Navigating Warrants in Debt Recovery in India: A Comprehensive Guide

Imagine you’re a business owner who’s done a job or sold something, but the customer hasn’t paid you. That’s where warrants come in. They’re like powerful tools that help you make sure you get what you’re owed.

Throughout this guide, we’ll explain how warrants work in debt recovery. We’ll talk about what they are, how they help creditors and how they make sure debtors meet their obligations.

Introduction to Debt Recovery in India

Debt recovery is a critical aspect of financial management and legal enforcement in India, ensuring that creditors can reclaim funds owed to them.

The process is governed by a complex legal framework, designed to balance the rights and obligations of creditors and debtors. Understanding the issuance of a warrant in debt is essential for anyone involved in this legal proceeding.

What Are Warrants in Debt Recovery?

Warrants in debt recovery are legal documents issued by a court or authorized entity that empower creditors to take specific actions to recover outstanding debts from debtors. These warrants typically grant creditors the authority to seize assets, initiate legal proceedings, or enforce payment through various means.

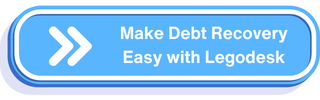

Types of Warrants in Debt Recovery

Warrant of Execution: A warrant of execution is a court order that authorizes a creditor to seize the debtor’s assets to satisfy a judgment debt. This type of warrant allows creditors to enforce payment by seizing and selling the debtor’s property, such as vehicles, real estate, or personal belongings, to recover the outstanding debt amount.

Warrant of Distress: A warrant of distress, also known as a distress warrant or distress writ, is commonly used in cases of commercial rent arrears. It enables landlords to seize and sell the tenant’s goods or possessions to recover unpaid rent. This type of warrant typically applies to commercial leases and allows landlords to take swift action to remedy rent default.

Warrant of Seizure and Sale: A warrant of seizure and sale empowers creditors to seize specific assets owned by the debtor and sell them to satisfy the outstanding debt. This type of warrant may be issued for various types of assets, including vehicles, equipment, or other valuable property owned by the debtor.

Arrest Warrant: In cases where a debtor fails to comply with court orders or judgments related to debt repayment, a creditor may seek an arrest warrant to compel the debtor’s appearance in court. While arrest warrants are less common in debt recovery, they can be pursued in situations involving flagrant defiance of legal obligations.

Legal Framework and Relevant Laws

India’s approach to debt recovery is outlined in key legislation, including the Recovery of Debts and Bankruptcy Act, 1993 (RDB Act), and the Insolvency and Bankruptcy Code, 2016 (IBC). These laws establish the foundation for resolving disputes over debt and provide mechanisms for the recovery of owed funds.

