How Technology is Transforming Debt Collection Services

The average net non-performing assets ratio for commercial banks in India stood at 3.9% in March 2023. This shows that banks can reap significant benefits by streamlining their debt collection process.

Many lenders outsource their debt collection operations. Traditionally, debt collection operations have largely been completely manual with agents calling on the borrower either by phone or knocking on their door in an effort to persuade them to clear the dues. This approach while effective is highly costly and time-consuming.

Thanks to emerging technology, we now have better ways of managing debt collection operations. While the manual element cannot be removed completely, technology promises to make the process easier and more efficient in terms of both time and money. This will help lenders focus on their core offerings rather than expend resources on collecting their dues.

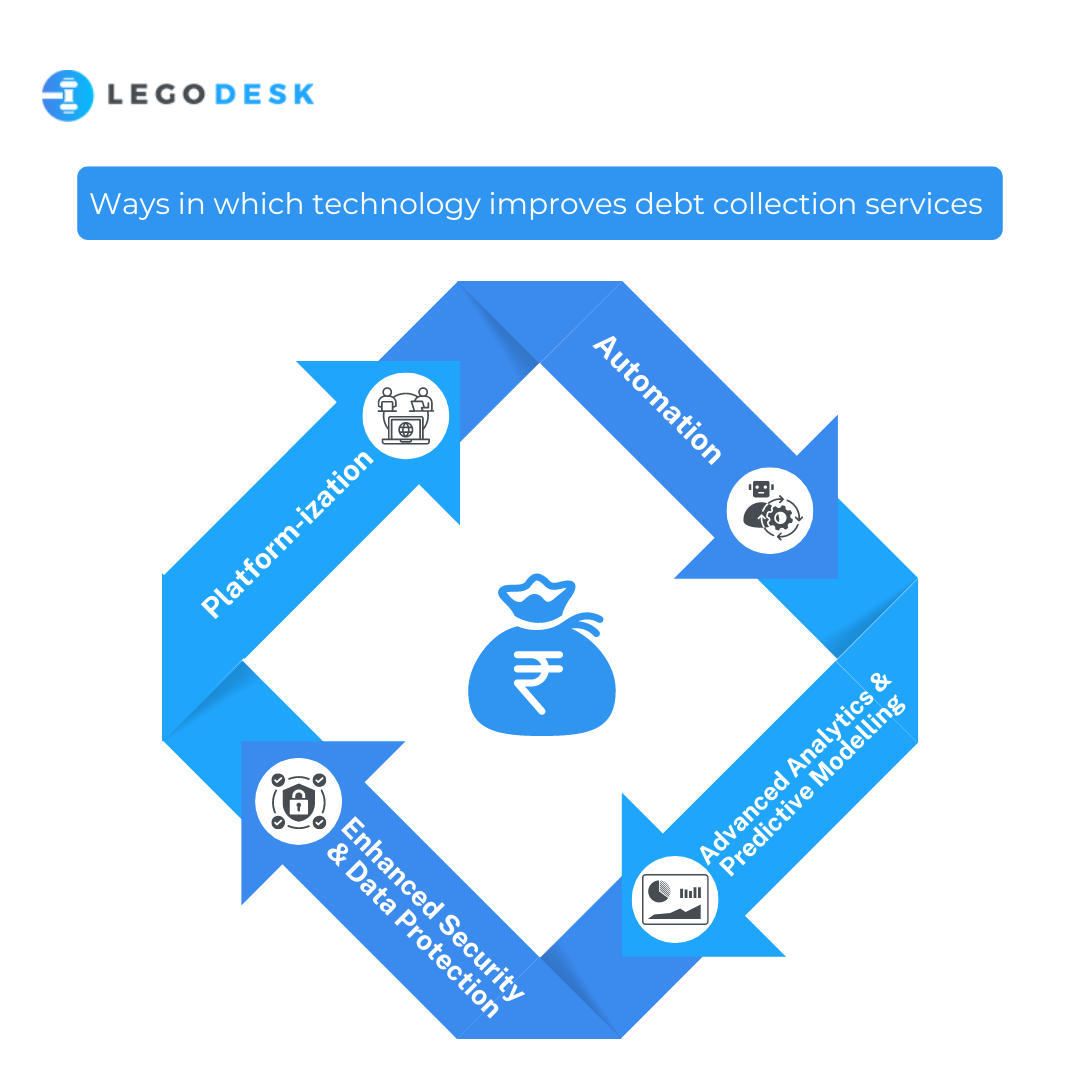

Let’s take a look at four important ways in which technology improves debt collection services.

