NPA Resolution Framework under RBI Guidelines

The Reserve Bank of India (RBI) provides guidelines on how lenders, particularly banks, should approach non-performing assets (or NPAs). The RBI recognizes that bad loans are part of the lending endeavor and every effort should be made to reduce the impact of bad loans on the lender and the overall economy.

These guidelines are updated from time to time and the majority of the stipulations can be found in the Master Circular for Income Recognition, Asset Classification, Provisioning and Other Related Matters which was last updated in 2023.

There are also other notifications related to NPAs which deal with specific aspects of the issue.

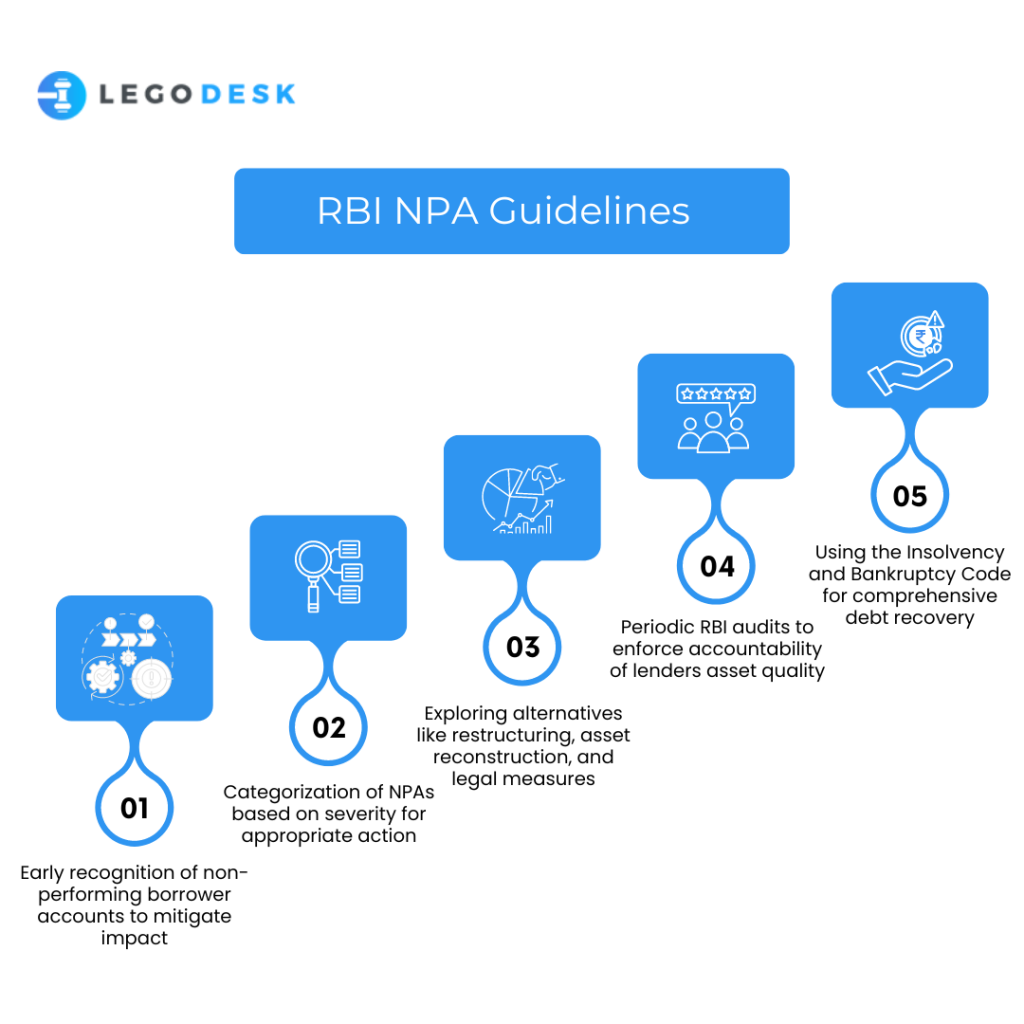

Let’s dive into some of the non-performing assets RBI guidelines to reduce the impact of non-performing assets and create a more healthy ecosystem.

