Microfinance in India: A Journey Towards Financial Inclusion and Empowerment

Microfinance has emerged as a significant tool for economic development, particularly in developing countries. It provides financial services such as small loans, savings accounts, and insurance to individuals who lack access to traditional banking systems. The importance of microfinance lies in its ability to empower low-income individuals, promote entrepreneurship, and alleviate poverty.

Understanding Microfinance

Microfinance refers to financial services that cater to low-income individuals or those without access to typical banking services. The concept was popularized by Muhammad Yunus, Nobel Prize winner, and the founder of Grameen Bank in Bangladesh, who aimed to provide small loans to impoverished individuals to help them start businesses and improve their livelihoods.

The history of microfinance began in 1976 when Muhammad Yunus, an economics professor in Bangladesh, launched a small experiment by providing collateral-free loans to a group of 42 women in the village of Jobra. This experiment laid the foundation for the establishment of Grameen Bank in 1983, which pioneered the group-lending model and focused on providing credit to the poor, especially women. The success of Grameen Bank inspired the growth of microfinance institutions worldwide.

It’s important to note that Microfinance Institutions (MFIs) operate on the principle of providing financial support to those who do not qualify for traditional loans due to lack of collateral or credit history.

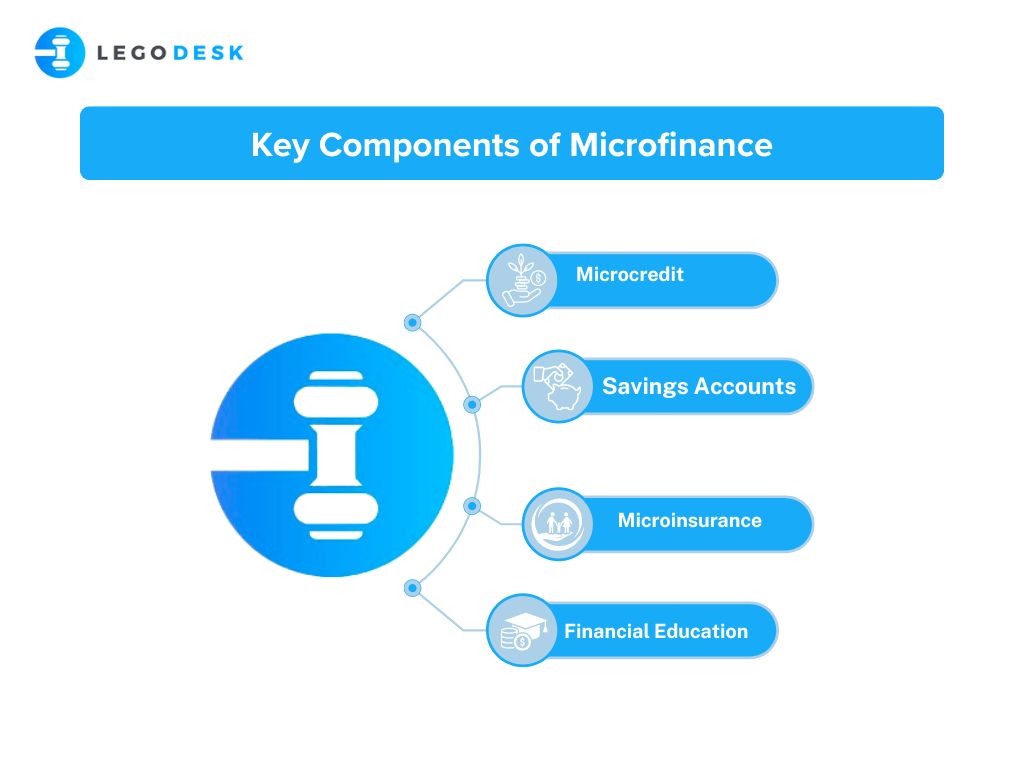

Key Components of Microfinance

1. Microcredit: Small loans provided to individuals or groups to start or expand small businesses.

2. Savings Accounts: Encouraging low-income individuals to save money, which can help them manage financial emergencies and invest in their future.

3. Microinsurance: Insurance products designed for low-income individuals to protect them against unforeseen events, such as health emergencies or natural disasters.

4. Financial Education: Many MFIs offer training and resources to help borrowers manage their finances effectively, enhancing their financial literacy.

The Importance of Microfinance

1. Poverty Alleviation

Microfinance plays a crucial role in reducing poverty by providing financial resources to the poorest segments of society. Studies have shown that microfinance can significantly impact poverty reduction, particularly in rural areas where traditional banking services are scarce.

2. Empowering Women

Microfinance has a unique impact on women’s empowerment. Many MFIs focus on providing loans to women, who often face barriers in accessing traditional financial services. By offering financial support, microfinance enables women to become economically independent, make decisions regarding their households, and contribute to their communities.

