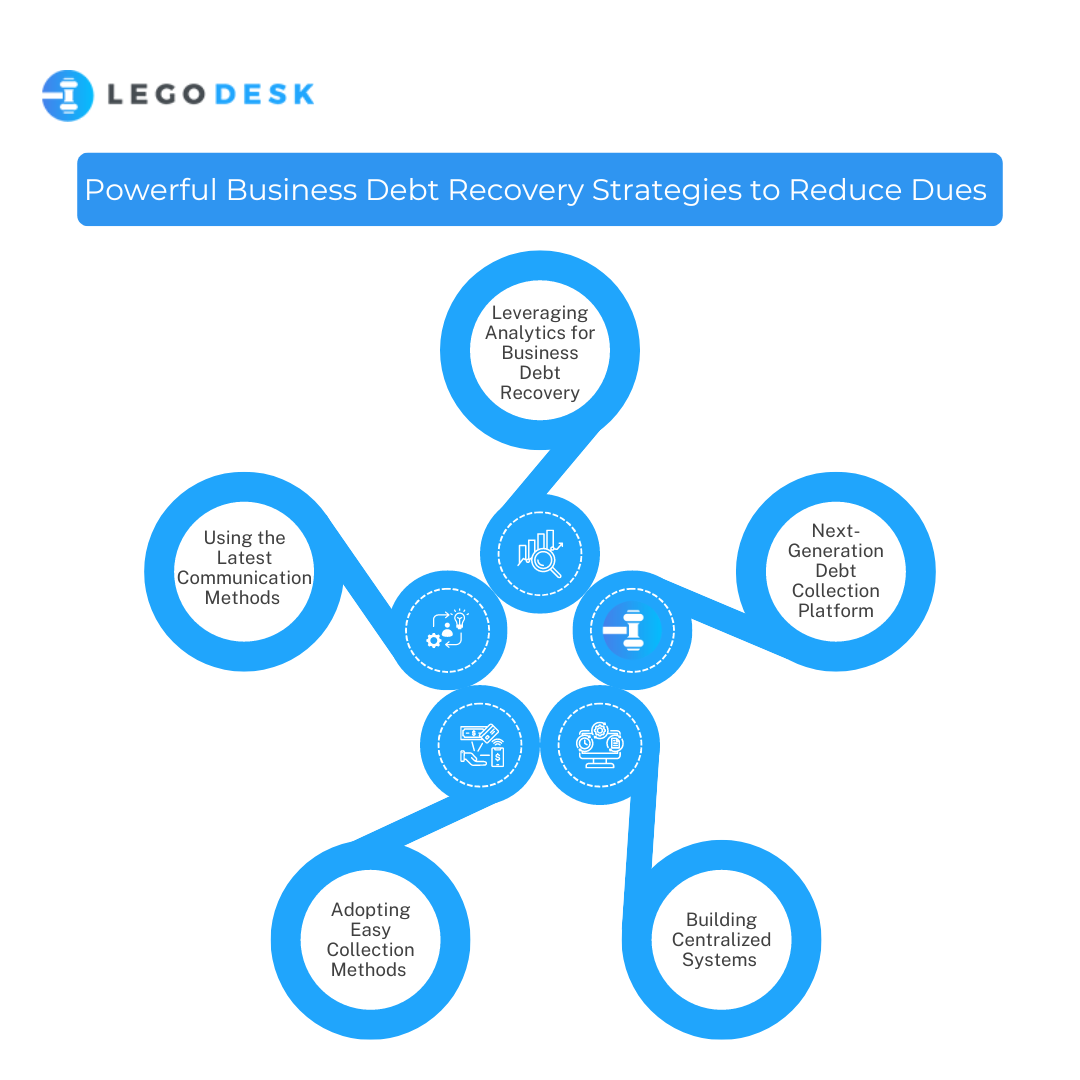

Use These Powerful Business Debt Recovery Strategies to Reduce Dues

Debt is a normal part of business and almost every business runs a credit line for their customers. While sales strategies are constantly updated and improved upon, many businesses are guilty of letting their debt collection processes become stale and outdated.

19% of borrowers have stated that they are being chased for dues that have already been paid. This shows how businesses and collection agencies can do better when it comes to leveraging better systems and processes for better outcomes.

It’s essential to use the latest techniques when collecting overdue payments not only because they save time and lower costs, but also because they can help improve success rates.

