Managing Student Loan Debt: Strategies for Borrowers and Lenders

Understanding Student Loan Debt: A Growing Financial Challenge

Student loan debt has become a significant financial challenge for individuals seeking higher education. This section delves into the complexities and implications of student loan debt. It explores the reasons behind the increasing burden of student loans, including rising tuition costs and limited financial aid options. Additionally, it discusses the impact of student loan debt on borrowers’ financial well-being, such as delayed savings, limited career choices, and reduced ability to pursue other life goals.

Understanding the nature of student loan debt is crucial for both borrowers and lenders. It requires a comprehensive understanding of loan terms, interest rates, and repayment options. By delving into the intricacies of student loan debt, individuals can make informed decisions about their borrowing choices and develop effective strategies for managing their debt. Moreover, this article highlights the importance of addressing student loan debt on a broader societal level. It emphasizes the need for policy changes, increased access to financial aid, and enhanced financial literacy programs to alleviate the burden faced by borrowers. By comprehensively understanding the challenges associated with student loan debt, individuals and policymakers can work together to find sustainable solutions and create a more equitable higher education financing system.

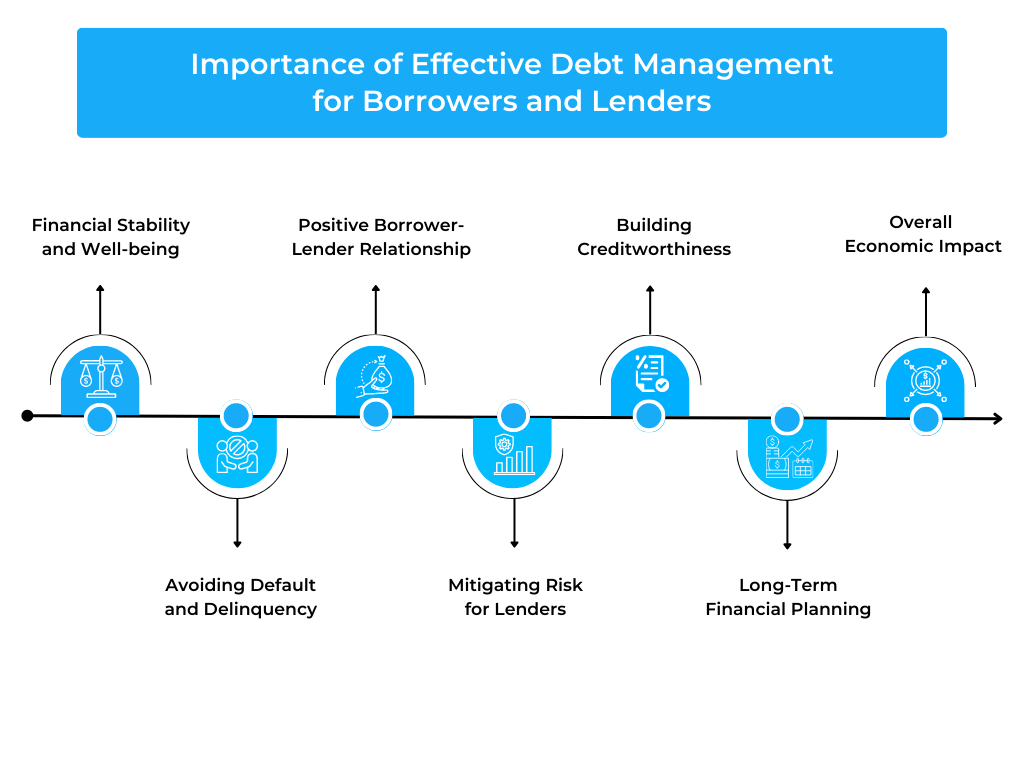

Importance of Effective Debt Management for Borrowers and Lenders

- Financial Stability and Well-being: Effective debt management allows borrowers to maintain their financial stability and overall well-being. It helps borrowers avoid the stress and negative consequences of excessive debt, promoting a healthier financial life.

- Avoiding Default and Delinquency: By managing their debt effectively, borrowers can avoid default and delinquency, which can have severe consequences on credit scores and future financial opportunities. Lenders benefit from reduced default rates, ensuring the sustainability of their lending operations.

