Demystifying Debt: A Comprehensive Guide to Different Types of Debts

Debt is a pervasive aspect of modern life, influencing individuals, businesses, and governments alike. While it can serve as a valuable tool for achieving various goals, debt also carries risks and complexities that must be understood to navigate financial landscapes effectively.

In this comprehensive guide, we will delve into the world of debt, exploring its different types, characteristics, and implications.

Understanding Debt

At its core, debt represents borrowed money that must be repaid with interest over time. It enables individuals and entities to access funds beyond their immediate financial resources, facilitating purchases, investments, and other endeavors.

However, taking on debt entails a commitment to future payments, which can impact one’s financial stability and flexibility.

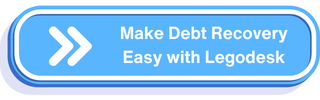

Types of Debts in India

In India, individuals and businesses often encounter various types of debts, representing financial obligations that arise from borrowing or financial transactions. Here are the prominent types of debts prevalent in the Indian financial landscape:

- Consumer Debts: These debts arise from everyday expenses and purchases, often incurred through credit cards, personal loans, or buy-now-pay-later schemes. Consumer debts may include outstanding credit card balances, personal loan repayments, or installment payments for consumer goods.

- Housing Loans: Also known as mortgage debts, housing loans are acquired for purchasing or constructing residential properties. Borrowers repay these loans over extended periods, typically spanning decades. Non-payment of housing loans can lead to foreclosure or repossession of the property by the lending institution.

- Vehicle Loans: Debts related to vehicle loans result from financing the purchase of automobiles, including two-wheelers, four-wheelers, and commercial vehicles. Failure to repay vehicle loans can result in the lender seizing the vehicle as collateral.

- Education Loans: With the rising costs of education, many individuals rely on education loans to fund higher studies. These debts cover tuition fees, accommodation expenses, and other educational costs. Repayment usually begins after completing the education, with interest rates varying based on the lender’s terms.

- Business Loans: Entrepreneurs and businesses often take out loans to fund operations, expansion, or capital investments. Business loans may include working capital loans, term loans, or lines of credit, tailored to meet specific business needs.

- Gold Loans: Leveraging gold assets, borrowers obtain gold loans from financial institutions. These loans provide short-term liquidity, with gold jewelry or ornaments serving as collateral. Failure to repay gold loans can lead to the forfeiture of pledged gold assets.

- Personal Debts: Personal debts encompass a wide range of financial obligations incurred for personal reasons, such as medical expenses, weddings, or vacations. These debts may be unsecured or secured by collateral, depending on the borrower’s financial standing and creditworthiness.

- Overdrafts: Overdrafts represent short-term borrowing facilities offered by banks, allowing account holders to withdraw funds exceeding their account balance. Overdrafts incur interest on the borrowed amount and are typically repaid within a specified period.

- Government Debts: Government debts comprise borrowings by central and state governments to finance public expenditure, infrastructure projects, or budgetary deficits. These debts may take the form of government bonds, treasury bills, or loans from international financial institutions.

- Corporate Debts: Corporations raise capital through various debt instruments, including corporate bonds, debentures, and commercial paper. These debts enable businesses to finance operations, acquisitions, or capital expenditures, with repayment terms and interest rates determined by market conditions and credit ratings.

Understanding the different types of debts is essential for individuals and businesses to manage their financial obligations effectively, maintain liquidity, and avoid default. Proper debt management strategies, including budgeting, repayment planning, and prudent borrowing decisions, can help borrowers navigate the complexities of debt and achieve financial stability.