Emerging technology has made it possible to streamline systems which require less manpower as well as less managerial infrastructure. Many aspects of the process can now be automated and human agents can focus on more complex negotiations and tougher cases.

Let’s dive into some of the most useful business debt recovery strategies used by lenders around the world in 2024.

Leveraging Analytics for Business Debt Recovery

Many large companies have volumes of data on their borrowers but are unsure of how to this data in a way that makes their business more efficient. One of the biggest applications of this data is in predictive modeling.

Such models can help lenders gain better insight into the risk profile of their borrowers. Certain borrowers exhibit behavior that signals that it is highly unlikely that they will ever default. In contrast, other borrowers exhibit behavior that shows that a default is likely going forward.

Using such data, companies can make better decisions on how to approach different types of cases and segment their borrowers based on risk profile. They can offer incentives to borrowers who are at high risk of default to pay on time to get ahead of the situation.

Overall, leveraging analytics can help lenders use their data on borrowers’ credit history, past behavior, demographics, and other indicators to help drive better decision-making to ease the collection process.

Using the Latest Communication Methods

It is unlikely that a defaulting borrower will pick up a phone call from an unknown number. The communication methods used by debt collectors matter significantly. Some methods can be much more effective than others.

In 2024, lenders are increasingly relying on automated messages and emails as the best way to keep borrowers accountable. Such communications use much fewer resources but may be as effective as a personal call.

Automating communications has several benefits. It takes the guesswork away from the process since the exact process is documented and planned beforehand. The execution of the process is also very simple and we only need a couple of software tools to execute the campaigns.

Further, it becomes easier to test different processes and reach an optimal outreach method that has a high likelihood of increasing the collection rate.

It reduces the chance of human error and also serves to improve the lender’s relationship with the borrower.

This method can also be used by small businesses that can automate messages to be sent to their customers once a due date has been crossed.

Adopting Easy Collection Methods

It’s in the lender’s best interest to make the payment process as easy as possible. A lot of lenders still rely on traditional payment techniques with long-winded hoops to jump through before being able to make a payment. This can subconsciously deter borrowers from making their payments on time and encourage later payments.

A better approach would be to have easy links that take the borrower straight to the payments page to create a hassle-free experience for the borrower. The link can be shared multiple times during the debt collection communications to make the payment process easier for the borrower. This method applies to small business debt recovery as well.

Further, it’s essential to make the payment process secure for the borrower. If money is deducted from the borrower’s account without reaching the lender’s, then it can undermine the legitimacy of the system.

Building Centralized Systems

Most lenders and debt collection agencies are switching to centralized systems or platforms that drive operations. These software tools offer a one-stop view of borrower information along with various project management tools to ensure that agents don’t have to rely on several different IT tools to manage their work.

Just some of the features that should be part of the platform include complete visibility of all cases that need to be addressed, an easy-to-follow interface, and a way for agents to view their completed and pending tasks.

Such a platform can help lenders keep business debt recovery process costs down and significantly improve the efficiency of agents.

Legodesk Offers a Next-Generation Debt Collection Platform

Meant for enterprise lenders who are looking to elevate their debt collection process, Legodesk is an all-in-one AI-ready platform.

Just some of the features offered by Legodesk include case management, legal notice automation, contact management, case tracking, and document management. It also offers several collaboration tools that make it easier for agents to act more efficiently. This holistic platform helps lenders reduce costs and save time while also improving the debt collection rate.

Our services have delivered a 22% improvement in loan repayment rate, reducing the turn-around time for debt collection operations by 70%, and increasing engagement with less active defaulters by 50%.

Legodesk is trusted by enterprises, banks, NBFCs, as well as FinTech companies operating in the lending space. Our mission is to become the first name when it comes to lending management software that helps with recovering unpaid debts.

Wrapping Up

Overall, there are several ways in which business debt recovery can be improved. If a business is interested in cutting costs while also boosting its success rate and reducing its outstandings, then it’s advisable for them to leverage the latest techniques being used in the market.

The debt collection process can be riddled with difficulties and unforeseeable landmines. Businesses need to be empathetic with defaulting customers while also demonstrating a firm hand which can be a difficult balancing act.

Agents who are working with borrowers to help them repay their outstanding dues understand how time-sensitive communications from the lenders are. That’s why lenders can benefit from elevating their processes to ensure that borrowers feel like the lender is aligned with their needs which can lead to better cooperation and a more fruitful relationship.