Debt Recovery Solutions in 2024: Best Practices and Trends

The debt recovery solutions that worked a decade ago may not deliver the same results in 2024. Technological capabilities have evolved and we now have various software tools that can help streamline our approach towards debt collection.

For many lenders, overdue debt collection is a part and parcel of the lending process. That’s why it’s essential to have debt recovery procedures in place that are efficient and cost-effective while maintaining the human touch that is crucial to the process.

Let’s dive into the latest ways debt collection can be made easier in 2024 and beyond.

Have a Multi-channel Approach

Gone are the days when the only way to get in touch with the borrower was by knocking on their door. In 2024, we have several channels that can be leveraged to approach the borrower to not only remind the borrower of the overdue payment but also bring home the urgency of the matter.

The need for a multi-channel approach has been felt by lenders over the years. This is because a single-channel approach can require more resources and fewer follow-ups are possible.

A multi-channel approach can use various channels such as physical visits, phone calls, emails, and text messages. The schedule and messaging of such reminders need to be carefully crafted based on the particulars of each case and the aims of the lender.

Further, another advantage of using a multi-channel approach is that parts of the digital methods of outreach can now be automated which can greatly reduce expenditure and save limited resources. For example, automated text messages can be sent to the borrower according to a fixed schedule which also displays the exact amount that is overdue.

