Section 138 NI Act: Empowering Creditors in Debt Recovery

As a bank, fintech, or lender, encountering situations where customers fail to fulfill their financial obligations can be daunting. Fortunately, legal provisions such as Section 138 NI of the Negotiable Instruments Act (NI Act) serve as formidable tools for creditors seeking recourse in debt recovery scenarios.

This act is especially crucial when borrowers lack the intention of repayment and are willfully avoiding paying their debt.

In this guide, we’ll delve into the intricacies of how Section 138 NI acts as a potent mechanism for recovering outstanding debts, including dishonored cheques, and the legal framework surrounding its implementation.

Understanding Section 138 NI:

Section 138 NI of the Negotiable Instruments Act addresses the dishonor of Negotiable Instruments. These are commonly known as cheques.

The Section outlines the legal repercussions for individuals involved in such transactions. When a cheque is dishonored due to insufficient funds or exceeds the arrangement made by the drawer’s account, the drawer becomes liable for legal action.

Additionally, this Section establishes both civil and criminal liabilities for such dishonored cheques, underscoring the seriousness of honoring financial commitments and maintaining the integrity of negotiable instruments.

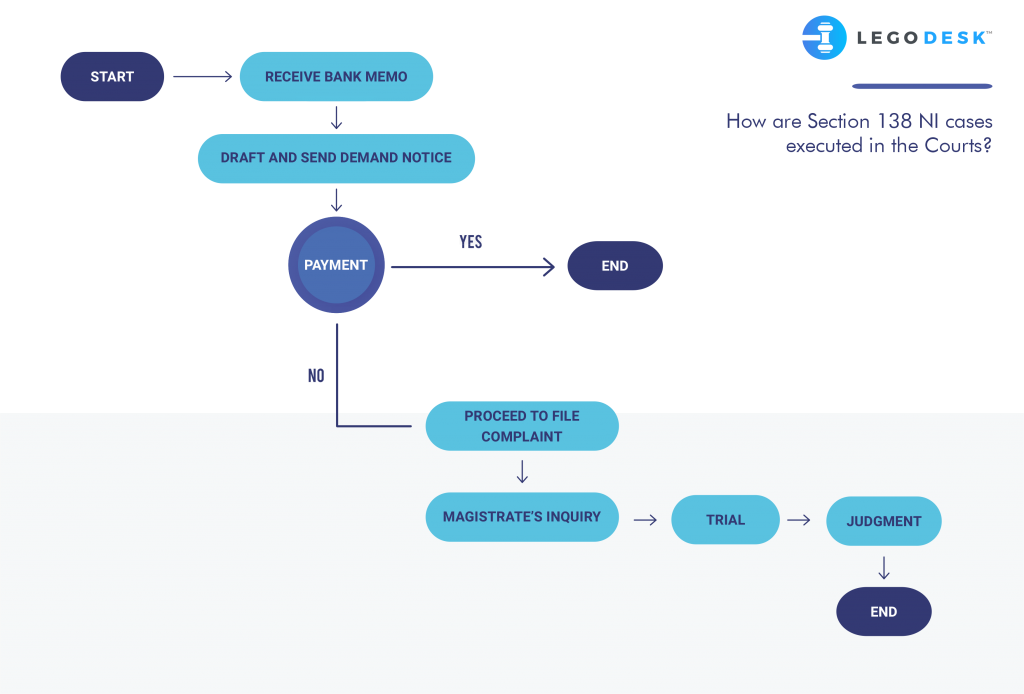

How Section 138 NI act is filed in the Courts:

The first step begins after receiving a Bank Memo where it will be mentioned that the cheque was dishonored due to insufficient funds

Demand Notice (Within 30 Days of Bank Memo):

- Drafting and Sending: Preparing a legal demand notice under Section 138(2) of the NI Act. This notice should clearly state:

- Details of the dishonored cheque (cheque number, date, amount)

- Reason for dishonoring (as per bank memo)

- Demand for repayment of the cheque amount within 15 days of receiving the notice

- Mention potential legal action under Section 138 if payment isn’t received

- Sending Method: Sending the demand notice through registered post or speed post with Acknowledgment Due (AD). Do retain a copy of the notice and the postal receipt for proof of service

Filing a Complaint (After 15 Days of Unpaid Notice):

- Beyond 15 Days: If payment isn’t received within 15 days of delivering the demand notice, lenders can proceed to file a complaint with the Magistrate’s Court.

