Effective strategies for debt collection and accounts receivable management for banks and NBFCs

Debt collection and accounts receivable management are critical aspects of banking and non-banking financial institutions’ operations. Effective management of these functions can significantly impact an organization’s financial health and growth prospects. However, with the increasing complexity of financial transactions and the evolving regulatory landscape, these tasks have become more challenging than ever.

This article aims to help banks and non-banking financial institutions manage their debt collection and accounts receivable processes more efficiently. We will explore some effective strategies that can be adopted for this purpose. We will discuss some best practices for managing credit risk, optimizing collection processes, and building strong customer relationships.

Whether you are a seasoned banking professional or just starting your career in financial services, this article is for you. We will provide you with valuable insights and practical tips to improve your debt collection and accounts receivable management practices.

Understanding Debt Collection and Accounts Receivable Management

Debt collection refers to the process of pursuing payments from customers who have not paid their debts on time or have defaulted on their loan obligations. It involves a range of activities such as contacting debtors, negotiating payment plans, and enforcing legal actions to recover the debt.

Accounts receivable management, on the other hand, involves monitoring and controlling the accounts receivable balances of an organization. It includes the processes of invoicing, credit management, and cash application, aimed at ensuring timely payments from customers.

The role of legal and compliance teams in debt collection and accounts receivable management

Legal and compliance teams play a critical role in debt collection and accounts receivable management. The organization must comply with applicable laws and regulations. These laws include the Fair Debt Collection Practices Act (FDCPA) and the Consumer Financial Protection Bureau (CFPB) guidelines. Compliance officers are responsible for ensuring this compliance.

The legal team may also be involved in enforcing legal actions against delinquent customers, such as filing lawsuits or obtaining judgments.

Common challenges faced in debt collection and accounts receivable management

Debt collection and accounts receivable management face several common challenges, including:

- Inefficient collection processes: Inefficient collection processes can lead to delays in receiving payments, which can impact an organization’s cash flow and revenue. This can result in increased bad debt write-offs and higher collection costs.

- Lack of customer information: Incomplete or inaccurate customer information can make it difficult to contact debtors and negotiate payment plans.

- Changing regulatory landscape: The regulatory landscape for debt collection and accounts receivable management is constantly evolving, making it challenging for organizations to comply with the latest regulations.

- Increasing debt volumes: As the volume of debt increases, it can be difficult for organizations to manage the collection process efficiently.

- Negative impact on customer relationships: Debt collection can be a sensitive issue, and aggressive collection practices can damage customer relationships and harm an organization’s reputation.

