Laws that govern debt recovery in India

Debt recovery is a crucial aspect of the financial sector and is governed by a set of laws in India. These laws aim to provide a structured process for creditors to recover their outstanding debts from debtors. The legal framework also protects the rights of debtors and ensures that the debt recovery process is conducted in a fair and transparent manner.

In this article, we will discuss debt recovery laws in India. We will delve into the provisions of each act and understand how they work.

1. The SARFAESI Act

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act is a central legislation in India. It enables financial institutions and banks to recover their non-performing assets (NPAs) by selling the securities associated with the loan. The act provides for the securitization of financial assets of banks and financial institutions and the enforcement of security interests.

Under the SARFAESI Act, a financial institution or bank can take possession of collateral security, such as property. And this may not require any court intervention in case of default. It also enables the financial institution or bank to take measures such as selling the security, or appointing a management agency.

The SARFAESI Act aims to provide an efficient mechanism for debt recovery and to reduce the burden on the courts. It provides for a time-bound debt recovery process and reduces the time and cost involved in the recovery of NPAs. The act also provides for an appeal mechanism for borrowers in case they feel that the act’s provisions have been violated.

2. The Debt Recovery Tribunal (DRT) Act

The Debt Recovery Tribunal (DRT) Act is a central legislation in India that provides for the establishment of Debt Recovery Tribunals (DRTs) to provide an expeditious and inexpensive forum for debt recovery proceedings. The DRT Act was enacted to provide a specialized forum for debt recovery proceedings for banks and financial institutions.

Under the DRT Act, debt recovery proceedings can be initiated by banks and financial institutions against defaulting borrowers for the recovery of debts due to them. The DRT has the power to pass an order for the recovery of debt, including the attachment and sale of properties of the borrower. The act also provides an appeal mechanism for debtors who are not satisfied with the orders passed by the DRT.

The DRT Act aims to provide a quick and efficient mechanism for debt recovery and to reduce the burden on the courts. The act provides for a time-bound debt recovery process and reduces the time and cost involved in the recovery of debts.

3. The Insolvency and Bankruptcy Code (IBC)

The Insolvency and Bankruptcy Code (IBC) is a central legislation in India that provides a time-bound process for resolving insolvency in companies and individuals. The IBC was enacted to consolidate and amend the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms, and individuals in a time-bound manner for maximization of the value of assets of such persons.

Under the IBC, the insolvency resolution process for companies and individuals is initiated by filing a petition with the National Company Law Tribunal (NCLT). The NCLT then constitutes an insolvency resolution professional (IRP) to manage the affairs of the company or individual during the insolvency resolution process. The IRP is responsible for conducting an evaluation of the assets and liabilities of the company or individual and formulating a resolution plan.

The IBC provides a framework for the resolution of insolvency in a time-bound manner, with the objective of maximizing the value of assets of the company or individual. The IBC also provides for a priority of claims of various creditors, including financial creditors, operational creditors, and workmen, among others.

Comparison of the SARFAESI Act, DRT Act, and IBC

The SARFAESI Act, DRT Act, and IBC are three important laws that govern debt recovery in India. While all three laws play a crucial role in the debt recovery process, they have different objectives, scopes, and jurisdictions.

The SARFAESI Act provides a mechanism for banks and financial institutions to recover their non-performing assets (NPAs) by selling the securities associated with the loan, without the intervention of a court. The DRT Act provides a specialized forum for debt recovery proceedings for banks and financial institutions, with the objective of providing a quick and efficient mechanism for debt recovery. The IBC provides a time-bound process for resolving insolvency in companies and individuals, with the objective of maximizing the value of assets.

In terms of scope, the SARFAESI Act is relevant for banks and financial institutions; while the DRT Act and IBC have a broader scope and cover all types of creditors. The IBC also covers individuals and partnership firms, in addition to companies.

In terms of jurisdiction, the SARFAESI Act provides for an appeal mechanism for borrowers, while the DRT Act provides for an appeal mechanism for debtors who are not satisfied with the orders passed by the DRT. The IBC provides an appeal mechanism for all stakeholders, including creditors, debtors, and resolution professionals.

The role of courts in debt recovery

In India, the courts play a crucial role in the debt recovery process. Debt recovery proceedings can be initiated in civil courts, tribunals, or specialized forums like the Debt Recovery Tribunal (DRT). The jurisdiction of these courts and tribunals varies depending on the type of debt, the amount involved, and the type of borrower.

Civil courts have jurisdiction over debt recovery proceedings for all types of debts and amounts. However, the process of debt recovery in civil courts can be time-consuming and often lacks the specialized expertise required for efficient debt recovery.