Identification of NPAs

If a borrower fails to repay an overdue principal amount or an overdue interest amount, then that loan needs to be classified as a non-performing asset. The intent behind identifying non-performing assets as early as possible is so that the lender has the chance to address and reduce the impact of the loan.

It gives the lender the chance to take protective measures so that the maximum amount can be recovered from the bad loan. Identifying non-performing assets as early as possible can be crucial for lenders since it gives a formalized channel for such loans to treated differently from other loans.

Classification of NPAs

All non-performing assets are not to be treated the same. The RBI has released very specific rules for the classification of non-performing assets.

This classification depends on the severity of the matter. As non-performing asset examples, borrowers who have not paid their dues for over a year are classified differently compared to borrowers who have missed just one or two payments.

The various types of classification include sub-standard assets, doubtful assets, and loss assets depending on the severity of the matter. Each type of asset has different rules to abide by and the provisioning requirements are different for the lender.

Resolution Process

The non-performing assets RBI guidelines provides for a variety of resolution mechanisms that are aimed at asset recovery. Lenders are encouraged to attempt different mechanisms depending on the type of asset and the level of distress.

The resolution process can involve loan restructuring which means changing the terms of the loan to make it more suitable for the borrower. Asset reconstruction can also be a productive option in certain cases.

Otherwise, lenders can approach the matter through legal means as well through the Debt Recovery Tribunal which has been specifically established for loan recovery matters.

Lenders should adopt a proactive approach when it comes to handling NPAs since they can involve considerable costs for the lender. They are required to develop robust policies that are efficient and effective in handling the various types of NPAs.

Asset Quality Review (AQR)

The RBI has not left the classification of NPAs purely up to the lenders. The RBI is involved in conducting periodic asset quality reviews where it checks in with each lender to see the quality of the assets that they hold. These Asset Quality Review (AQRs) are meant to help lenders keep themselves accountable to the type of assets that they bring into the fold.

The AQR also helps to identify stressed and potentially stressed assets so that lenders can take timely action for their resolution.

Insolvency and Bankruptcy Code (IBC)

A major step in the right direction for lenders has been the introduction and implementation of the Insolvency and Bankruptcy Code (IBC) by the government. This statute provides a comprehensive framework that allows lenders to use the law to recover their dues once assets completely cease to perform. The IBC provides extensive legal support to the issue of bad loans and bankruptcy which was largely dealt with in an ad-hoc manner before the introduction of the code in 2016.

Banks are encouraged to refer matters involving stressed assets to the NCLT which is the first tribunal responsible for dealing with matters involving the IBC.

Prudential Norms and Provisioning

The RBI has provided for prudential norms and provisioning. These norms are required to be followed by lenders so that they are not caught off-guard by loan defaults. Provisioning requirements ensure the stability of the overall lending eco-system.

Provisioning involves lenders setting aside certain sums of money on their books to offset losses which occur when borrowers default or go bankrupt without being able to pay for their dues. These prudential norms are the cornerstone for the security of the country’s financial system since they ensure that lenders themselves can deal with the consequences of non-performing assets.

Monitoring and Reporting

Lenders are required to monitor the performance of stressed assets in particular and NPAs in general. The results of the such monitoring are required to be disclosed to the RBI on a periodic basis and banks are expected to maintain a detailed list of non-performing assets. This monitoring and reporting requirements helps the RBI to keep the banks accountable.

It provides a basis for lenders to ensure that they keep non-performing assets in check and take proactive steps to make sure that they are following extant guidelines.

How Can Legodesk Help Lenders?

Legodesk offers a software platform which has been designed to be used by banks and other lenders. This software platform has a range of features that help lenders’ debt collection through contact management, case management, legal notice automation, and so on.

The primary advantage of using Legodesk is that lenders can approach debt collection more efficiently which will help reduce the overall costs associated with non-performing assets.

Wrapping Up

Non-performing assets are an undesirable part of the lending business, however, lenders need to acknowledge that they are inevitable and take effective measures to reduce the impact that they have. Leveraging new-age software platforms can help lenders not only reduce costs but also meet regulatory requirements.

The RBI has laid down comprehensive guidelines for loan recovery for banks to follow.

The advantage of these guidelines is that they form a basis for lenders to formulate their own processes which help them meet the requirements of these guidelines. Large leeway has been left for banks to formulate and implement their own policies which can help them make incremental improvements based on the feedback loop.