What is DRA certification?

The Debt Recovery Agent (DRA) Exam, conducted by the Indian Institute of Banking & Finance (IIBF), stands as a crucial step for individuals aspiring to work as Debt Recovery Agents in India.

This comprehensive certification assesses candidates’ knowledge of debt recovery processes, ethical standards, and professional conduct. In this article, we will delve into the eligibility criteria, exam pattern, application process, syllabus, tips for preparation, fees, and frequently asked questions (FAQs) related to the DRA Exam.

Eligibility Criteria

The eligibility criteria for the DRA certification are structured to ensure that candidates possess the necessary educational background and training:

- Educational Qualification: Candidates must have a minimum of 10+2 or higher from a recognized board or university.

- Age: Applicants should have completed 18 years of age at the time of application for training.

- Training: Mandatory completion of a training certificate, with 100 hours for candidates who have passed 10+2 and 50 hours for candidates with higher qualifications. Exceptions exist for experienced debt collection agents and those with a graduate degree.

Exam Pattern

Understanding the DRA certification pattern is crucial for effective preparation. The DRA Exam consists of 50 objective-type questions, distributed across three sections:

- Part A: 15 questions with 3 marks each, and a negative marking of 1/3.

- Part B: 10 questions with 3 marks each, and a negative marking of 1/3.

- Part C: 25 questions with 1 mark each, without negative marking.

The total marks for the exam are 100, with negative marking applicable only to Part A and B.

Application Process

Initiating the journey towards DRA certification involves a step-by-step application process:

- Training: Candidates must complete a 100-hour training program from an accredited institution.

- Online Application: Once training is complete, candidates can apply online through the IIBF website, providing personal details, educational qualifications, training completion certificate details, and exam center preferences.

- Application Fee: An application fee, payable online via credit card, debit card, or net banking, is part of the process.

