The Role of Debt in Recovery for Revenue-Based Financing Fintechs

Revenue-Based Financing (RBF) has emerged as an alternative financing model that caters to the unique needs of startups and small businesses. In this innovative approach, FinTech companies play a crucial role by providing funding based on a company’s future revenue projections. Unlike traditional debt financing, RBF offers flexible repayment terms and aligns the interests of both the FinTech and the business seeking funding. This article explores the role of debt in recovery for revenue-based financing FinTechs, highlighting how they navigate the challenges of debt utilization and maximize recovery potential for their portfolio companies.

Understanding Debt as a Key Component

Debt plays a crucial role in revenue-based financing FinTechs, providing them with the necessary capital to support the growth and expansion of portfolio companies. In this model, debt is structured as a percentage of future revenues, aligning the interests of both the FinTech and businesses seeking funding. Unlike traditional loans, RBF debt offers flexibility in repayment, tied to the company’s revenue, making it suitable for startups and small businesses. Understanding the significance of debt in revenue-based financing FinTechs allows us to explore its role in implementing effective recovery strategies and supporting sustainable growth.

Role of Debt in Recovery for Revenue-Based Financing

The role of debt in recovery is pivotal for revenue-based financing FinTechs. Debt enables these FinTechs to provide crucial capital to portfolio companies, aiding their recovery efforts. It offers financial resources for strdeategic initiatives and flexible repayment terms tied to future revenue. Debt not only fuels recovery but also aligns the interests of FinTechs and portfolio companies. Effective debt management enhances recovery strategies, fostering sustainable growth for businesses in revenue-based financing models.

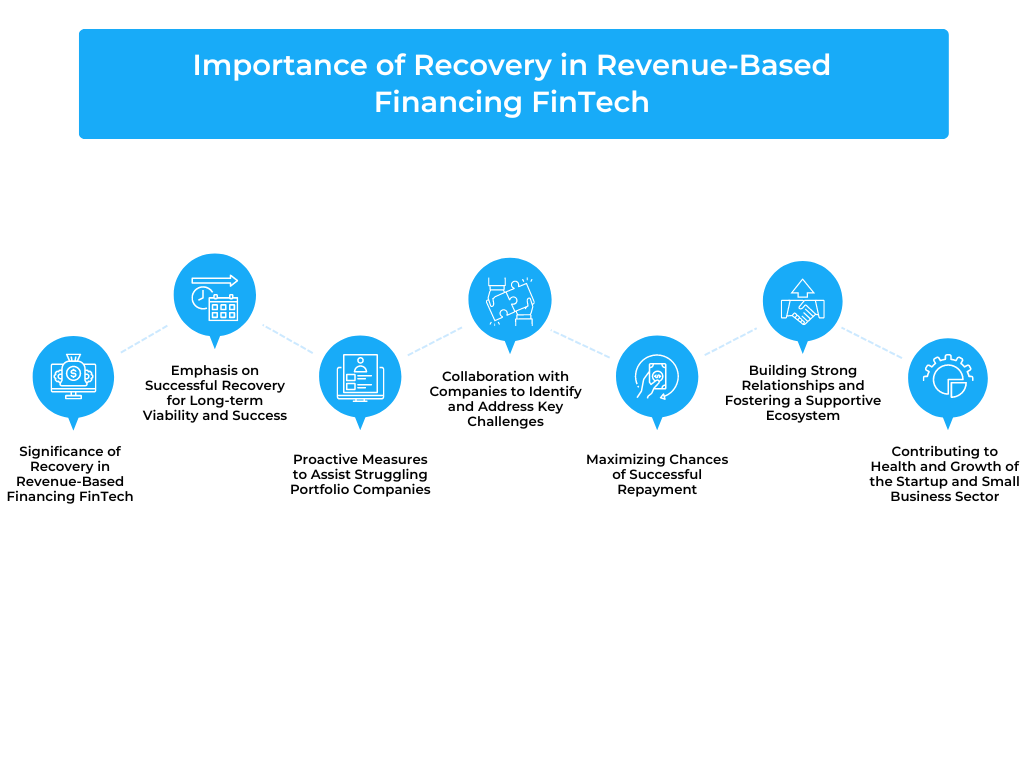

Importance of Recovery in Revenue-Based Financing for FinTechs

- Significance of Recovery in Revenue-Based Financing FinTech: Recovery is a crucial aspect of revenue-based financing FinTech, aiming to achieve successful repayment and financial stability. It emphasizes the importance of sustainable growth and long-term viability for both the FinTech and portfolio companies.

- Emphasis on Successful Recovery for Long-term Viability and Success: Successful recovery ensures the continued operation and success of revenue-based financing FinTechs. It allows FinTechs to maintain a healthy portfolio and attract future investors and lenders.

- Proactive Measures to Assist Struggling Portfolio Companies: Revenue-based financing FinTechs take proactive steps to support portfolio companies during their recovery process. These measures include providing additional guidance, mentorship, and resources to help companies overcome financial challenges.

- Collaboration with Companies to Identify and Address Key Challenges: FinTechs collaborate closely with portfolio companies to identify and address the specific challenges they face. This collaborative approach allows for tailored recovery strategies and solutions that align with the unique needs of each business.

- Maximizing Chances of Successful Repayment: Revenue-based financing FinTechs focus on maximizing the chances of successful repayment by implementing effective recovery strategies. These strategies may involve financial restructuring, operational improvements, and revenue optimization to enhance cash flow and profitability.