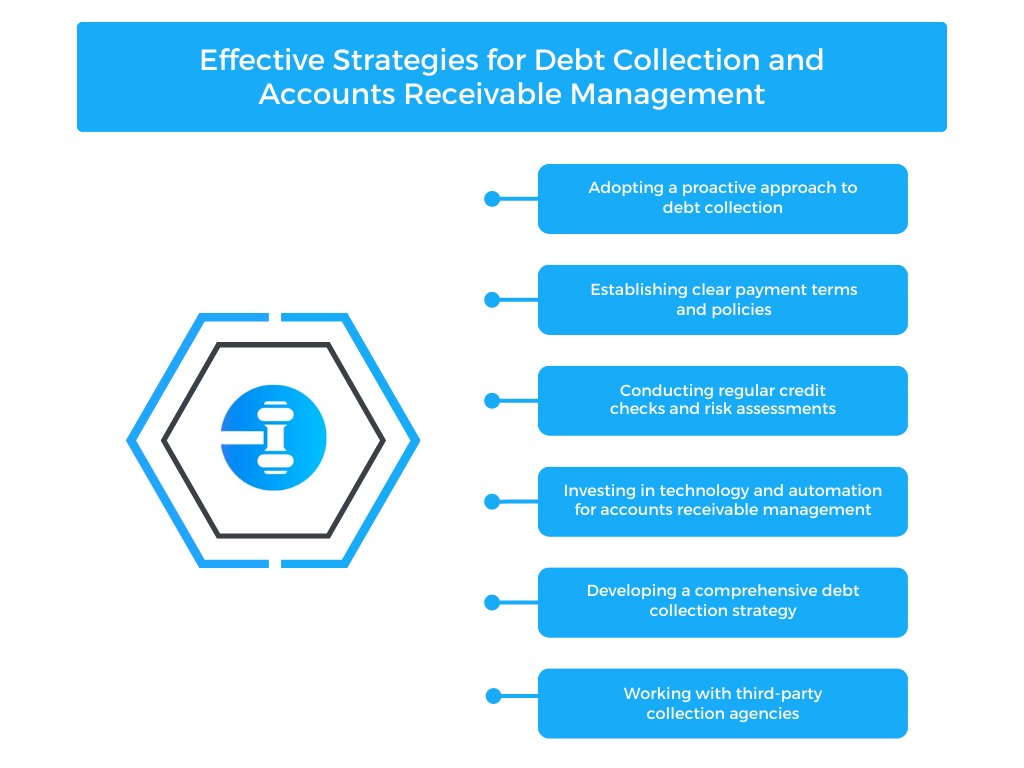

Effective Strategies for Debt Collection and Accounts Receivable Management

By adopting these strategies, organizations can improve their debt collection and accounts receivable management processes, reduce bad debt write-offs, and improve their cash flow and financial health.

Adopting a proactive approach to debt collection

Adopting a proactive approach to debt collection involves identifying and addressing payment issues before they become overdue. This can include reaching out to customers before their payment is due to confirm payment arrangements or addressing late payments promptly. It can also involve tracking payment patterns to identify trends and proactively address potential issues.

Establishing clear payment terms and policies

Establishing clear payment terms and policies is critical for managing accounts receivable efficiently. Clear payment terms help customers understand their payment obligations and can reduce disputes over payment amounts and timelines. Well-defined payment policies can also streamline the invoicing and payment process, making it easier for customers to pay on time.

Conducting regular credit checks and risk assessments

Conducting regular credit checks and risk assessments can help organizations assess their customers’ creditworthiness and identify potential risks. This can include analyzing credit reports, financial statements, and payment histories to identify any warning signs of potential payment issues.

Investing in technology and automation for accounts receivable management

Investing in technology and automation for accounts receivable management can improve efficiency and accuracy. This can include implementing electronic invoicing, automating payment processing, and using analytics to identify payment patterns and trends.

Developing a comprehensive debt collection strategy

Developing a comprehensive debt collection strategy can help organizations manage the collection process efficiently and effectively. A comprehensive strategy should include clear policies for communicating with customers, a process for escalating delinquent accounts, and guidelines for legal action when necessary.

Working with third-party collection agencies

Working with third-party collection agencies can provide additional resources and expertise in debt collection. These agencies can help organizations manage delinquent accounts and recover outstanding debts. It is essential to select reputable agencies that comply with all legal and regulatory requirements.

Legal and Compliance Considerations for Debt Collection and Accounts Receivable Management

Understanding legal regulations and compliance requirements is critical for organizations engaging in debt collection and accounts receivable management. Some of the key regulations and compliance requirements include the FDCPA, CFPB guidelines, and state and federal regulations governing debt collection practices.

Mitigating legal risks associated with debt collection and accounts receivable management

Mitigating legal risks associated with debt collection and accounts receivable management involves implementing best practices to comply with legal and regulatory requirements. Proper debt collection requires clear policies and procedures, thorough documentation, and ethical communication. To achieve these goals, financial institutions must implement effective practices and maintain high professional standards.

Ensuring ethical and professional practices in debt collection

Ensuring ethical and professional practices in debt collection involves treating customers with respect and fairness, maintaining confidentiality, and avoiding abusive or harassing practices. It is also essential to avoid deceptive or misleading communications, such as misrepresenting the amount owed or threatening legal action that is not warranted.

Clear guidelines for handling customer complaints and disputes are essential for effective debt collection. Organizations should provide customers with clear instructions on how to dispute debts and seek resolution. Adhering to legal and ethical standards is crucial for organizations that want to minimize the risk of legal action and maintain customer trust. It can also help protect their reputation in the market

Conclusion

In summary, effective debt collection and accounts receivable management require a proactive approach to managing payment issues. This includes investing in technology and automation, developing a comprehensive debt collection strategy, and working with reputable third-party collection agencies.

Prioritizing legal and compliance considerations is critical for organizations engaged in debt collection and accounts receivable management. By adhering to legal and ethical standards, organizations can reduce legal risks, maintain customer trust and confidence, and protect their reputation.

The future outlook for debt collection and accounts receivable management in banks and NBFCs are expected to involve increased use of technology and automation. The purpose of this is to improve efficiency and accuracy in the debt collection and accounts receivable management processes. As the financial landscape evolves, organizations that prioritize effective debt collection and accounts receivable management will be better positioned to achieve their financial goals and maintain a strong competitive edge.