Proactive Measures to Minimize Bad Debts and Improve Accounts Receivable Recovery

Bad debts refer to uncollectible amounts owed by customers or clients that are unlikely to be recovered. Managing bad debts and Improving accounts receivable recovery is vital for the financial stability and success of any business. Bad debts can negatively impact cash flow, profitability, and the overall financial position of a company.

On the other hand, improving accounts receivable recovery ensures a steady flow of cash, reduces liquidity risks, and enhances the company’s ability to meet its financial obligations.

The purpose of this article is to provide businesses with a comprehensive understanding of proactive measures they can adopt to minimize bad debts and for improving accounts receivable recovery. By implementing these strategies, companies can enhance their financial management, reduce the risk of bad debts, and maintain a healthy cash flow.

Understanding Bad Debts and Accounts Receivable

A. Differentiating Bad Debts from Doubtful Debts and Uncollectible Accounts

It is crucial to differentiate between bad debts, doubtful debts, and uncollectible accounts. Bad debts are debts that are confirmed to be irrecoverable. Doubtful debts are those where there is uncertainty about their recovery, while uncollectible accounts refer to debts that are unlikely to be collected due to various reasons.

B. Impact of Bad Debts on Financial Health and Cash Flow

Bad debts can have a significant negative impact on a company’s financial health, affecting its profitability and liquidity. Unrecovered debts tie up resources that could have been used elsewhere and hinder cash flow, making it challenging to meet operational expenses.

C. Factors Contributing to Bad Debts

Several factors contribute to bad debts, such as inadequate credit screening, poor communication with customers, economic downturns, and customer financial instability. Understanding these factors is crucial for devising effective strategies to minimize bad debts.

D. Analyzing Accounts Receivable Aging Reports

Accounts receivable aging reports provide valuable insights into the status of outstanding invoices and help identify potential bad debts. By analyzing these reports regularly, businesses can take timely action to recover overdue payments and mitigate bad debt risks.

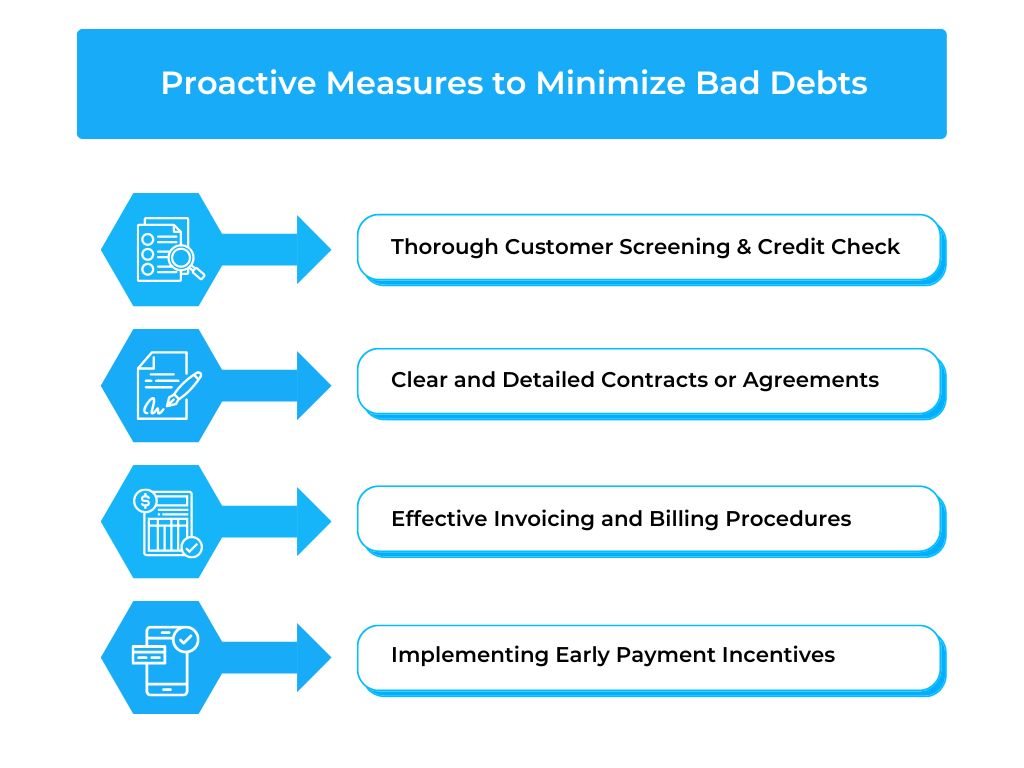

Proactive Measures to Minimize Bad Debts

A. Thorough Customer Screening and Credit Check

Establishing Credit Policies and Criteria

Implementing clear credit policies and criteria for extending credit to customers ensures that creditworthy clients are chosen, reducing the risk of bad debts.

