Impact of NPA Provisioning on Financial Statements and Performance

Non-performing assets are an unavoidable aspect of lending, which is why central banks implement NPA provisioning norms for banks and NBFCs operating in the country. The Reserve Bank of India has also notified extensive rules regarding provisioning and how lenders are supposed to navigate the provisioning question.

Provisioning is good for lenders since it allows them to be more financially stable and weather the storm of bad loans. However, provisioning can also have an impact on the financial statements and deemed performance of lenders.

Let’s take a look at the various ways in which this impact takes shape.

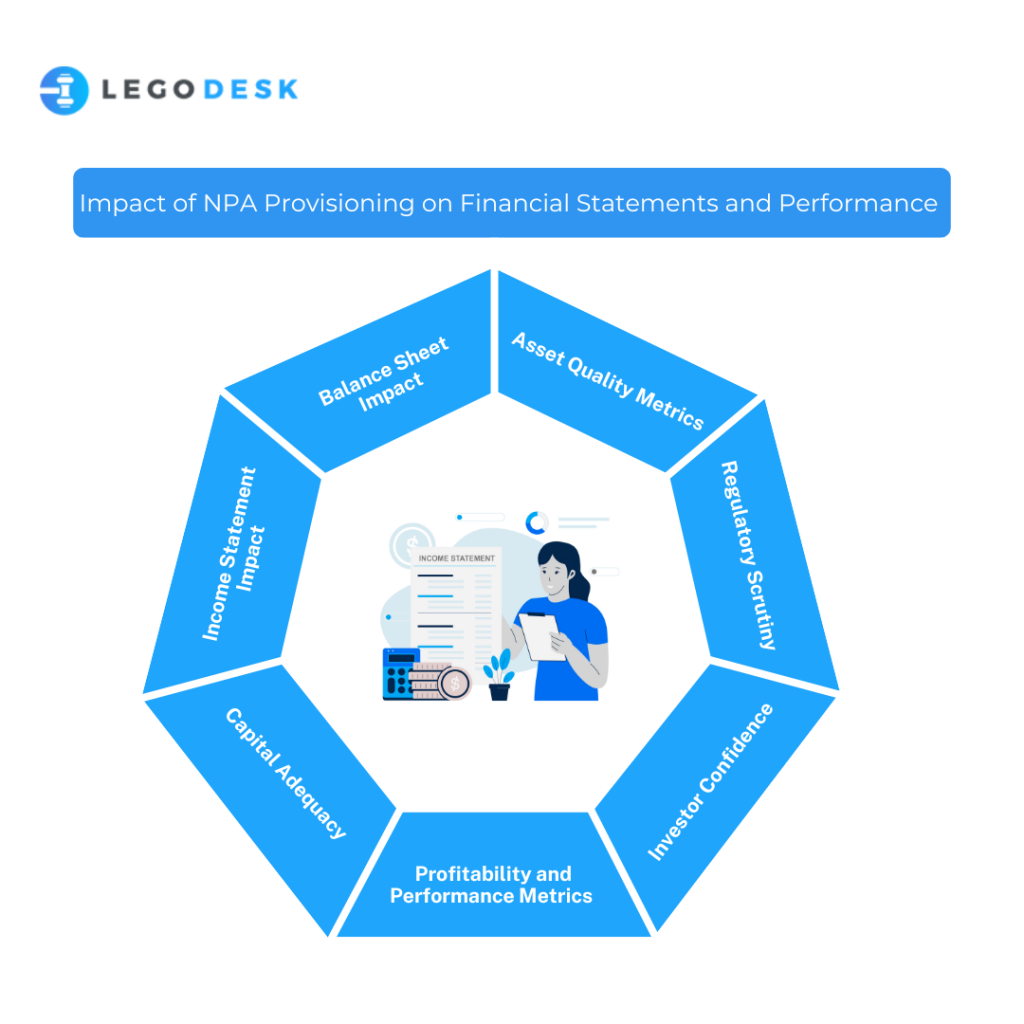

Income Statement Impact

The income statement is closely scrutinized by investors and other stakeholders of any lender. The income statement is deemed to be an indicator of the overall performance of a financial institution. However, investors should be aware of how provisioning norms have a significant impact on a lender’s income statement.

