Maximizing Collections: The Role of Legal Strategies in Debt Recovery

Every financial institution needs to be highly familiar with the legal processes that govern their work. The same is true for debt recovery laws and the legal strategies that can help lenders recover their dues more efficiently and at a lower cost.

This is because negotiations and settlement processes with borrowers can often break down leading to lenders having no other recourse apart from approaching a court of law. However, approaching the law without having the right legal strategies can be counterproductive.

Instead, lenders need to focus on lawyers who have sufficient experience working on debt recovery matters and know which buttons to press and which levers to pull. Let’s dive into a few legal strategies in debt recovery.

Timely Legal Intervention

It is advisable for lenders to impress on defaulters as early as possible that non-payment of dues is a breach of their contractual obligations and the lender is willing to approach the courts for assistance. Since legal proceedings can be highly costly for borrowers, most borrowers will be more amenable to negotiating on better terms for the lender.

The first step that a lender can take is to send a legal notice to the borrower (also known as a demand letter). This legal notice will outline the dues of the borrower and also explain the legal consequences in case the borrower does not meet their obligations.

It’s important to note that legal proceedings should be initiated only once all other avenues have been explored without fruit. One of the most effective ways for lenders to manage non-performing assets is through negotiation and restructuring of loans. Legal proceedings can be initiated once positive negotiations aren’t working.

Litigation

The process of initiating legal proceedings can be fraught with legal difficulties. The lender must involve a legal team which can be a combination of in-house help and outsourced specialized legal services.

The legal team must be made abreast of all the facts of the matter so that they can approach the courts with all the necessary information and can represent the lender in the best way possible. This involves coordination between a vast cast of actors so it can help the lender if they make a single executive ultimately responsible for the entire project.

The primary advantage of litigation is that it can result in the law getting involved which acts as a significant deterrent for borrowers. Further, the court can mandate a payment plan failing which the consequences for the defaulter can be exceedingly severe.

Leveraging DRTs (Debt Recovery Tribunals)

In India, specialized courts have been set up which manage almost all debt recovery matters. These courts (or tribunals) are known as the Debt Recovery Tribunals. These courts were set up in order to expedite debt recovery matters.

Since the lawyers and judges practicing in these courts are familiar with debt recovery laws, all the proceedings can be done faster than if non-specialized lawyers are used.

In other cases, it may be necessary for insolvency proceedings to be started. In such cases, the proceedings may largely be held in one of the various High Courts of the land depending on which court has jurisdiction.

Use of Asset Reconstruction Companies

An extreme option for lenders could be to sell the matter to an asset reconstruction company. An Asset Reconstruction Company is a specialized company that purchases bad loans from a lender and takes the responsibility of recovering the dues. In such a scenario, any dues that an asset reconstruction company recovers will be the property of the ARC and not the lender.

The ARC can initiate any necessary legal proceedings and they have a higher chance of success since they have highly specialized knowledge when it comes to navigating the legal system for a favorable outcome. Further, the ARC can also restructure the debt or re-negotiate payment terms with the defaulting borrower.

Enforcement of Collateral

In case the loan which is overdue for repayment is a secured loan, the lender can have a relatively easier time recovering the loan.

This is because the collateral can be foreclosed upon and the lender can assume ownership of the collateral in lieu of the loan. However, even in such circumstances, the lender will need to go through the legal system. The court will order whether the underlying asset will be transferred to the lender or not.

The best legal strategy in debt recovery in such cases may be to approach the courts with clean hands. The court is highly likely to appreciate the facts of the case and subsequently make orders which may be in favor of the lender according to the claims made by the lender.

Benefits of The Right Legal Strategies for Debt Recovery

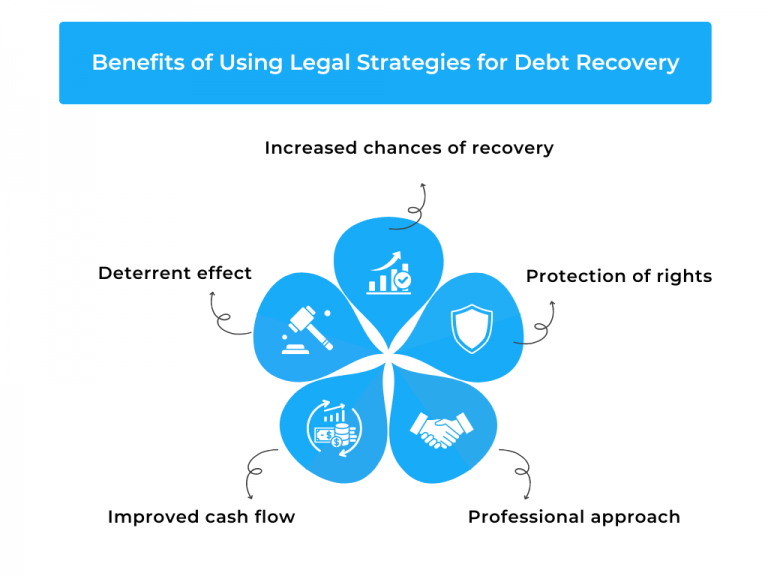

Using legal strategy in debt recovery can have several benefits for businesses. Here are some of the key advantages of using legal approaches to debt recovery:

Increased Chances of Recovery

Legal strategies can increase the chances of recovering outstanding debts by providing a formal, legal process for pursuing unpaid debts. This can be particularly effective in cases where other debt recovery methods have failed.

Deterrent effect

The threat of legal action can act as a deterrent to debtors who may otherwise be unwilling to pay their debts. The possibility of facing legal consequences can encourage debtors to prioritize their debt repayment obligations.

Improved cash flow

Recovering outstanding debts through legal strategies can improve a business’s cash flow, allowing them to meet their financial obligations and invest in growth opportunities.

Professional approach

Legal strategies provide a professional approach to debt recovery, demonstrating to debtors that the business is serious about recovering outstanding debts. This can help to maintain the business’s reputation and build trust with customers.

Protection of rights

Legal strategies help to protect the legal rights of businesses and their creditors. By pursuing debts through legal channels, businesses can ensure that their rights are respected and that they receive fair treatment.

While legal strategy in debt recovery can be effective in recovering outstanding debts, it’s important for businesses to consider the costs and risks associated with these approaches. Legal professionals can provide guidance on the most appropriate legal strategy for a particular situation, as well as advice on how to minimize risks and costs.

Best Practices for Implementing Legal Strategies Effectively

Implementing legal strategies for debt recovery can be complex and time-consuming. Here are some best practices to help businesses implement legal strategies effectively:

Keep accurate records

Maintaining accurate records of all financial transactions and communications with debtors is essential when implementing legal strategies. Accurate records help to establish the validity of the debt and demonstrate that the business has made reasonable efforts to recover outstanding debts.

Act Quickly

Time is of the essence when it comes to debt recovery. Businesses should act quickly to pursue outstanding debts and avoid delays that can increase the risk of non-payment or insolvency.

Use Demand Letters Effectively

Demand letters are a powerful tool for debt recovery, but they must be used effectively. Businesses should ensure that their demand letters are clear, concise, and legally sound, and that they provide debtors with a reasonable timeframe to repay their debts.

Work with Legal Professionals

Working with legal professionals can help businesses to navigate the complexities of debt recovery and minimize the risks associated with legal action. Legal professionals can provide guidance on the most appropriate legal strategy in debt recovery for a particular situation, as well as advice on how to minimize risks and costs.

Consider the Debtor’s Financial Situation

When pursuing legal strategy in debt recovery, it’s important to consider the debtor’s financial situation. If the debtor is experiencing financial difficulties, negotiating a payment plan or settlement may be a more appropriate approach than litigation.

Monitor progress

Monitoring the progress of legal strategies is essential for ensuring that businesses achieve their debt recovery objectives. Businesses should track the progress of legal action and adjust their approach as necessary to maximize their chances of recovering outstanding debts.

By following these best practices, businesses can implement legal strategies for debt recovery more effectively, minimize risks and costs, and increase their chances of recovering outstanding debts.

Choosing the Right Legal Approach for Your Business

Choosing the right legal approach for debt recovery depends on a range of factors, including the size of the debt, the debtor’s financial situation, and the objectives of the business. Here are some key considerations to help businesses choose the right legal approach:

Size of the Debt

The size of the debt is a critical factor in determining the appropriate legal approach. For small debts, small claims court may be the most appropriate option, while larger debts may require litigation.

Debtor’s Financial Situation

The debtor’s financial situation is an important consideration when choosing a legal approach. If the debtor is experiencing financial difficulties, negotiating a payment plan or settlement may be a more appropriate approach than litigation.

Cost and Complexity

The cost and complexity of legal approaches can vary significantly. Businesses should consider the costs and benefits of each legal approach and choose the approach that best suits their needs and objectives.

Timeframe

The timeframe for debt recovery is another important consideration. Some legal approaches, such as mediation and negotiation, can be resolved more quickly than litigation, which can be a lengthy and time-consuming process.