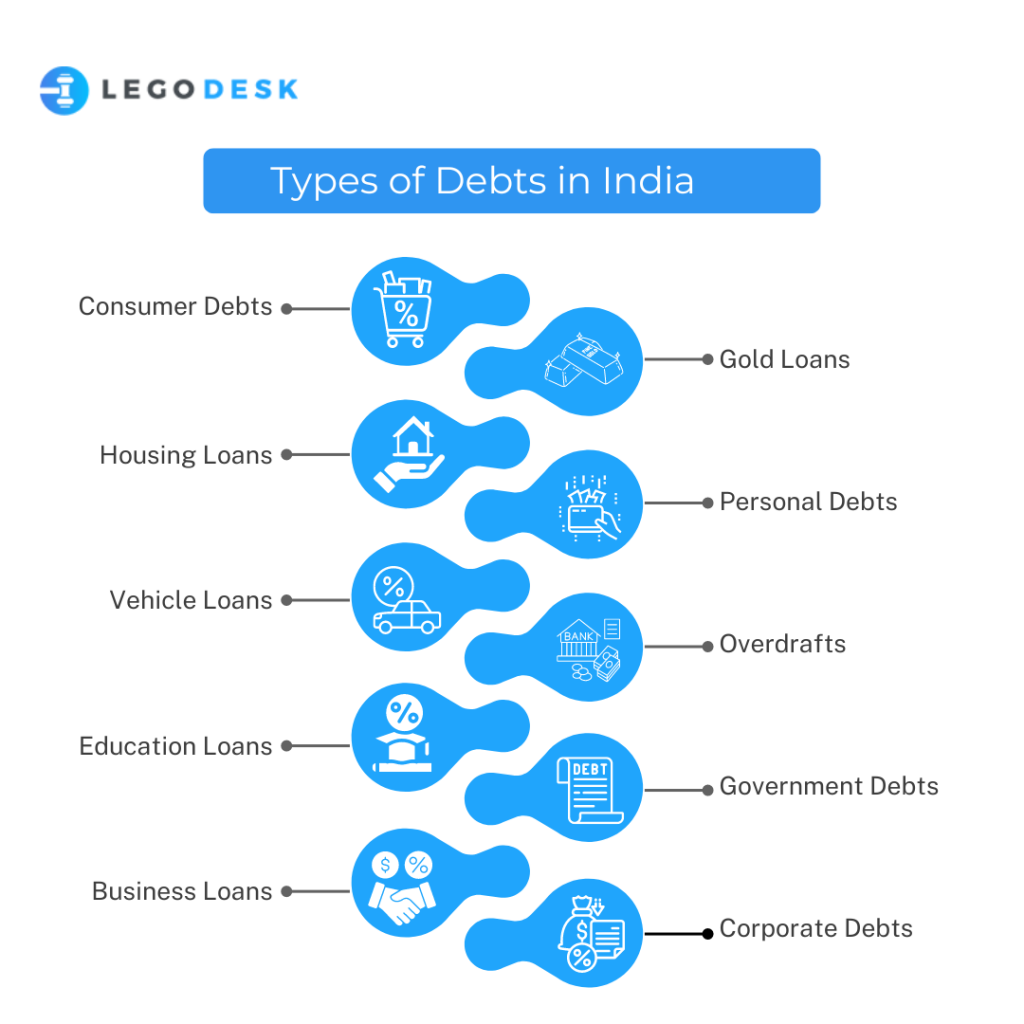

Characteristics of Debt

Regardless of its type, debt shares several common characteristics that borrowers should consider:

- Interest Rates: Debt typically accrues interest, which represents the cost of borrowing money. Interest rates can be fixed or variable, impacting the total amount repaid over time.

- Repayment Terms: Debt obligations come with specific repayment terms, including the frequency of payments, the duration of the loan, and any penalties for late payments or early repayment.

- Security: Some debts are secured by collateral, such as real estate or vehicles, providing lenders with recourse in case of default. Unsecured debts, on the other hand, are not backed by collateral and rely solely on the borrower’s creditworthiness.

- Credit Impact: Borrowing and repaying debt can influence one’s credit score, which reflects their creditworthiness and ability to manage debt responsibly. Timely payments and low levels of debt can improve credit scores, while missed payments or high debt balances may have adverse effects.