3. Promoting Entrepreneurship

Microfinance fosters entrepreneurship by providing the necessary capital for individuals to start or expand their businesses. Moreover, this not only creates jobs for the borrowers but also stimulates local economies. Entrepreneurs who benefit from microfinance often reinvest their profits into their businesses, leading to further economic growth.

4. Financial Inclusion

Microfinance promotes financial inclusion by bringing marginalized individuals into the financial system. By offering accessible financial products, microfinance institutions help individuals build credit histories, which can lead to access to larger loans and other financial services in the future.

5. Community Development

Microfinance has a ripple effect on community development. As individuals improve their economic situations, they are more likely to invest in their communities through education, healthcare, and infrastructure. Furthermore, many MFIs encourage group lending, which fosters a sense of community and mutual support among borrowers. This collective approach can strengthen social ties and enhance community resilience.

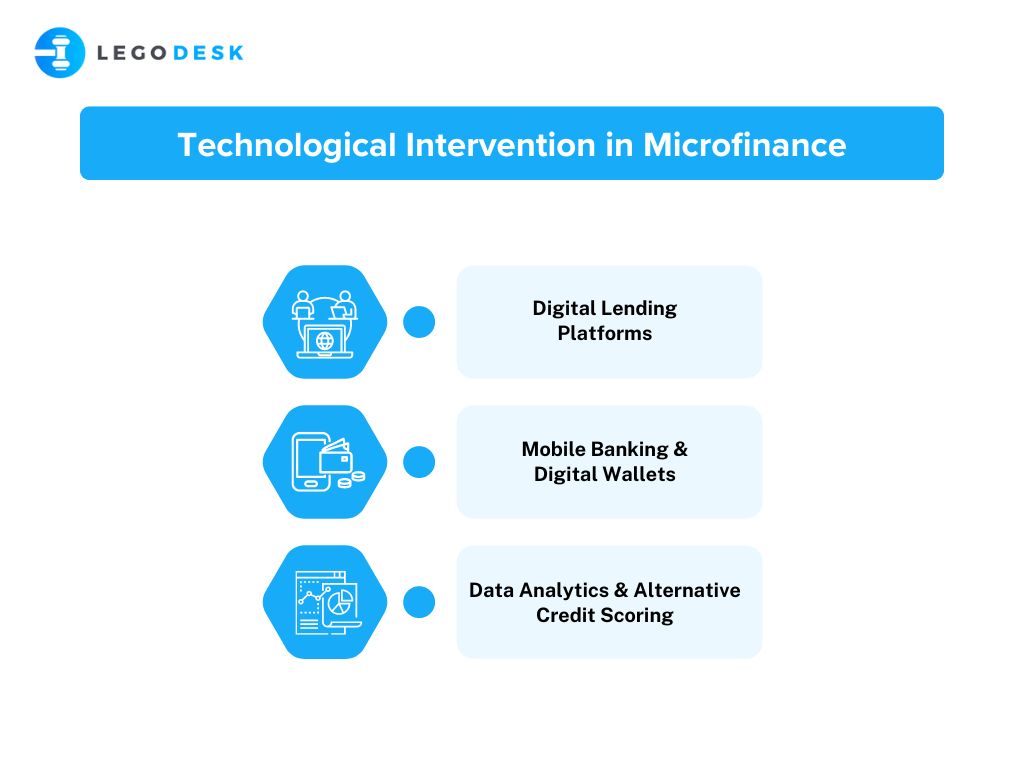

Technological Intervention in Microfinance

The microfinance sector has witnessed significant technological advancements in recent years, revolutionizing the way financial services are delivered to the underserved population. Here are some key ways technology has transformed microfinance:

1. Digital Lending Platforms

MFIs have embraced digital lending platforms that streamline the loan application process, reduce paperwork, and enable faster disbursement of funds. These platforms use algorithms to assess creditworthiness, reducing the reliance on traditional collateral and credit history. This has made the lending process more efficient and accessible for borrowers.

2. Mobile Banking and Digital Wallets

The widespread adoption of mobile phones has paved the way for mobile banking and digital wallets in microfinance. Borrowers can now access their accounts, make repayments, and receive disbursements through their mobile devices, eliminating the need for physical branch visits. This has increased the reach of microfinance services, particularly in remote areas.

3. Data Analytics and Alternative Credit Scoring

MFIs are leveraging data analytics and alternative credit scoring models to assess the creditworthiness of borrowers. By analyzing data from various sources, such as utility bills, mobile phone usage, and social media activity, Moreover, MFIs can create comprehensive credit profiles even for individuals with limited or no formal credit history. This has enabled MFIs to reach a wider segment of the population and make more informed lending decisions.

Challenges and the Way Forward

Despite its numerous benefits, microfinance faces several challenges that need to be addressed for its long-term sustainability and growth. Some of the key challenges include:

1. Balancing financial sustainability with social impact: MFIs need to strike a balance between achieving financial sustainability and maintaining a strong social mission to serve the poorest segments of society.