- Positive Borrower-Lender Relationship: Effective debt management fosters a positive relationship between borrowers and lenders, built on trust and mutual understanding. This relationship allows for open communication, potential negotiation of repayment terms, and collaborative solutions during financial hardships.

- Mitigating Risk for Lenders: Lenders mitigate their risk by promoting effective debt management among borrowers. It reduces the likelihood of loan defaults, which can have a significant impact on lenders’ financial health and profitability.

- Building Creditworthiness: Effective debt management helps borrowers build and maintain a positive credit history. This enhances their creditworthiness and opens doors to future financial opportunities, such as lower interest rates on loans and access to other forms of credit.

- Long-Term Financial Planning: Debt management encourages borrowers to engage in long-term financial planning. It promotes responsible budgeting, savings, and investment practices, ensuring a stronger financial future.

- Overall Economic Impact: When borrowers effectively manage their debt, it positively impacts the broader economy. Reduced default rates and increased financial stability contribute to a more robust and resilient financial system.

Choosing the Right Repayment Plan: Options and Considerations

When it comes to managing student loan debt, choosing the right repayment plan is crucial. This section explores the various repayment options available to borrowers and highlights the key considerations to keep in mind when making this important decision.

- Standard Repayment Plan: This plan involves fixed monthly payments over a set repayment period. It offers the advantage of predictable payments and the potential to pay off the loan sooner, but it may require higher monthly payments.

- Income-Driven Repayment Plans: Income-Driven Repayment (IDR) plans calculate monthly payments based on borrowers’ income and family size. Options such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) can provide more manageable payments based on income but may result in longer repayment periods and potentially higher overall interest payments.

- Graduated Repayment Plan: The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This plan may suit borrowers who expect their income to grow in the future, but it could result in higher overall interest payments.

- Extended Repayment Plan: The Extended Repayment Plan extends the repayment period beyond the standard ten years, allowing for smaller monthly payments. While it provides more manageable payments, borrowers should consider the increased interest costs over the extended period.

- Considerations for Choosing a Repayment Plan:

- Monthly Budget: Assess your financial situation and determine the maximum monthly payment you can comfortably afford.

- Income Outlook: Consider your current income and future earning potential when choosing a repayment plan that aligns with your financial goals.

- Loan Forgiveness and Discharge: Research if you qualify for loan forgiveness or discharge programs under specific repayment plans.

- Total Interest Paid: Calculate the total interest paid over the life of each plan to understand the long-term cost implications.

- Flexibility: Evaluate the flexibility offered by different plans, such as the option to switch plans or make additional payments without penalties.

Exploring Loan Forgiveness and Discharge Programs: Eligibility and Benefits

Loan forgiveness and discharge programs, such as Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, Income-Driven Repayment (IDR) Forgiveness, Total and Permanent Disability Discharge, Closed School Discharge, and Bankruptcy Discharge, provide relief to borrowers by reducing or eliminating their student loan debt. These programs offer benefits such as reduced debt burden, potential savings, career and professional opportunities, and alleviating financial hardship. PSLF encourages borrowers to pursue public service careers, while Teacher Loan Forgiveness supports educators working in low-income schools. IDR Forgiveness provides relief after a designated payment period, while disability and closed school discharges address specific circumstances. Although student loans are generally not dischargeable in bankruptcy, extreme financial hardship may qualify for a discharge. Overall, these programs offer borrowers much-needed assistance in managing their student loan debt.

Financial Literacy and Education: Empowering Borrowers to Manage Student Loan Debt:

Financial literacy and education are crucial for empowering borrowers to effectively manage their student loan debt. By providing borrowers with the knowledge and skills needed to navigate their loan repayment journey, financial literacy initiatives play a vital role in equipping individuals with the tools for financial success. This includes understanding loan terms, creating budgets, exploring repayment options, and minimizing interest accumulation. By building credit and financial health, borrowers can establish a strong foundation for their financial future. Collaboration between financial institutions, educational institutions, and government agencies can enhance access to resources and support. Overall, promoting financial literacy enables borrowers to make informed decisions, leading to improved financial well-being and long-term success.

