Your Guide to a Modern Approach to Debt Collections Processes

Traditionally, debt collection has been associated with striking fear and apprehension in the hearts of defaulters. However, over time, this has hurt the lending industry more than it has helped.

A movement towards destigmatizing debt is now underway in India and around the world. A more collaborative approach towards debt collection is the need of the hour and lenders are increasingly taking steps to humanize and temper down their approach to debt collection.

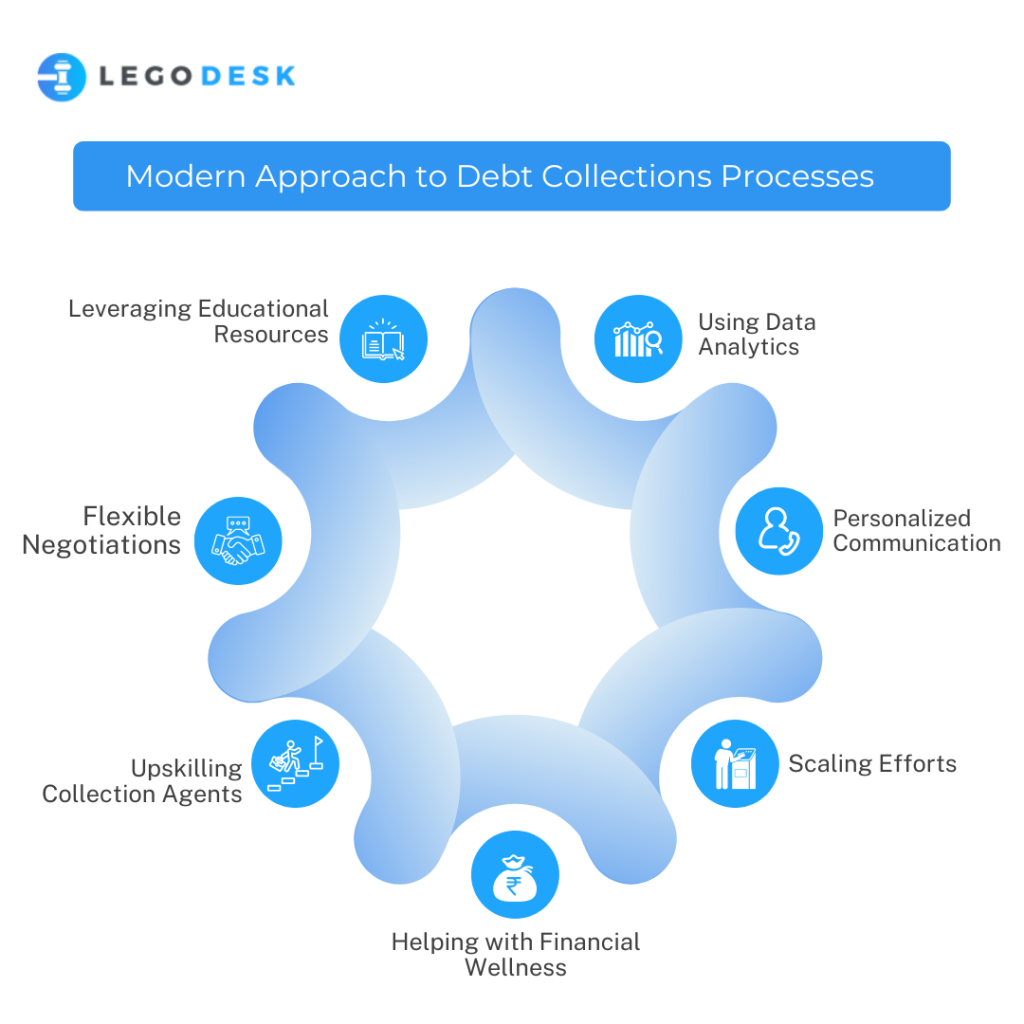

If you’re wondering how to improve debt collection, here are some of the ways intelligent debt collection can be beneficial for debt collection agencies to change their approach:

Leveraging Educational Resources

Many debtors may fall into default due to poor financial skills and the inability to manage their money. While personal financial content that is publicly available is playing a role in educating people about important life skills such as how to budget your money and how to take debt responsibly, there is still a long way to go.