2. Ensuring responsible lending practices: There is a need to promote responsible lending practices, prevent over-indebtedness, and protect borrowers from exploitative interest rates and collection practices.

3. Expanding the range of financial services: While microcredit has been the primary focus, there is a need to diversify the range of financial services offered, such as microsavings, microinsurance, and money transfers, to better meet the needs of the underserved population.

4. Strengthening regulatory frameworks: Appropriate regulatory frameworks are necessary to ensure the stability and growth of the microfinance sector while protecting the interests of borrowers and investors.

5. Leveraging technology for greater outreach and efficiency: Continued investment in technology is crucial for expanding the reach of microfinance services, improving operational efficiency, and enhancing the quality of services provided to borrowers.

6. Enabling debt recovery: MFIs face several challenges in recovering debt from clients, which can significantly impact their sustainability and effectiveness. One major issue is the insufficient capital to cover recovery costs, making it difficult for MFIs to pursue delinquent loans effectively. Additionally, many MFIs struggle with weak internal controls on loan recovery, which can lead to ineffective debt collection practices. The higher interest rates charged by MFIs compared to mainstream banks can also create repayment difficulties for borrowers, increasing the likelihood of defaults. Furthermore, extraordinary events such as natural disasters or economic downturns can severely affect borrowers’ ability to repay their loans, resulting in increased delinquencies and further complicating the debt recovery process for MFIs.

Microfinance in India

If the history of microfinance is any proof, it is now a critical component of the financial landscape in India, serving as a vital tool for poverty alleviation and economic empowerment. With a significant portion of the population lacking access to traditional banking services, microfinance institutions (MFIs) have stepped in to fill this gap, providing essential financial services to low-income individuals and groups.

Key Players in Indian Microfinance

The microfinance sector in India is characterized by a diverse range of players, including:

- Microfinance Institutions (MFIs): These are specialized financial institutions that provide microloans, savings, and insurance products to low-income clients. MFIs can be classified into various categories, including:

- Non-Banking Financial Companies (NBFC-MFIs): These are regulated by the Reserve Bank of India (RBI) and are allowed to accept deposits and provide loans. Examples include SKS Microfinance (now known as Bharat Financial Inclusion) and Ujjivan Financial Services.

- Non-Governmental Organizations (NGOs): Many NGOs operate as MFIs, providing microfinance services alongside other social programs. They focus on community development and empowerment.

- Cooperatives: Some cooperative societies function as MFIs, providing financial services to their members.

- Self-Help Groups (SHGs): SHGs are grassroots organizations that promote savings and facilitate access to credit for their members. They play a crucial role in the microfinance ecosystem by acting as intermediaries between the banks and the borrowers.

- Government Initiatives: Various government schemes, such as the National Rural Livelihoods Mission (NRLM), support the microfinance sector by promoting SHGs and providing financial assistance to low-income households.

Functioning of Microfinance Institutions

MFIs in India operate on several key principles:

- Group Lending: Many MFIs use a group lending model, where borrowers form groups to apply for loans collectively. This model reduces the risk for lenders, as group members provide mutual guarantees for each other’s loans.

- Interest Rates: MFIs typically charge interest rates that are lower than those charged by informal moneylenders but can be higher than traditional banks. The interest rates vary based on the loan amount, purpose, and repayment capacity of the borrower.

- Financial and Non-Financial Services: In addition to providing microloans, many MFIs offer non-financial services such as financial literacy training, business development support, and health education. This holistic approach helps borrowers utilize their loans effectively and improve their overall livelihoods.

- Technology Integration: The use of technology has transformed the microfinance landscape in India. Digital platforms facilitate loan applications, repayments, and financial literacy programs, making services more accessible to rural populations.

Current Landscape and Impact

As of recent reports, the microfinance sector in India has witnessed substantial growth, with over 168 MFIs operating across 29 states and 4 Union Territories, showing the evolution of microfinance in india. The sector serves approximately 33 million clients, with an outstanding loan portfolio exceeding ₹46,842 crore. The SHG-Bank linkage program has also expanded significantly, with an outstanding loan portfolio of around ₹61,581 crore.

Microfinance has played a pivotal role in improving the economic conditions of millions of low-income individuals, particularly women. By providing access to credit, microfinance enables borrowers to invest in income-generating activities, leading to enhanced livelihoods and financial stability.

Conclusion

The evolution of microfinance in India is promoting economic development, empowering individuals, and alleviating poverty. By providing access to financial services, microfinance institutions play a vital role in fostering entrepreneurship and financial inclusion. However, addressing the challenges facing the sector is essential to ensure its sustainability and effectiveness. As microfinance continues to evolve, it holds the potential to contribute significantly to achieving sustainable development goals and improving the lives of millions around the world.

In summary, microfinance is not just about providing financial services; it is about creating opportunities, fostering resilience, and building a more inclusive financial system that benefits everyone.

Try our Debt Resolution solutions today Request a Demo