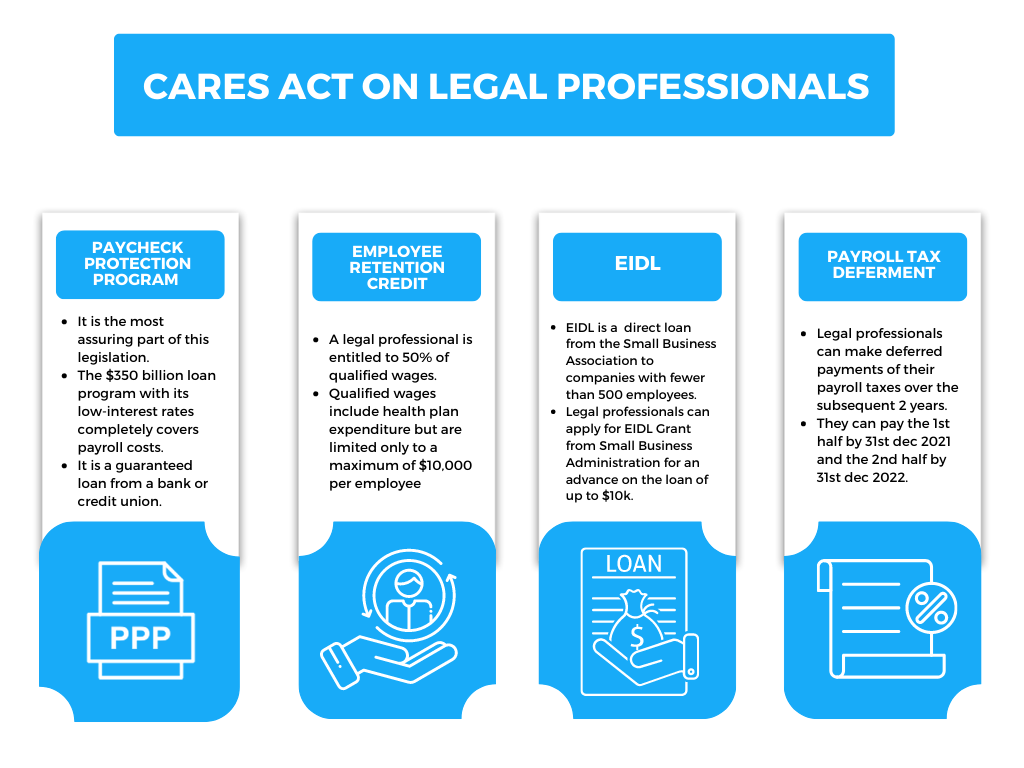

- The CARES Act, through the following packages, helps legal professionals to sustain their practice through this pandemic. The packages and the impacts of the CARES Act is as follows:

Paycheck protection program (PPP):

The Paycheck Protection Program (PPP) is the most assuring part of this legislation. The $350 billion loan program with its low-interest rates completely covers payroll costs. It is a guaranteed loan from a bank or credit union. It helps the legal professionals (inclusive of sole proprietors and independent contractors) to eliminate significant debt and allows them to pay it off after the pandemic gets over.

Read Also – Financial Emergency in India

Applicability: Legal firms with less than 500 employees are eligible to seek the benefit of a CARES loan. Businesses with more than the prescribed number of employees are eligible for the loan if they satisfy specific criteria given under the legislation.

Features: CARES loan will cover up to two months of average monthly payroll costs of lawyers. The previous year’s payroll expenses calculate it with an additional 25% up to a $10 million cap. It can also be used to pay up the rent, mortgage interest, and utilities accumulating before 15th February 2020. Hence, the CARES loan cannot be made use for a prospective loan, for example, in order to lease an office.

Read Also – Article 352 of the Indian Constitution Talks About National Emergency

Coverage for payroll costs includes-

- Salaries, wages, commissions or tips

- Employee benefits such as costs for vacation, medical or sick, and parental leave.

- Any retirement benefits

- Group health care benefits including premiums.

- State or local tax assessed on the compensation of employees

- Allowance for dismissal or separation.

Read Also – Understanding Employees Versus Independent Contractors

-

Employee Retention Credit:

A legal professional is entitled to 50% of qualified wages. Qualified wages include health plan expenditure but are limited only to a maximum of $10,000 per employee (i.e., per employee must have a maximum qualified wage of $5,000). If an employer obtains a PPP loan, they cannot avail the benefit of Employee Retention Credit.

The employer is in authorization to Employee Retention Credit if they satisfy the below mentioned two conditions:

- If the legal practice was partially or fully suspended due to COVID-19 related shut-down directives.

- If the legal professional lost more than 50% in total when compared to previous years’ same quarter performance.

Read Also – Fundamental Rights During Emergencies

-

Payroll Tax Deferment:

Legal professionals can make deferred payments of their payroll taxes over the subsequent two years. They can pay the first half by 31st December 2021 and the other remaining half by 31st December 2022. Even if an employer avails PPP loans, they are still in authorization to Payroll Tax Deferment.

-

Economic Injury Disaster Loan Emergency Advance (EIDL):

EIDL is a direct loan from the Small Business Association to companies with fewer than 500 employees. Legal professionals can apply for EIDL Grant from Small Business Administration (SBA) for an advance on the loan of up to $10,000. Lawyers will not have to pay back the Emergency EIDL.

Read Also – Is an attorney and a lawyer the same thing?

Other Benefits for Legal Fraternity

- CARES Act provides for emergency funding of $50 million to the Legal Services Corporation. The aim is to address the growing legal needs of the low-income earning Americans to help them against the effects of pandemic.

- Federal Courts and their staff will get $7.5 million to support their legal activities. This is to bolster telework capabilities and to cover higher costs of pre-trial and other probation-related services.

- The Act also caters to funding to the Federal Bureau Prisons for personal protective equipment, electronic monitoring, and various other things to improve the conditions in prison.

- It is also a boon to low-income, generating Americans. They are provided with affordable housing and homelessness assistance programs. Consequentially, there will be a drastic reduction in evictions and foreclosures.

- The CARES Act allocated $850 million for Jails and local police departments so as to provide those with health protection needs. Ad hoc rules will be to facilitate video and audio conferences for legal procedures such as detention hearings and misdemeanor pleas.

Read Also – 22 parts of Constitution of India

Conclusion

In conclusion, we can rightly point out that the CARES Act addresses the unprecedented economic upheaval by reducing the burden on the legal fraternity. Therefore, it is a positive step the government is taking to address the hardships of American citizens during a disastrous period.

Read Also – Is an attorney and a lawyer the same thing?

Try our Debt Resolution solutions today Request a Demo