The Debt Recovery Tribunal (DRT) is a specialized forum established under the Debt Recovery Tribunal (DRT) Act to provide a quick and efficient mechanism for debt recovery by banks and financial institutions. The DRT has the power to pass ex parte orders, attach assets, and even issue arrest warrants in certain cases.

The Insolvency and Bankruptcy Code (IBC) provides a time-bound process for resolving insolvency in companies and individuals, and the National Company Law Tribunal (NCLT) is the forum for insolvency resolution proceedings under the IBC. The NCLT has the power to order the liquidation of the assets of a company and the appointment of a liquidator in case of a default.

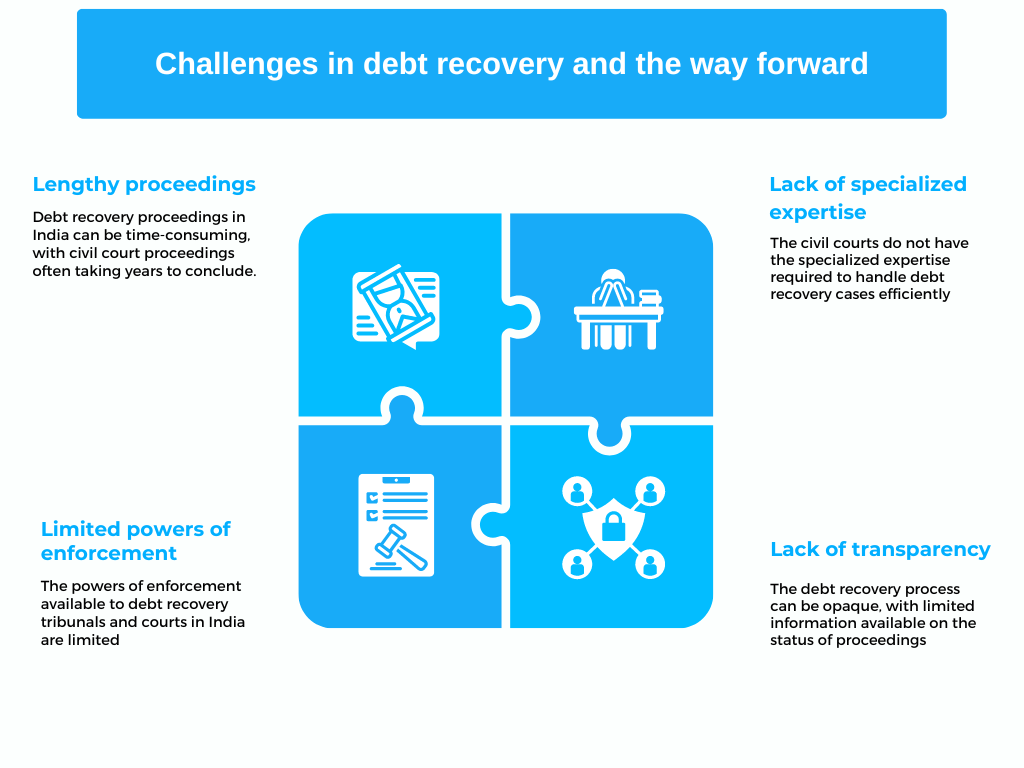

Challenges in debt recovery and the way forward

The debt recovery process in India faces several challenges, some of which are:

- Lengthy proceedings: Debt recovery proceedings in India can be time-consuming, with civil court proceedings often taking years to conclude. This can result in a significant drain on resources for creditors, as well as a delay in the recovery of their debts.

- Lack of specialized expertise: The civil courts do not have the specialized expertise required to handle debt recovery cases efficiently. This can result in delays and an ineffective process.

- Limited powers of enforcement: The powers of enforcement available to debt recovery tribunals and courts in India are limited, which can make it difficult for creditors to recover their debts.

- Lack of transparency: The debt recovery process can be opaque, with limited information available on the status of proceedings, which can make it difficult for creditors to track the progress of their cases.

To address these challenges, the government has taken several steps to improve the debt recovery process in India, including:

- Strengthening the powers of debt recovery tribunals and courts, such as the Debt Recovery Tribunal (DRT) and the National Company Law Tribunal (NCLT) under the Insolvency and Bankruptcy Code (IBC).

- Encouraging the use of technology, such as the introduction of an online debt recovery system, to make the process quicker and more efficient.

- Improving transparency and accountability in the debt recovery process, through measures such as regular reporting and the appointment of independent monitors.

Conclusion

In conclusion, while the SARFAESI Act, DRT Act, and IBC play different roles in the debt recovery process in India, they complement each other in providing a comprehensive and efficient framework for debt recovery. Creditors and debtors in India can avail of the provisions of these laws to recover debts or resolve insolvency in a time-bound, fair, and transparent manner.