Communication and Collaboration: Building a Strong Borrower-Lender Relationship

A strong borrower-lender relationship is essential for effective student loan debt management. Clear and open communication between borrowers and lenders fosters mutual understanding, trust, and cooperation. By maintaining open lines of communication, borrowers can stay informed about important updates, changes in loan terms, and available repayment options. Lenders, on the other hand, can provide timely and accurate information regarding payment schedules, interest rates, and potential assistance programs. Collaborative efforts between borrowers and lenders can also lead to tailored solutions and repayment plans that align with the borrower’s financial circumstances. Through ongoing communication and collaboration, borrowers and lenders can work together to address challenges, explore alternative repayment options, and ensure a smoother loan repayment experience.

Addressing Default and Delinquency: Strategies for Early Intervention and Resolution

Addressing default and delinquency in student loan debt requires proactive strategies and early intervention. By recognizing warning signs and implementing targeted measures, borrowers and lenders can work together to overcome financial challenges. This includes establishing proactive communication channels, offering assistance options tailored to borrowers’ needs, and providing financial counseling and education. Exploring alternative repayment options can also help prevent default and support sustainable repayment solutions. By taking these steps, borrowers and lenders can address default and delinquency effectively, ensuring a smoother loan repayment experience for all parties involved.

FAQ

1. Why has student loan debt become such a significant financial challenge?

Student loan debt has become a significant financial challenge due to factors such as rising tuition costs, limited financial aid options, and increasing numbers of students pursuing higher education. These factors have contributed to the accumulation of substantial loan amounts, leading to financial burdens for borrowers.

2. What are the different types of repayment plans available for student loans?

Standard Repayment Plan: Fixed monthly payments over a set repayment period.

Income-Driven Repayment Plans: Monthly payments based on income and family size, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Graduated Repayment Plan: Lower initial payments that gradually increase over time.

Extended Repayment Plan: Extended repayment period beyond the standard ten years, resulting in smaller monthly payments.

Please note that the availability of these plans may vary depending on the country and specific loan program

3. What are the key elements of student loan terms, interest rates, and repayment options that borrowers should understand?

The key elements of student loan terms, interest rates, and repayment options that borrowers should understand include:

Loan Terms: Borrowers should be aware of the loan amount, disbursement dates, repayment start date, and the length of the repayment period.

Interest Rates: Understanding the interest rate is crucial. It determines the cost of borrowing and affects the total amount repaid over time. It’s important to know if the interest rate is fixed or variable and how it can impact monthly payments and overall loan costs.

Repayment Options: Borrowers should familiarize themselves with the available repayment plans. These can include standard repayment, income-driven repayment (IDR), graduated repayment, and extended repayment. Each plan has different payment structures and terms that should be considered based on personal financial circumstances.

Grace Period: Some loans offer a grace period after graduation or leaving school before repayment begins. Understanding the length of this grace period is important to plan finances accordingly.

Deferment and Forbearance: Borrowers should be aware of the options for deferment and forbearance. These allow temporary pauses or reductions in loan payments under certain circumstances, such as financial hardship or returning to school.

Loan Fees: Loan fees, such as origination fees, may be charged by lenders. It’s essential to understand these fees and how they impact the total loan cost.

Prepayment and Early Repayment Penalties: Knowing whether there are any penalties for prepayment or early repayment is important for borrowers who want to pay off their loans faster or save on interest.

Understanding these key elements helps borrowers make informed decisions, choose the most suitable repayment options, and effectively manage their student loan debt.

Conclusion:

Navigating Student Loan Debt for Borrowers and Lenders

Managing student loan debt is a critical aspect for both borrowers and lenders in today’s educational landscape. This article has explored various strategies and considerations for effectively managing this financial challenge. By understanding the nuances of student loan debt, borrowers can make informed decisions regarding repayment plans, loan forgiveness programs, and accessing financial literacy resources. Lenders, on the other hand, play a crucial role in fostering open communication, collaborating with borrowers, and implementing proactive measures to address default and delinquency.

Ultimately, successful management of student loan debt requires a partnership between borrowers and lenders, with a focus on financial education, proactive communication, and tailored solutions. By embracing these strategies, borrowers can navigate their debt responsibly and lenders can contribute to a more sustainable and supportive lending ecosystem. With a collective effort, the burdens associated with student loan debt can be alleviated, allowing individuals to pursue their educational goals while maintaining financial well-being.