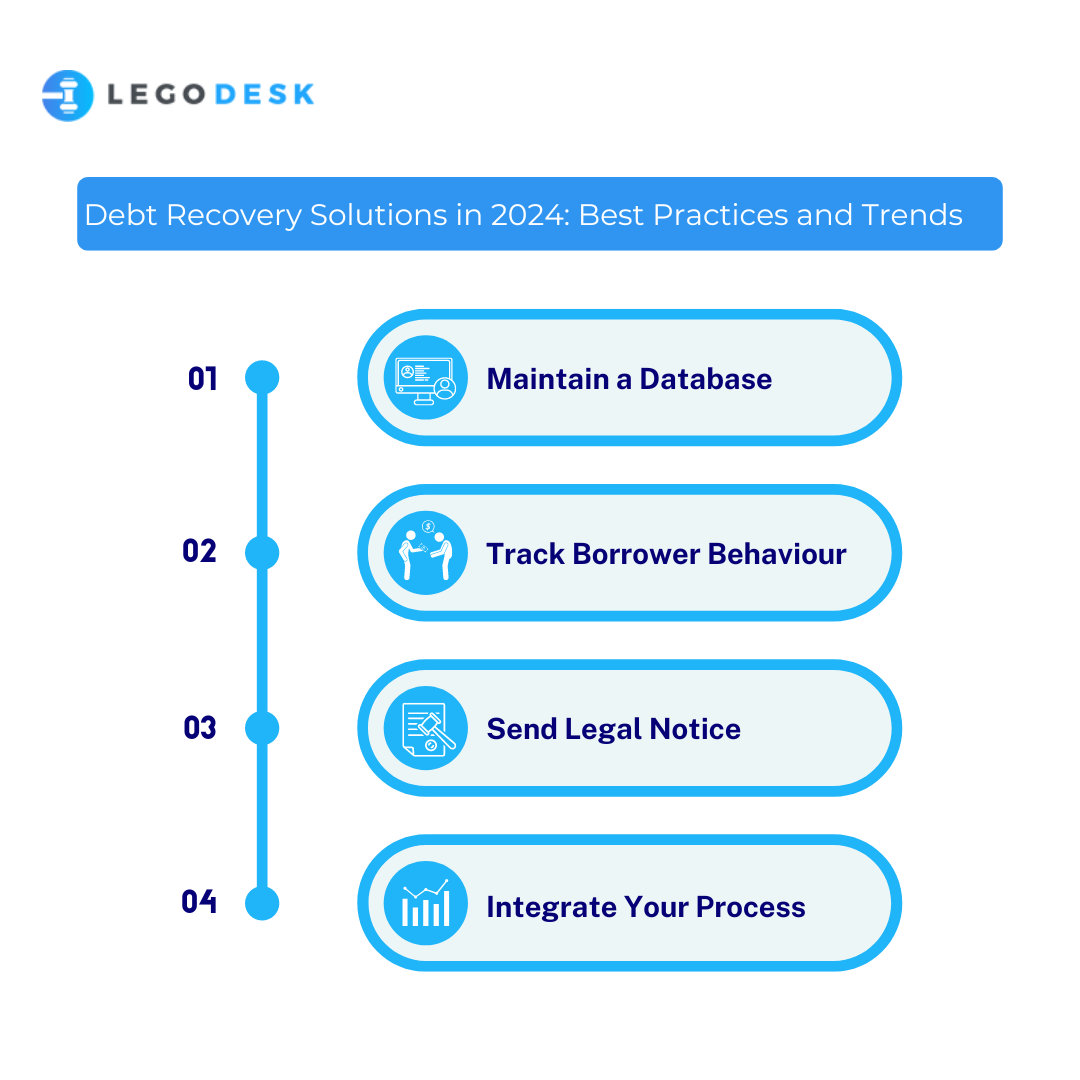

Maintain a Database

While we leverage the multi-channel approach, it’s also important to maintain a record of each message and interaction irrespective of the channel used. Lenders should keep a single-source database that contains all the required information relating to the debt collection efforts made by the lender.

This contact schedule should contain information such as how and when the borrower was reached and their respective response each time if any. This helps the lender build on the previous communication and escalate or de-escalate their collection efforts based on the particulars of the matter. It also helps lenders have a track record of their outreach efforts should the matter become more serious and legal action be considered.

The contact schedule also serves another purpose which is to ensure that the collection efforts are neither too invasive nor too passive.

Track Borrower Behaviour

Many lenders implement an automated outreach schedule that is not built around the borrower’s behavior. An issue that commonly arises is that the borrower makes the overdue payment but still gets calls or emails asking them to clear their dues. This can lead to avoidable conflict and can also reflect poorly on the lender.

Nowadays, debt collection solutions can be leveraged by lenders that notify the debt collection team of any developments concerning every borrower. The collection team is privy to the status of each borrower along with real-time updates which ensures that the debt collection process is carried out smoothly.

Another benefit of having debt collection agents track borrower behavior is that it can save time and resources. As soon as a borrower clears their dues, the collection team can update their information and remove the borrower from their schedule.

Send Legal Notice

Once debt settlement negotiations break down, it’s important for lenders to have a plan B. Even though legal proceedings can be costly, lenders need to be ready to escalate the issue when necessary. The first step to initiating legal proceedings is sending a legal notice.

The legal notice is a document drafted by a lawyer that intimates to the borrower that legal proceedings may be necessary in case they don’t act in accordance with their contractual obligations. It’s important to note that the legal notice itself does not mean that the matter will go to court. In case the borrower complies and clears their dues then there may be no need to take the matter to the debt recovery tribunal.

The main advantage of the legal notice is that it increases the chances that overdue payments are cleared in situations when reminders and notifications may not be enough.

Integrate Your Process

With ever-increasing digital transformation, it has now become easier for lenders to integrate their entire debt collection process. Debt collection agents can have complete visibility with regard to the borrower they are approaching with real-time information about the status of the matter and the case history.

Further, managers can keep track of the numerous cases that may be pending before them. This helps managers make the right decisions and assign limited resources in a way that maximizes the collections. An integrated approach to collections means that the process is more streamlined and cost-effective with less waste.

How Can Legodesk Help?

Legodesk has been built from the ground up keeping the debt collection needs of lenders in mind. We offer an integrated approach to debt collections management that leverages the latest technological capabilities to deliver an experience that is more efficient than traditional approaches.

Some of the notable features of our debt recovery solution include debt management, contact management, legal notice management, real-time defaulter data, campaign management, a one-view dashboard, and notice tracking.

Our debt recovery solution is aimed at reducing delinquency and eliminating manual processes that benefit lenders across several parameters.

We are confident that institutional lenders such as banks, NBFCs, FinTech operations, and enterprises will view our approach to debt collection as a much-needed improvement to legacy processes.

Wrapping Up

Debt recoveries can be the most issue-ridden aspect of the lending process. Updated methods of debt recovery can help lenders reduce costs and improve the returns of their collection efforts. Leveraging the latest software tools has become imperative in an increasingly competitive lending environment with decreasing margins and demanding consumers.

The methods outlined above can be used by institutional lenders of all types with the aim of cultivating better systems that drive better results.

It’s a very nice blog post about debt recovery solutions, very useful and informative. Looking for more post like this.