In an effort to reduce delinquency, lenders can shoulder more responsibility and offer educational resources to borrowers. These resources can help provide the right frameworks to borrowers so that they don’t fall into default in the first place and help with how to get out of debt in case they do.

Using Data Analytics

It has now become possible to not only collect data on borrowers but also analyze the data in ways that can help lenders.

Software tools can help build complete borrower profiles that debt collection executives can access and plan their next approach toward each individual borrower.

These borrower profiles can contain important information such as the past behaviour of the borrower, his repayment history, his banking history, and how he has interacted with collection agents in the past. The profile can also contain important information about any new terms that have been entered into between the lender and the borrower.

Such data can provide invaluable in helping debt collection agents decide the best approach toward each individual borrower to maximize the success of intelligent debt collection.

Personalized Communication

The one-size-fits-all approach may not work best for debt collection efforts. Each borrower is different and each default case is unique.

Lenders who keep this fact in mind and tailor their outreach strategy to suit the needs of each particular case stand to benefit more. Emerging technological capabilities have now made it easier to segment borrowers based on their profiles. This can go a long way in personalizing outreach and the approach that is taken by lenders to each matter.

For example, a case in which a borrower has simply forgotten to make a payment needs to be treated differently from a case of a wilful defaulter.

Scaling Efforts

Emerging technology now allows lenders to automate the texts and emails that they send to lenders while keeping personalization intact. Different templates can be used for different borrower profiles and different debt collection stages. This means the lenders can scale their debt collection for a lower cost and make efficiency gains.

Another method to scale collection efforts more efficiently is to provide self-checkout options for debt repayment that can help borrowers make their payments much more easily and without any hassle. Borrowers can also be connected with debt repayment advisors who can help them adjust their finances in a way that optimizes loan repayment which is beneficial for the borrower as well as the lender.

Helping with Financial Wellness

Lenders can now shoulder the responsibility of helping consumers and borrowers improve their financial habits and become more financially conscious and aware. This approach looks beyond the immediate needs of debt collection and fosters an environment in which the issue of default doesn’t arise in the first place.

Lenders can play the role of financial guru and not only provide access to financial education and the latest techniques to maximize financial wellness, they can also help with financial counseling that can be tailored to the needs of each individual borrower.

Upskilling Collection Agents

Collection agents are the intermediaries between the lender and the borrower. They represent the lender whenever they approach a borrower and they become the lender in the eyes of the borrower. Hence, it’s important for lenders to invest resources into ensuring that agents are properly trained in how to represent the interests of the lender.

This can involve instructing agents in how to take a more humanized and empathic approach with borrowers, it can be about putting the best foot of the lender forward, and it can also be about being firm about the terms and conditions that need to be met as well as meeting the obligations under the fair debt collection practices act.

Flexible Negotiations

When a borrower is unable to meet their obligations, then there are two pathways that are open to the lender.

Either they can start taking legal recourse and recover as much of the dues as they can or they can work with the borrower to negotiate a better deal that can help the borrower meet their obligations but with a more lenient timeline or a more lenient interest rate or both.

Being willing to negotiate with borrowers can help a lender once the lender has no doubt that the borrower will otherwise not be able to meet their obligations.

Why Choose Legodesk?

For lenders who want to maximize the efficiency of their debt collection efforts, using the latest software tools that have relevant features is paramount. Legodesk offers a single source of truth software solution that has been specially crafted from the ground up to meet the needs of intelligent debt collection by lenders and enterprises.

Our innovative software platform supports best-in-class features such as contact management, case management, legal notice automation, and more.

Do get in touch with us to find out more about how our software offer can supercharge your collection efforts.

Read More: 10 Ways To Make Debt Recovery Easier!

Wrapping Up

Taking a more modern approach to debt collection can help lenders improve their brand loyalty and market reputation. In an age where lenders are demonized for how they treat borrowers, a lender that takes a human-centric path can create a wider space for itself in the market.