Syllabus

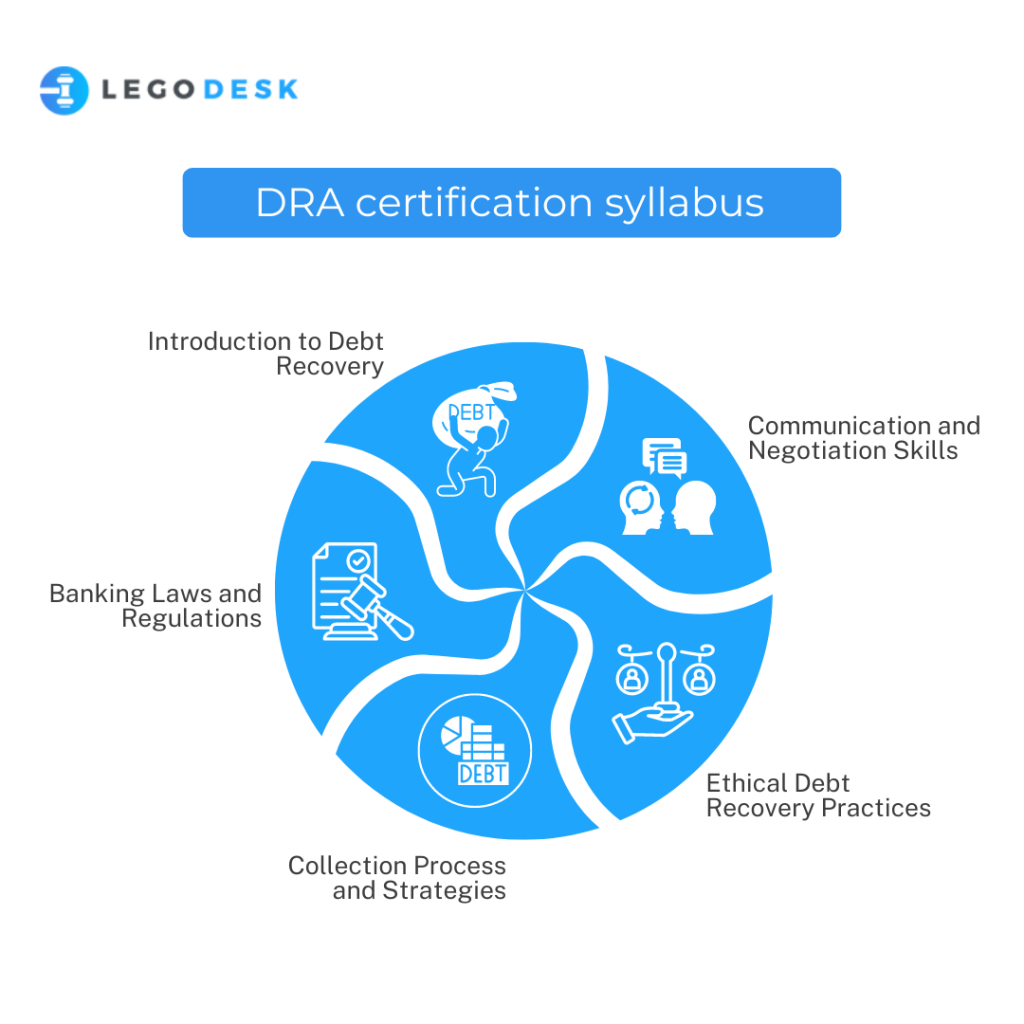

The DRA certification syllabus is designed to ensure that aspiring Debt Recovery Agents (DRAs) possess a well-rounded understanding of the intricacies involved in debt recovery. The knowledge areas covered include:

- Introduction to Debt Recovery:

- Overview of debt recovery processes.

- Understanding the role and responsibilities of a Debt Recovery Agent.

- Historical context and evolution of debt recovery in the Indian financial landscape.

- Banking Laws and Regulations:

- In-depth exploration of relevant banking laws and regulations.

- Examination of the legal framework governing debt recovery in India.

- Familiarity with Reserve Bank of India (RBI) guidelines pertaining to debt recovery practices.

- Collection Process and Strategies:

- Detailed analysis of debt collection methodologies.

- Strategies for effective and ethical debt recovery.

- Case studies and practical applications of successful collection processes.

- Ethical Debt Recovery Practices:

- Emphasis on ethical considerations in debt recovery.

- Understanding and adhering to a professional code of conduct.

- Balancing the interests of creditors and debtors while maintaining ethical standards.

- Communication and Negotiation Skills:

- Developing effective communication skills for interactions with debtors and creditors.

- Negotiation techniques to facilitate mutually agreeable solutions.

- Conflict resolution strategies within the context of debt recovery.

The syllabus is crafted to ensure that DRAs not only possess theoretical knowledge but also practical insights into the real-world challenges of debt recovery. It seeks to equip candidates with the ability to navigate complex scenarios, make informed decisions, and uphold ethical standards throughout the debt recovery process. By covering these diverse topics, the DRA Exam aims to create well-rounded professionals who can contribute effectively to the financial industry’s integrity and efficiency in India.

Tips for Exam Preparation

Effective preparation is key to success. Here are some additional tips for DRA Exam preparation:

- Start Early: Initiate the application process early to avoid a last-minute rush.

- Document Preparation: Organize and prepare all necessary documents before commencing the application form.

- Meticulous Form Filling: Fill out the application form meticulously, cross-checking all details before submission.

- Timely Fee Payment: Ensure timely payment of the application fee to prevent any delays.

- Admit Card Download: Download and print the admit card well in advance of the exam date for a stress-free experience.

Fees

Understanding the fee structure is crucial for candidates planning to undertake the DRA Exam:

- For the first attempt, the fees are Rs. 1,200 for members and Rs. 1,500 for non-members.

- Subsequent attempts have a fee of Rs. 1,200 for both members and non-members.

FAQs

Here are comprehensive answers to frequently asked questions about the DRA Exam:

What is the DRA Exam?

The DRA Exam is a certification exam for Debt Recovery Agents in India, conducted by IIBF on behalf of RBI. It assesses candidates’ knowledge of debt recovery processes, ethical standards, and professional conduct.

What is the format of the DRA Exam?

The DRA Exam comprises 50 objective-type questions, divided into three sections: Part A, Part B, and Part C. The total marks for the exam are 100, with negative marking applicable only to Part A and B.

What is the passing score for the DRA Exam?

The passing score for the DRA Exam is 50%.

What are the fees for the DRA Exam?

For the first attempt, the fees are Rs. 1,200 for members and Rs. 1,500 for non-members. Subsequent attempts have a fee of Rs. 1,200 for both members and non-members.

Conclusion

The DRA Exam is a vital step for individuals aiming to pursue a career as a Debt Recovery Agent in India. By understanding the eligibility criteria, exam pattern, application process, syllabus, and other key details, candidates can approach the certification process with confidence and prepare themselves for a rewarding profession in debt recovery.

Beyond merely obtaining a certification, this journey equips individuals with the knowledge and skills needed to contribute to the integrity and efficiency of debt recovery practices in the country.

Try our Debt Resolution solutions today Request a Demo