Platform-ization

By platformization, we are referring to integrated software platforms that serve as a one-stop source of truth for all your debt collection workflow management. Instead of using 15 different spreadsheets and five different software tools that are not meant for debt collection management, lenders can opt for a single platform that has been specially designed for debt collection.

There can be several advantages to using one platform. The agents and executives working on numerous cases will be able to save a lot of time and effort while going about their duties. This will help them focus on their core responsibilities rather than wasting their efforts managing the data and the workflow.

Further, having a single platform will help to reduce mistakes. How many times has it happened that the data between two spreadsheets doesn’t match and then we have to go down a rabbit hole trying to figure out what the correct data is? This can become especially challenging when the spreadsheets are large and threatening to become larger.

Having a single source of truth means that executives can rely on the accuracy of the information and it is easier for them to consistently update the information. Legodesk offers such a platform along with debt collection services for small businesses, banks, NBFCs, etc.

Automation

Automation is affecting almost every field in the world and lending is no different. A few tasks that are part of the debt collection process can be automated so that agents can save time and become more efficient.

For example, templated reminders for payment of dues can be automatically sent based on pre-defined timelines. Legodesk’s debt collection services to banks and other lenders come with automated legal notices and other automation.

Artificial intelligence can also be leveraged to analyze data to provide the best strategies for debt recovery as well. Such systems are programmed to be able to analyze the financial history and past behavior of borrowers to personalize the debt recovery methods to improve the rate of success.

Overall, the automation of highly technical as well as routine tasks can help lenders make their operations more streamlined and cost-effective. New ways of automation may also be developed in the near future so lenders should keep an eye on the latest capabilities to leverage them once they become feasible.

Advanced Analytics and Predictive Modelling

Gone are the days when lenders were left guessing about their non-performing assets. Studies have found that 58% of debt collectors are leveraging AI to predict debt outcomes while 56% are using it to segment and profile customers based on workflow requirements.

Thanks to advances in data analytics, it’s now possible to leverage science to make more accurate predictions on the outcome of pending loans that a lender has.

These tools can analyze borrower demographics, preferences, payment history, finances, and behavior to predict which loans should be categorized as “high-risk” of default. The lender can then allocate their resources and plan accordingly.

While predictive modeling is not a perfect science, it is still far better than the alternative of not having any view with regard to the future performance of debt assets held by a lender. This predictive modeling can help lenders make better lending decisions as more and more data is collected from the market.

Enhanced Security and Data Protection

One of the big headaches of collecting and leveraging data to help make better business decisions is managing and protecting that data. Every lender understands the importance of data management and protection.

Any leakage of sensitive information can harm not only the customers whose data has been leaked but also the hard-won reputation of the company. Since the potential losses can be high, it’s important to leverage the latest technology when it comes to data protection and security.

Several legal compliance norms need to be met to ensure that the data is collected and used in accordance with legal boundaries and the data is protected against misuse and leakages.

Thanks to emerging technology, data protection tools are now available which can help ensure not only the safety of the data but also its compliance with existing regulations. These secure platforms are built from the ground up to ensure that any data stored is encrypted as per industry standards and there is no data breach.

How Does Legodesk Help?

Legodesk offers the complete software solution designed for debt collection management that lenders need.

Our platform has been built from the ground up to offer a single point for executives and agents to manage their workflows. We have built-in automation capabilities that leverage the latest technology to reduce manual work as much as possible and allow agents to focus on their core duties. Further, any data stored on Legodesk is protected and encrypted so that lenders can rest assured.

Legodesk is trusted by banks, NBFCs, and FinTech companies as their partner helping with debt collection services that improve efficiency and reduce costs.

Wrapping Up

Emerging technology is changing the way in which lenders approach debt, especially the debt collection process. Thanks to artificial intelligence, specialized software tools, data analytics, and cybersecurity capabilities, lenders can have an easier time managing the loan assets on their books and reducing their non-performing assets.

The contemporary consumer expects a certain level of service. Meeting such expectations allows lenders to maintain and build their reputation over time and leveraging new-age technology is a step in the right direction.

Overall, support services such as Legodesk can help lenders improve business outcomes by streamlining part of the process. Since lenders handle large volumes, efficiency gains can help lenders improve their bottom line and increase value.

Try our Debt Resolution solutions today Request a Demo