Legal Expertise

Legal expertise is essential for choosing the right legal approach and implementing legal strategies effectively. Businesses should work with legal professionals who have experience in debt recovery and can provide guidance on the most appropriate legal approach for a particular situation.

By considering these factors, businesses can choose the right legal approach for debt recovery and maximize their chances of recovering outstanding debts. Legal professionals can provide guidance on the most appropriate legal approach for a particular situation, as well as advice on how to minimize risks and costs.

Working with Legal Professionals to Maximize Collections

Working with legal professionals is essential for maximizing collections and implementing legal strategy in debt recovery effectively. Here are some key considerations when working with legal professionals:

Choose the Right Legal Professional

When choosing a legal professional, businesses should consider factors such as experience, expertise, and reputation. It’s important to work with a legal professional who has experience in debt recovery and can provide guidance on the most appropriate legal approach for a particular situation.

Establish Clear Communication

Establishing clear communication with legal professionals is essential for ensuring that debt recovery strategies are implemented effectively. Businesses should ensure that legal professionals are kept informed of all developments and that they understand the objectives of the business.

Set Realistic Expectations

Legal strategies can be complex and time-consuming. Businesses should set realistic expectations with their legal professionals and understand the potential costs and risks associated with legal action.

Collaborate on strategy

Legal professionals can provide valuable guidance on the most appropriate legal approach for debt recovery, but it’s important for businesses to collaborate on strategy and ensure that legal strategies align with the overall objectives of the business.

Monitor Progress

Monitoring the progress of legal strategies is essential for ensuring that businesses achieve their debt recovery objectives. Legal professionals should provide regular updates on the progress of legal action, and businesses should be prepared to adjust their approach as necessary to maximize their chances of recovering outstanding debts.

Working with legal professionals can help businesses to navigate the complexities of debt recovery and maximize their chances of recovering outstanding debts.

By choosing the right legal professional, establishing clear communication, setting realistic expectations, collaborating on strategy, and monitoring progress, businesses can implement legal strategies more effectively and achieve their debt recovery objectives.

Overcoming Common Challenges in Legal Debt Recovery

Legal debt recovery can be a complex process, and businesses may encounter a range of challenges along the way. Here are some common challenges that businesses may face in legal debt recovery, along with strategies for overcoming them:

Inadequate Documentation

Inadequate documentation can make it difficult to pursue legal action for debt recovery. Businesses should ensure that they have clear and complete documentation of the debt, including any agreements, invoices, and correspondence.

Insufficient Information about the Debtor

Lack of information about the debtor’s financial situation can make it difficult to determine the appropriate legal approach for debt recovery. Businesses should conduct due diligence to gather as much information as possible about the debtor’s financial situation, including their assets and liabilities.

Resistance from the Debtor

Debtors may resist legal action for debt recovery, which can make the process more challenging. Businesses should be prepared to negotiate and collaborate with debtors to find a mutually acceptable solution, such as a payment plan or settlement.

Complex Legal Processes

Legal processes for debt recovery can be complex and time-consuming, requiring significant resources and expertise. Businesses should work with legal professionals who have experience in debt recovery and can provide guidance on the most appropriate legal approach for a particular situation.

Enforcement Challenges

Even after obtaining a judgment, businesses may face challenges enforcing the judgment and recovering the debt. Businesses should be prepared to take further legal action, such as garnishing wages or seizing assets, to enforce the judgment and recover the debt.

By addressing these common challenges, businesses can overcome obstacles to legal debt recovery and maximize their chances of recovering outstanding debts. Working with legal professionals who have experience in debt recovery can be particularly helpful, as they can provide guidance on strategies for addressing these challenges and implementing legal strategies effectively.

How Can Legodesk Help?

Legodesk offers a software platform that has been built from the ground up keeping the needs of lenders in mind.

Legodesk’s software tool has a range of built-in features that can make the debt collection efforts of lenders more efficient and less costly. Some of the primary features include case management, contact management, legal notice automation, and the Feet-on-Street app.

Our range of features streamlines several aspects of the debt collection process and is meant to be used as a collaborative tool between agents and executives.

Legodesk is a trusted provider for banks, NBFCs, as well as enterprises that provide credit in any form.

Wrapping Up

The role of the law cannot be ignored when it comes to debt collection. Even when a court of law is not directly approached in a matter, it still plays a role as a deterrent and a negotiation tool.

It is advisable for agents and executives working on debt collection matters to be familiar with relevant laws so that they can act more confidently take the right decisions and be more effective as negotiators.

Overall, using the right legal strategies in debt recovery can help lenders leverage the court system of India to collect their dues at lower cost and with a higher chance of success.