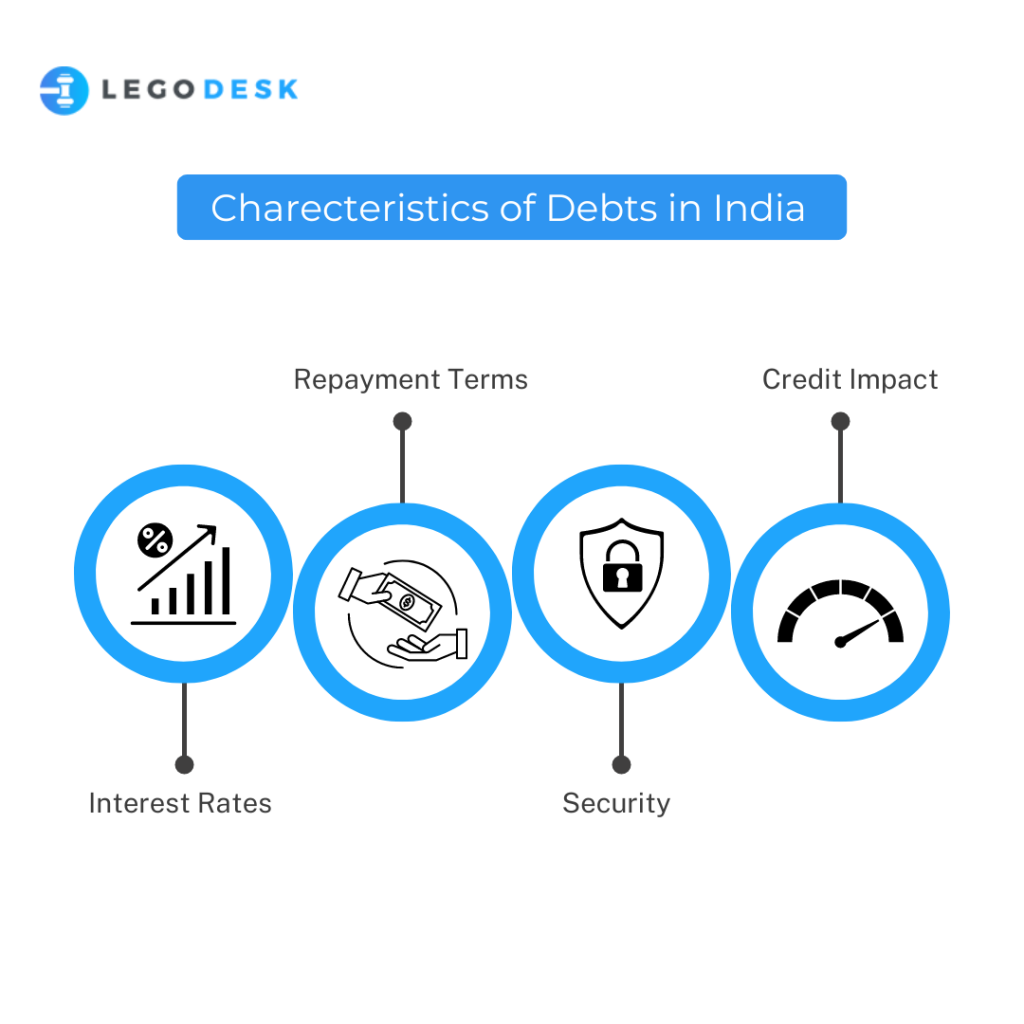

Managing Debt

Effectively managing debt is essential for maintaining financial health and stability. Strategies for managing debt include:

- Budgeting: Creating and adhering to a budget can help individuals and businesses prioritize expenses, allocate funds for debt repayment, and avoid accumulating additional debt unnecessarily.

- Debt Consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify repayment and potentially reduce overall interest costs. However, borrowers should carefully evaluate consolidation options to ensure they result in cost savings and improved financial outcomes.

- Financial Planning: Developing a comprehensive financial plan can help individuals and businesses set goals, allocate resources effectively, and make informed decisions about borrowing, investing, and saving.

- Communication: Maintaining open communication with lenders and creditors can be beneficial, especially when facing financial difficulties. Lenders may offer assistance programs or modified repayment plans to help borrowers manage their debt obligations more effectively.

Conclusion

Debt is a multifaceted financial instrument with various types, characteristics, and implications. Understanding the different types of debts and their associated features is essential for making informed financial decisions and managing debt effectively.

By demystifying debt and adopting sound financial practices, individuals and businesses can navigate the complexities of borrowing while working towards their financial goals.