Documents Required:

- Complaint Petition: This document drafted by a lawyer or the lender themselves should include:

- Details of the parties involved (lender and borrower)

- Description of the financial transaction (loan amount, cheque details)

- Copy of the dishonored cheque with bank’s dishonorment stamp

- Proof of presenting the cheque for encashment

- Copy of the demand notice sent to the borrower

- Statement outlining the prejudice caused by the non-payment (optional, but strengthens the case)

- Evidence on Affidavit: An affidavit sworn before a notary public is required. This affidavit typically includes:

- Reaffirmation of the facts mentioned in the complaint petition

- Verification of the attached documents as genuine

- Power of Attorney assigned to any authorized representative of the Lender who can in turn engage a Counsel or an Advocate to represent in the Courts

- In practical scenarios, the limitation period of filing the case is often lapsed and the lender may file a Delay Condonation appeal to condone the delay before the case is admitted

Court Process:

The following court process remains the same as explained earlier:

- Magistrate’s Inquiry: The Magistrate examines the complaint and evidence

- Summons Issuance: If satisfied, the Magistrate issues summons to the defendant. Summons can be issued by 5 medium to the accused

– By Registered Post with AD

– By an officer of the Court

– In cases where the Jurisdiction is outside of the Territorial Jurisdiction of the Court then the summons are sent directly to the concerned Police stations where the accused resides to get them served

– In some instances, Courts allow the complainant to serve the summons physically to the accused and submit a copy of the summons duly signed by the accused as a token of accepting the summons - Warrants – The court issues warrants when it compels the accused to be present before it. It is usually done in case of cognizable offenses and to ensure the administration of Justice where the presence of the accused is necessary for proper adjudication of the case

- Trial: The complainant presents evidence, and the defendant has the opportunity to defend themself

- Judgment: The Magistrate delivers a judgment based on the presented arguments

Additional Considerations:

- Time Limit: Remember, there’s a strict time limit of 30 days from receiving the bank memo to sending the demand notice and a further 15 days for the borrower to respond before filing the complaint

- Legal Representation: Consulting a lawyer is recommended for drafting the complaint petition, and affidavit, and navigating the court proceedings effectively

- Gathering Additional Evidence: Any communication regarding the loan or the cheque (emails, text messages) can be helpful as supporting evidence

By following these steps and adhering to the time limits, you increase your chances of a successful outcome in recovering the amount owed through the legal route provided by Section 138 of the NI Act.

The Role of Warrants in Debt Recovery:

Warrants empower Courts to compel accused persons to appear before it. In the context of Sec 138 NI act, it becomes evidently clear that once the warrant is issued by the Court, the law enforcement agencies are instructed to produce the accused person(s) in the Court who have issued the warrant. During the process, the Police and other enforcement agencies get in touch with the borrower and execute the warrants respectively.

Moreover, it is observed that at this very juncture most of the borrowers who have been evading these notices and debt repayment contact the lender to cease the legal proceedings and negotiate on settlement of the due amount. This very process helps lenders to recover their defaulted amounts in the right lawful manner instead of using any coercive techniques used by the Collection agents or Agencies.

Procedural Compliance and Challenges:

The major challenge that any Lender faces during the process of warrant execution is mapping the correct Police Station while pleading with the Court to issue Warrants. This incorrect mapping loses a lot of precious Judicial time when warrants do not reach the correct Police stations and they are not executed. These cause huge delays in getting the cases resolved.

Furthermore, warrants are of primarily two types

- Bailable Warrants – Here the Police arrest the accused and release them once the borrower is able to provide a surety bond of the amount fixed by the Court

- Non-Bailable Warrants – Here the Police arrest the accused and produce them to the nearest Court ensuring the compliance of arrest is met. Now every effort is being made by the Police to produce the accused in the Court who have issued the warrant

Leveraging Technology for Efficient Execution:

Technology facilitates efficient warrant execution by enabling lenders’ agents to use mobile applications for secure access to accurate customer information, aiding law enforcement agencies. Additionally, India Posts’ consignment tracker ensures swift notification to ground agents once warrant copies reach relevant police stations, saving significant time on follow-ups.

Comprehensive debt collection technology providers, such as Legodesk, can enable effective debt recovery. Contact us to know how

Conclusion:

In conclusion, Section 138 NI of the Negotiable Instruments Act serves as a potent recovery tool for creditors grappling with dishonored cheques and outstanding debts. By understanding the legal framework and leveraging warrants in debt recovery, stakeholders can navigate financial disputes effectively and ensure the enforcement of legal remedies. Proactive measures, adherence to procedural compliance, and the integration of technology are imperative in overcoming challenges and fortifying the integrity of the debt recovery process under the Section.