When a lender provisions a certain sum of money in preparation for future bad loans, this amount is deemed to be an expense for the lender and hence shows up as an expense in the income statement. This can lower the final bottom line of the lender and reduce the profitability that the lender can show on their income statement.

Balance Sheet Impact

As with the income statement, the balance sheet is also one of the key indicators of the performance of a financial institution. Almost every investor, including many retail investors, rely at least partially on the results of the annual balance sheet to determine how well a lender is performing when compared to its peers.

Investors would do well to note that provisioning is an expense for lenders and it is treated as an expense in the balance sheet as well. That’s why the amount of money that has had to be provisioned by a lender will have an impact on the deemed assets and liabilities of the bank and affect the bottom line.

This is how provisioning norms for NBFCs and banks can impact the investor perception of a lender and also the stock price of said lender.

Asset Quality Metrics

Another small but significant way in which provisioning norms have an impact is because of asset quality metrics. Lenders are often judged parlly on the basis of their NPA ratio. This ratio indicates the amount of NPA on the books of the lender when compared to the total assets held by the said lender.

The higher the NPA ratio, the worse it is seen since it shows that the lender has too many non-performing assets. When NPA provisioning rate is set, it can impact the NPA ratio by increasing the amount of NPA which is shown on the books. Hence, a higher provisioning amount will serve to increase the NPA ratio which will lead to a poorer look in terms of financial performance.

Capital Adequacy

Lenders need to maintain adequate capital for their operational requirements. Various central banks implement different types of capital adequacy requirements depending on the conditions of the economy and the future outlook.

Provisioning requirements form an integral part of this capital adequacy requirement. Central banks closely scrutinize whether a lender is meeting its requirements and a high provisioned amount is deemed to be favorable by the central bank.

Insufficient provisioning can erode capital buffers, leading to regulatory sanctions or constraints on lending activities. Financial institutions must closely monitor their provisioning levels to ensure compliance with regulatory capital requirements.

Profitability and Performance Metrics

Another way in which the performance of financial institutions is judged by peers, investors, customers, and other stakeholders is through profitability metrics such as ROE (Return on Equity) and ROA (Return on Assets).

Higher provisioning levels reduce profitability metrics, reflecting lower net income and reduced returns on assets and equity. Conversely, lower provisioning levels may artificially inflate profitability metrics but expose the institution to higher credit risk.

That’s why it’s essential for central banks and commercial banks to arrive at a proper balance between the competing needs for a lender to achieve good performance while also maintaining adequate capital to meet safety and stability requirements.

Investor Confidence

While lower profitability may reduce the prospective returns that an investor can gain by investing in a lender’s stocks, higher perceived stability and good risk management practices can conversely win over investors as well.

Investors, especially institutional investors, are concerned with how stable their investment is and how well a company is managing its compliance requirements. Lenders can set themselves apart and project a higher standard by diligently following provisioning requirements and project themselves as a responsible lender.

Regulatory Scrutiny

Financial institutions are subject to regulatory scrutiny and supervision, including periodic assessments of asset quality, provisioning adequacy, and capital adequacy. Regulators closely monitor NPA provisioning levels to ensure compliance with regulatory requirements and sound risk management practices.

That’s why its essential for lenders to abide by all compliance needs to the letter. In case the lender is unsure about the exact interpretation of a rule, it is advisable to contact the central bank and obtain an official clarification. This can also help other lenders follow the rules as well and promote a more healthy ecosystem for lenders to operate in.

Introducing Legodesk

Legodesk offers a best-in-class software platform meant for lenders to increase their efficiency and operational performance. Our goal is to help lenders improve their bottom line, regardless of how strict the provisional rules set by the RBI are.

We are trusted by banks, NBFCs, as well as enterprises to help streamline the debt collection process. Our software tool boasts an impressive range of features including case management, legal notice automation, feet on the street app, and more.

Wrapping Up

NPA provisioning can seem to negatively impact the financial statements and performance of a lender, however, they are the financial equivalent of eating your vegetables. These NPA provisioning norms by the RBI have been put in place by regulators to ensure that lenders thrive over the long term and generate returns over the course of decades and not just a single day on the stock market.