Checking Credit History and Payment Behavior

Conducting comprehensive credit checks and analyzing customers’ payment behavior helps assess their creditworthiness and identify any potential red flags.

B. Clear and Detailed Contracts or Agreements

Ensuring Explicit Payment Terms and Conditions

Clear and detailed contracts should stipulate payment terms, including due dates, penalties for late payments, and consequences of non-payment.

Stipulating Consequences of Late or Non-Payment

By clearly outlining the consequences of late or non-payment, businesses encourage customers to adhere to the agreed-upon payment schedule.

C. Effective Invoicing and Billing Procedures

Timely and Accurate Invoicing

Sending invoices promptly and ensuring their accuracy reduces the chances of payment delays and disputes.

Providing Clear Payment Instructions

Including clear payment instructions on invoices simplifies the payment process for customers, leading to quicker settlements.

D. Implementing Early Payment Incentives

Offering Discounts for Early Payments

Providing incentives such as discounts for early payments motivates customers to pay their invoices promptly.

Encouraging Prompt Settlement of Invoices

Promoting a culture of prompt payments can be achieved by rewarding customers who consistently pay on time.

Improving accounts receivable recovery

A. Establishing a Collections Process

Defining a Systematic Approach to Debt Recovery

Having a well-defined collections process helps in efficiently managing outstanding debts and tracking the progress of recovery efforts.

Setting Up Reminders and Follow-Up Procedures

Automated reminders and follow-up procedures can significantly improve the chances of collecting overdue payments.

B. Utilizing Technology for Debt Tracking

Implementing Accounting Software for Streamlined Tracking

Utilizing accounting software streamlines the tracking of accounts receivable, making it easier to identify outstanding payments and overdue invoices.

Automating Payment Reminders and Notifications

Automated payment reminders and notifications keep customers informed about their outstanding dues, leading to faster recoveries.

C. Negotiating Payment Plans

Tailoring Repayment Schedules to Suit Debtors’ Financial Capabilities

Customizing payment plans based on debtors’ financial situations increases the likelihood of successful debt recovery.

Securing Written Agreements for Payment Plans

Having written agreements for payment plans protects the interests of both parties and provides legal recourse in case of default.

D. Engaging with Debtors Proactively

Maintaining Open Lines of Communication

Keeping communication channels open and amicable helps resolve disputes and encourages debtors to cooperate in settling their debts.

Addressing Disputes and Concerns Promptly

Responding promptly to debtors’ concerns and disputes can prevent escalations and pave the way for amicable resolutions.

Monitoring and Analyzing Key Performance Indicators (KPIs)

A. Days Sales Outstanding (DSO)

Monitoring DSO helps track the average number of days it takes to collect payments from customers and identifies trends in the efficiency of accounts receivable management.

B. Aging of Accounts Receivable

Analyzing the aging of accounts receivable provides a clear picture of outstanding invoices and helps prioritize debt recovery efforts.

C. Bad Debt Ratio

Calculating the bad debt ratio (bad debts divided by total credit sales) provides insights into the effectiveness of credit policies and debt recovery strategies.

D. Cash Flow Projection and Management

Monitoring cash flow projections and managing cash flow effectively enable businesses to plan for potential cash shortages and take preemptive measures.

Collaboration Between Sales and Finance Departments

A. Enhancing Communication Between Sales and Finance Teams

Improving communication between sales and finance departments ensures a shared understanding of credit policies, customer profiles, and the importance of timely payments.

B. Educating Sales Teams on Credit Policies and Debt Recovery Processes

Educating sales teams about credit policies and debt recovery processes empowers them to make informed decisions while extending credit to customers.

Regular Training and Development for Staff

A. Educating Employees on Debt Collection Laws and Regulations

Training staff on debt collection laws and regulations ensures compliance and protects the company from legal risks.

B. Improving Negotiation and Communication Skills

Enhancing negotiation and communication skills of employees involved in debt recovery facilitates successful payment arrangements.

Continuous Improvement Strategies

A. Conducting Regular Reviews and Assessments of Debt Management Procedures

Regularly reviewing and assessing debt management procedures allows businesses to identify weaknesses and make necessary improvements.

B. Learning From Past Experiences and Adjusting Strategies Accordingly

Learning from past experiences, both successes and failures, helps refine debt management strategies and enhance overall efficiency.

Conclusion

By implementing proactive measures such as thorough customer screening, effective invoicing, early payment incentives, and strategic debt recovery, businesses can minimize bad debts and improving accounts receivable recovery.

Efficient debt management leads to enhanced financial stability, increased cash flow, and improved business profitability in the long run. Encouraging businesses to adopt these proactive measures and commit to their implementation fosters a culture of financial responsibility, ultimately leading to sustained growth and success.