SaaS-ification for faster debt recovery

Debt recovery is a critical process for any business that extends credit to its customers. However, the traditional debt collection process can be time-consuming and resource-intensive, often resulting in delayed payments and lost revenue. As businesses increasingly turn to software-as-a-service (SaaS) solutions for their operations, there is a growing trend towards the “SaaS-ification” of debt recovery processes. SaaS-based debt recovery solutions offer several benefits, including faster recovery times, reduced manual labor, and increased efficiency. In this article, we will explore how SaaS-ification is revolutionizing debt recovery and the key advantages of adopting a SaaS-based debt recovery solution.

What is Saas-ification in debt recovery?

SaaS-ification in debt recovery refers to the process of using software-as-a-service (SaaS) solutions to automate and streamline the debt recovery process. Instead of relying on manual and time-consuming methods, such as phone calls and emails, SaaS-based debt recovery solutions leverage the power of technology to accelerate the process and improve overall efficiency. By adopting a SaaS-based debt recovery solution, businesses can automate many of the tasks associated with debt collection, such as sending automated reminders and notifications, tracking payment history, and generating reports. This not only saves time and reduces the need for manual labor but also enables businesses to recover debt more quickly and effectively. SaaS-ification of debt recovery also provides businesses with greater flexibility and scalability, as they can easily adjust and customize the software to meet their specific needs. Additionally, SaaS-based solutions are often more cost-effective than traditional debt collection methods, making them an attractive option for businesses of all sizes.

Importance of Saas-ification in debt recovery

SaaS-ification in debt recovery is becoming increasingly important for businesses of all sizes. Here are some of the key reasons why:

- Faster debt recovery: SaaS-based debt recovery solutions offer faster recovery times by automating many of the manual tasks associated with debt collection, such as sending reminders and notifications. This enables businesses to recover debt more quickly and reduce the risk of late or unpaid invoices.

- Increased efficiency: By automating many of the tasks associated with debt collection, businesses can increase efficiency and reduce the need for manual labor. This frees up time and resources that can be allocated to other areas of the business, improving overall productivity.

- Improved cash flow: Faster debt recovery and increased efficiency can lead to improved cash flow, as businesses can collect payments more quickly and reduce the risk of outstanding debts. This can help businesses to maintain healthy cash flow and avoid cash flow problems.

- Customization and scalability: SaaS-based debt recovery solutions can be customized and scaled to meet the specific needs of businesses. This allows businesses to tailor the solution to their unique requirements, whether they are small businesses or large enterprises.

- Cost-effective: SaaS-based debt recovery solutions are often more cost-effective than traditional debt collection methods. This is because they require less manual labor, can be automated, and can be tailored to the specific needs of businesses.

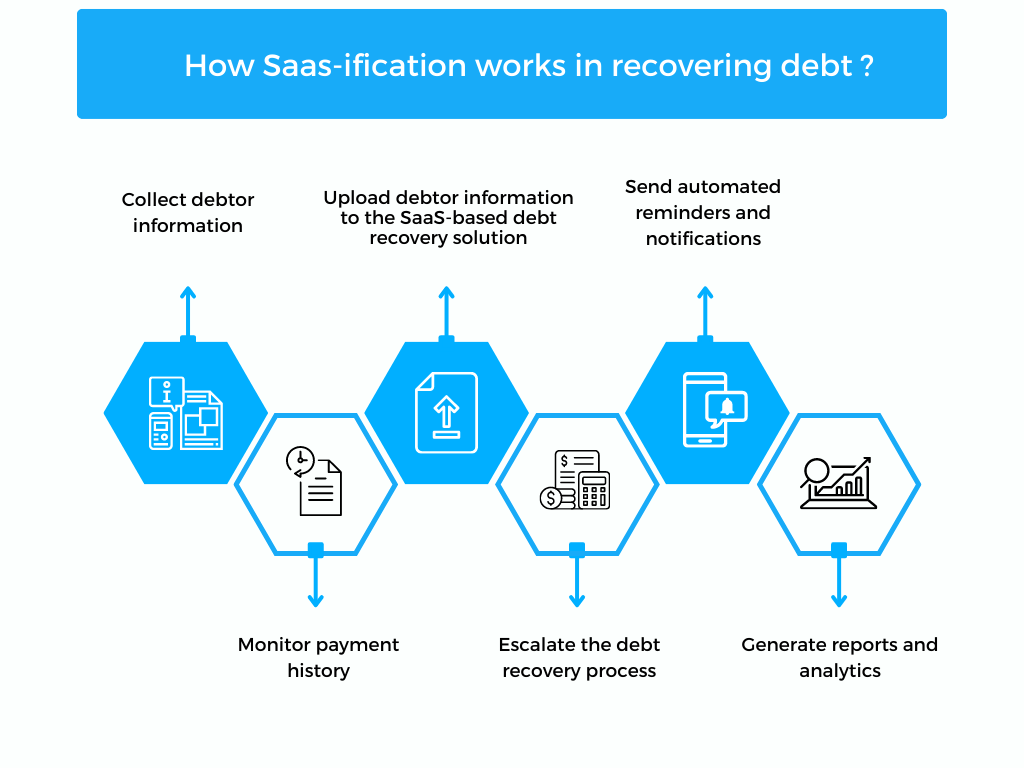

How Saas-ification works in recovering a debt?

SaaS-ification of debt recovery works by automating and streamlining the debt collection process through the use of software-as-a-service (SaaS) solutions. Here is a step-by-step explanation of how it works:

- Collect debtor information: The first step in the debt recovery process is to collect debtor information. This includes the name, address, and contact details of the debtor, as well as the amount owed and the payment history.

- Upload debtor information to the SaaS-based debt recovery solution: Once the debtor information has been collected, it is uploaded to the SaaS-based debt recovery solution. This can be done manually or automatically through an integration with the business’s accounting or invoicing software.

- Send automated reminders and notifications: The SaaS-based debt recovery solution sends automated reminders and notifications to the debtor, reminding them of the payment due date and requesting payment. These reminders can be sent via email, text message, or phone call, depending on the preferences of the debtor.

- Monitor payment history: The SaaS-based debt recovery solution monitors the payment history of the debtor, tracking when payments are made and when they are overdue. This information is used to trigger further reminders and notifications if payments are not made on time.

- Escalate the debt recovery process: If payments are not made on time, the SaaS-based debt recovery solution can escalate the debt recovery process. This may involve sending more frequent reminders, contacting the debtor’s employer, or engaging the services of a debt collection agency.

- Generate reports and analytics: The SaaS-based debt recovery solution generates reports and analytics on the debt recovery process, providing businesses with insights into their debt recovery performance. This information can be used to optimize the debt recovery process and improve overall performance.

Conclusion

In conclusion, the process of debt recovery can be time-consuming, resource-intensive, and frustrating for businesses. However, with the rise of software-as-a-service (SaaS) solutions, there is a growing trend toward SaaS-ification of debt recovery. By leveraging technology to automate and streamline the debt recovery process, businesses can recover debt more quickly, efficiently, and cost-effectively. SaaS-based debt recovery solutions offer several advantages, including faster recovery times, increased efficiency, improved cash flow, customization and scalability, and cost-effectiveness. By automating many of the tasks associated with debt collection, businesses can save time and resources while also maintaining healthy cash flow and reducing the risk of outstanding debts. As businesses continue to adopt SaaS-based solutions for their operations, it is becoming increasingly important to consider SaaS-ification of debt recovery. By embracing this trend, businesses can improve their debt recovery performance and position themselves for long-term success.