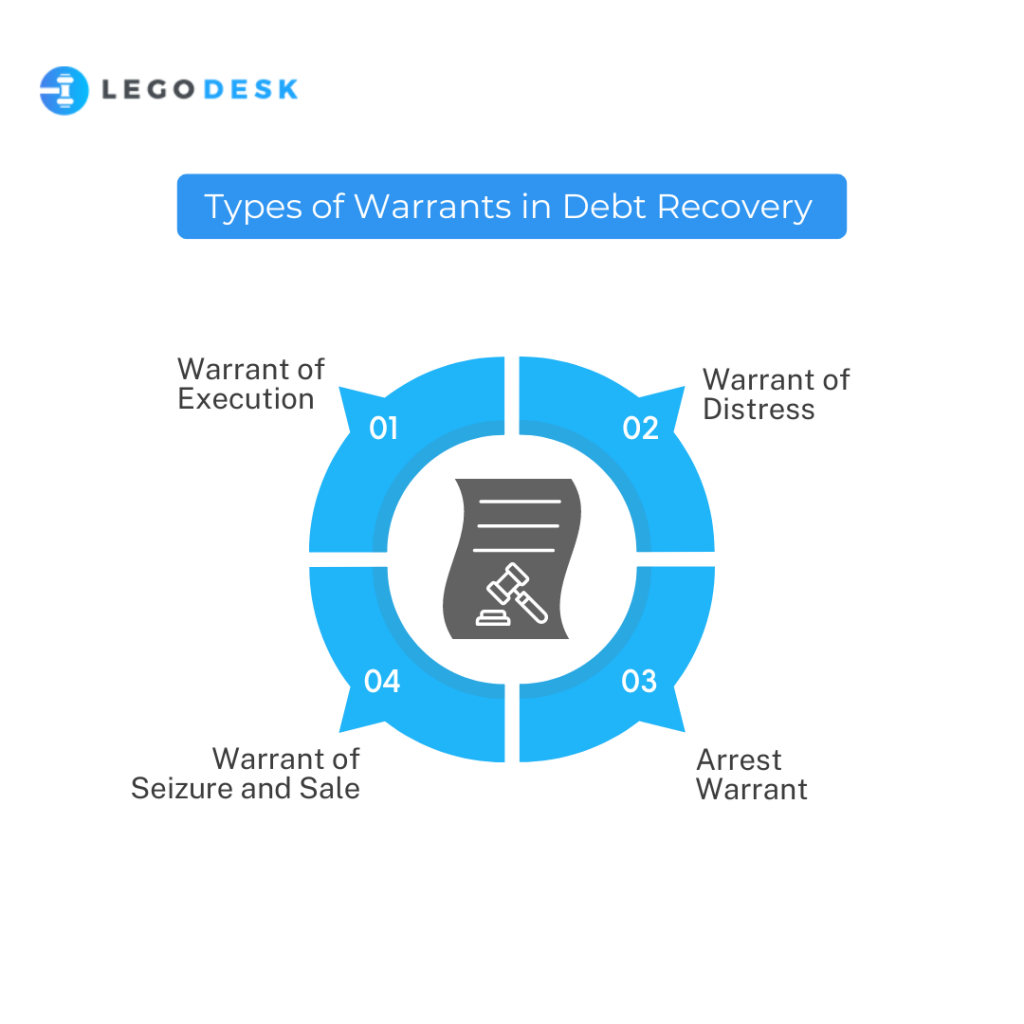

Key Components of Warrants in Debt Recovery:

The process begins with the creditor filing a claim against the debtor. If the court finds the claim valid, it issues a warrant in debt, signaling the start of formal legal proceedings. This process involves classification of debts (secured vs. unsecured) and varies based on the nature of the owed sum.

- Debtor Information: Warrants typically contain detailed information about the debtor, including their name, address, and contact details, to ensure accurate identification and enforcement.

- Description of Debt: Warrants specify the nature and amount of the outstanding debt, including any interest, fees, or penalties accrued.

- Authorized Actions: Warrants delineate the actions authorized by the court or issuing authority, such as asset seizure, sale, or legal proceedings, to facilitate debt recovery.

- Compliance Requirements: Warrants may outline specific requirements or deadlines for debtors to comply with, such as payment deadlines or court appearances, to avoid further legal consequences.