- Building Strong Relationships and Fostering a Supportive Ecosystem: Recovery efforts provide an opportunity for revenue-based financing FinTechs to build strong relationships with their portfolio companies. By offering support and guidance during the recovery process, FinTechs foster a supportive ecosystem that promotes long-term success.

- Contributing to the Overall Health and Growth of the Startup and Small Business Sector: Successful recovery in revenue-based financing FinTechs contributes to the overall health and growth of the startup and small business sector. It helps companies overcome financial challenges, sustain operations, and continue their growth trajectory, contributing to a thriving entrepreneurial ecosystem.

Leveraging Debt for Growth and Expansion

- Debt as a Catalyst for Growth: Debt plays a pivotal role in fueling the growth and expansion of revenue-based financing FinTechs. It provides the necessary capital to support portfolio companies in their pursuit of growth opportunities.

- Accessing Additional Funds: Debt allows revenue-based financing FinTechs to access additional funds beyond their available capital. This enables them to provide larger funding amounts to portfolio companies, supporting their ambitious growth plans.

- Scaling Operations and Market Reach: Debt financing empowers revenue-based financing FinTechs to scale their operations and expand their market reach. It provides the financial resources needed to invest in infrastructure, technology, and talent acquisition to accommodate business growth.

- Seizing Opportunities: Debt enables revenue-based financing FinTechs to seize opportunities that arise in the market. Whether it’s funding new ventures, acquiring competitors, or entering new markets, debt financing allows FinTechs to act swiftly and capitalize on favorable circumstances.

- Supporting Innovation: Debt financing facilitates innovation by providing the necessary funds for research and development activities. It allows revenue-based financing FinTechs to support portfolio companies in developing and launching new products or services, driving industry advancements.

- Diversifying Revenue Streams: Debt can be instrumental in helping revenue-based financing FinTechs diversify their revenue streams. It provides the financial means to explore new business models or enter complementary sectors, reducing reliance on a single source of income.

- Balancing Risk and Return: Leveraging debt involves striking a balance between risk and return for revenue-based financing FinTechs. By judiciously managing debt levels and ensuring appropriate debt structures, FinTechs can optimize growth while mitigating potential risks.

Managing Debt in Revenue-Based Financing Models

Effective debt management is crucial in revenue-based financing models to ensure financial stability and success. It involves carefully navigating the balance between utilizing debt as a growth tool and mitigating potential risks. One key aspect of managing debt in revenue-based financing is assessing the overall debt capacity of the FinTech and portfolio companies. This involves evaluating their ability to take on additional debt while maintaining healthy financial ratios. Additionally, debt management entails structuring repayment terms that align with the cash flow patterns and revenue projections of the portfolio companies. It is important to strike a balance between providing sufficient capital for growth and ensuring that repayment obligations are manageable for the businesses. Regular monitoring and analysis of debt levels, interest rates, and repayment schedules are essential to proactively address any potential issues. By effectively managing debt, revenue-based financing models can optimize their financial performance and support the sustainable growth of portfolio companies.

Potential Challenges and Risks of Debt in Recovery Strategies

- Debt Overburden: One potential challenge of utilizing debt in recovery strategies is the risk of overburdening the portfolio companies with excessive debt. If the repayment obligations become too burdensome, it can hinder the company’s ability to recover and negatively impact its financial health.

- Cash Flow Constraints: Debt repayment obligations tied to revenue can pose cash flow constraints for portfolio companies, especially during periods of low or fluctuating revenue. This can limit their ability to allocate resources towards recovery initiatives or operational expenses.

- Risk of Default: Depending on the terms of the debt, there is always a risk of default if the portfolio companies are unable to generate sufficient revenue to meet their repayment obligations. Defaulting on debt can have severe consequences, including damage to creditworthiness and potential legal ramifications.

- Strain on Relationships: The pressure of debt repayment during the recovery phase can strain the relationship between the revenue-based financing FinTech and the portfolio companies. Tensions may arise if the repayment terms are not aligned with the company’s revenue generation capabilities or if there are disagreements on the prioritization of funds.

- Limited Financial Flexibility: Debt obligations can limit the financial flexibility of portfolio companies during the recovery process. They may have less room to invest in growth initiatives, research and development, or new market expansion, which could hinder their recovery and long-term prospects.

- Market Volatility and Economic Conditions: External factors such as market volatility and economic downturns can pose challenges to debt repayment in recovery strategies. Unforeseen circumstances, such as a sudden decline in the market or industry-specific challenges, may impact the revenue generation of portfolio companies, making it difficult to meet debt obligations.

- Increased Cost of Capital: Depending on the interest rates and terms of the debt, there is a potential risk of an increased cost of capital for the portfolio companies. Higher interest payments can reduce their profitability and impede recovery efforts.

Conclusion: Maximizing Recovery Potential through Strategic Debt Management

Strategic debt management is essential for revenue-based financing FinTechs aiming to maximize the potential for recovery. By carefully navigating the challenges and risks associated with debt, FinTechs can support portfolio companies in their recovery journey effectively. This involves assessing debt capacity, structuring manageable repayment terms, monitoring cash flow, and maintaining open communication. With strategic debt management, FinTechs can optimize financial stability, provide the necessary capital for growth, and mitigate risks, ultimately enhancing the potential for a successful recovery and sustainable long-term growth.