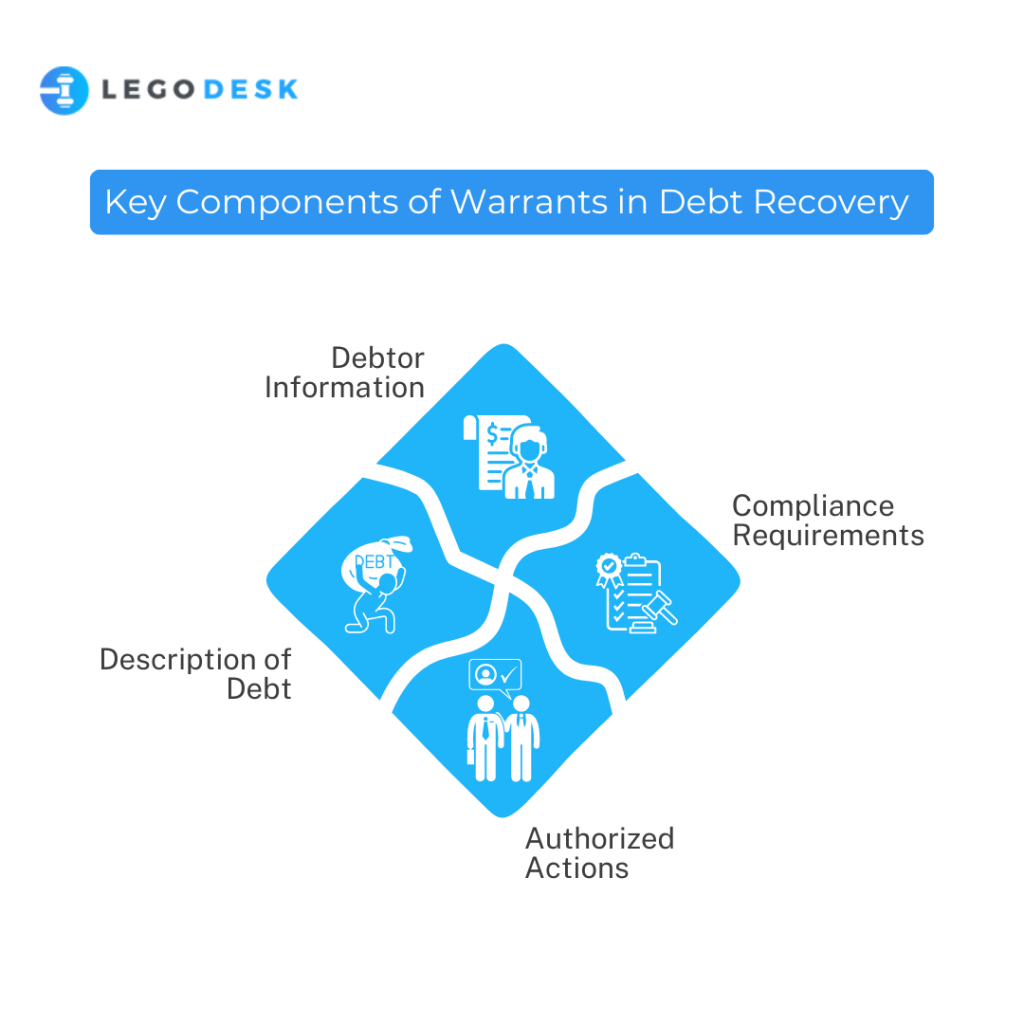

Process of Obtaining and Executing Warrants

The process begins with the creditor filing a claim against the debtor. If the court finds the claim valid, it issues a warrant in debt, signalling the start of formal legal proceedings. This process involves the classification of debts (secured vs. unsecured) and varies based on the nature of the owed sum. For better understanding here is a detailed breakdown of steps involved.

- Judgment: The debt recovery process typically begins with the creditor obtaining a judgment from a court or tribunal establishing the debtor’s liability for the outstanding debt.

- Warrant Application: Upon obtaining a judgment, the creditor may apply to the court for the issuance of a warrant, specifying the desired course of action for debt recovery.

- Warrant Issuance: If the court determines that the creditor’s claim is valid and meets the necessary legal criteria, it may issue the warrant, granting the creditor the authority to take appropriate actions to recover the debt.

- Enforcement: Once the warrant is issued, the creditor can proceed with enforcement actions, which may include asset seizure, sale, or other legal remedies, to compel the debtor to fulfill their payment obligations.

- Compliance or Consequences: Debtors are typically given an opportunity to comply with the terms outlined in the warrant, such as making payment or surrendering assets. Failure to comply may result in further legal consequences, including additional penalties or enforcement measures.

The Role of Warrants in Cheque Bounce Cases:

In cases of cheque bounce, where a cheque presented for payment is dishonored due to insufficient funds or other reasons, warrants in debt recovery become indispensable tools for creditors seeking recourse.

When a cheque bounces, it not only signifies a breach of trust but also imposes financial losses on the payee. Warrants in cheque bounce cases enable payees to pursue legal remedies to recover the amount owed to them.

Key Elements of Warrants in Cheque Bounce Cases:

Legal Basis: Warrants in cheque bounce cases are typically issued under the relevant provisions of laws governing negotiable instruments, such as the Negotiable Instruments Act, which outline the legal consequences of dishonored cheques.

Jurisdiction: Warrants in cheque bounce cases are issued by courts having jurisdiction over the matter, usually where the cheque was presented for payment or where the creditor resides or conducts business.

Procedure: The process of obtaining a warrant in a cheque bounce case involves initiating legal proceedings by filing a complaint or a petition before the appropriate court. The court then examines the evidence presented and, if satisfied, issues the warrant for debt recovery.

Failure to comply with a warrant in a cheque bounce case can lead to further legal consequences for the debtor, such as additional penalties, adverse credit history, or even imprisonment in some jurisdictions.

Rights and Obligations of the Parties Involved

Both creditors and debtors have specific rights and obligations. Debtors have the right to contest the claim and present their defense, while creditors must follow legal procedures accurately to recover the debt. Understanding these rights is crucial for both parties.

Enforcement of a Warrant in Debt

Once issued, a warrant in debt can lead to enforcement actions like property seizure or wage garnishment. These measures ensure compliance with the debt recovery process and facilitate the repayment of debts.

Role of Debt Recovery Tribunals (DRTs)

Debt Recovery Tribunals play a vital role in adjudicating debt recovery cases. They offer a specialized forum for resolving disputes and have the authority to enforce decisions related to debt recovery.

Impact on Credit Score and Financial Health

A warrant in debt can significantly impact a debtor’s credit score and financial health. It’s important for debtors to understand these implications and seek ways to manage or mitigate adverse effects.

Challenges and Considerations

- Legal Complexity: Warrants in debt recovery involve complex legal processes and requirements that may vary depending on jurisdiction and the nature of the debt.

- Debtor Rights: Debtors have legal rights and protections against unfair or abusive debt collection practices, including the right to dispute debts and challenge warrant enforcement actions.

- Procedural Safeguards: Courts and issuing authorities impose procedural safeguards to ensure the fair and lawful issuance and execution of warrants, including requirements for due process and judicial oversight.

- Practical Limitations: While warrants provide creditors with legal remedies for debt recovery, practical challenges such as locating assets or enforcing payment against insolvent debtors may impede the effectiveness of warrant enforcement.

Conclusion

Understanding the warrant in debt recovery process in India is crucial for anyone involved in financial disputes. With the right knowledge and resources, it’s possible to navigate these challenging situations successfully.

By demystifying warrants in debt recovery, stakeholders can better comprehend their roles and responsibilities in the debt collection process, fostering fair and equitable outcomes for all parties involved.

Remember, the key to managing debt recovery is not just in understanding the legal framework but also in seeking timely advice and support.