Strategic Debt Management Plans for Businesses in India: A Comprehensive Guide

In the dynamic business environment of India, effective debt management is crucial for sustaining growth and ensuring long-term financial stability. A well-structured Debt Management Plan India(DMP) enables businesses to leverage debt as a tool for expansion while mitigating associated risks.

This comprehensive guide aims to provide businesses operating in India with a detailed roadmap for developing and implementing a Strategic Debt Management Plan India.

I. Understanding the Indian Business Landscape

India’s diverse and dynamic business landscape presents both opportunities and challenges for enterprises. A comprehensive grasp of the economic and regulatory context is fundamental for effective debt management and overall business success.

A. Economic Overview

1. Growth Trajectory

India has emerged as one of the world’s fastest-growing major economies, consistently outpacing global growth rates. Its large consumer base, expanding middle class, and increasing urbanization contribute to a robust domestic market.

2. Sectoral Composition

Understanding the composition of India’s economy is crucial. It spans a wide range of sectors including information technology, manufacturing, agriculture, services, and emerging industries like renewable energy and biotechnology. Recognizing the growth trajectories and challenges within specific sectors aids in strategic debt planning.

3. Inflation and Interest Rates

India experiences varying levels of inflation and interest rates due to factors like monetary policies, global economic conditions, and domestic supply-demand dynamics. These fluctuations impact borrowing costs and should be factored into debt management strategies.

4. Exchange Rate Considerations

Given India’s global integration, businesses engaged in international trade need to monitor exchange rates closely. Fluctuations can affect the cost of imported goods, export competitiveness, and currency risk associated with debt in foreign currencies.

5. Government Fiscal Policies

The Indian government’s fiscal policies, including tax rates, subsidies, and public spending, have a direct impact on business operations and financial planning. Staying updated on policy changes is essential for sound debt management.

B. Regulatory Framework

1. Reserve Bank of India (RBI)

The RBI, as India’s central banking institution, plays a pivotal role in shaping monetary policy. Its decisions on interest rates, liquidity, and regulatory measures directly influence borrowing costs and liquidity conditions for businesses.

2. Securities and Exchange Board of India (SEBI)

SEBI regulates the securities market in India, overseeing activities related to stocks, bonds, and other financial instruments. Compliance with SEBI regulations is crucial for businesses considering debt issuance or public offerings.

3. Other Regulatory Authorities

Apart from RBI and SEBI, various other regulatory bodies oversee specific aspects of the financial sector, including the Insurance Regulatory and Development Authority (IRDA) and the Pension Fund Regulatory and Development Authority (PFRDA). Understanding the roles and regulations of these authorities is imperative for businesses involved in insurance, pension, and related financial activities.

4. Taxation and Corporate Laws

India’s tax and corporate laws are complex and subject to frequent changes. Being well-versed in these areas is vital for effective financial planning, including debt management, as tax implications can significantly impact a company’s financial position.

5. Compliance and Risk Mitigation

Compliance with regulatory guidelines is not only a legal requirement but also essential for risk mitigation. Non-compliance can lead to penalties, reputational damage, and legal consequences that can adversely affect a business’s financial health.

Read More: Debt Settlement in the Financial Industry

II. Assessing Debt Capacity

A. Debt-to-Equity Ratio

Calculating the debt-to-equity ratio provides a clear indication of a business’s financial leverage. Striking the right balance between debt and equity is crucial for maintaining a healthy financial structure.

B. Debt Service Coverage Ratio (DSCR)

DSCR measures a company’s ability to cover its debt obligations with its operating income. A DSCR above 1 indicates a healthy capacity to service debt.

III. Types of Debt Instruments

A. Bank Loans

Bank loans are a common source of debt financing for businesses. Understanding the various types, such as term loans, working capital loans, and trade finance, is crucial for effective debt management.

B. Bonds and Debentures

Issuing bonds or debentures allows businesses to raise capital from the market. This section covers the different types of bonds, regulatory requirements, and market dynamics.

C. Government Schemes and Subsidies

India offers various government-backed schemes and subsidies to promote business growth. Leveraging these resources can significantly impact a company’s debt management strategy.

IV. Risk Assessment and Mitigation

A. Interest Rate Risk

Given the volatility in interest rates, businesses must adopt strategies to hedge against potential fluctuations that may affect their debt servicing capabilities.

B. Currency Risk

For businesses engaged in international trade, exposure to currency risk is significant. Implementing hedging mechanisms and closely monitoring forex markets are vital components of a comprehensive debt management plan.

C. Market Risk

External market factors, such as changes in demand and competition, can impact a business’s ability to generate revenue. Conducting thorough market analyses and scenario planning helps in identifying potential risks.

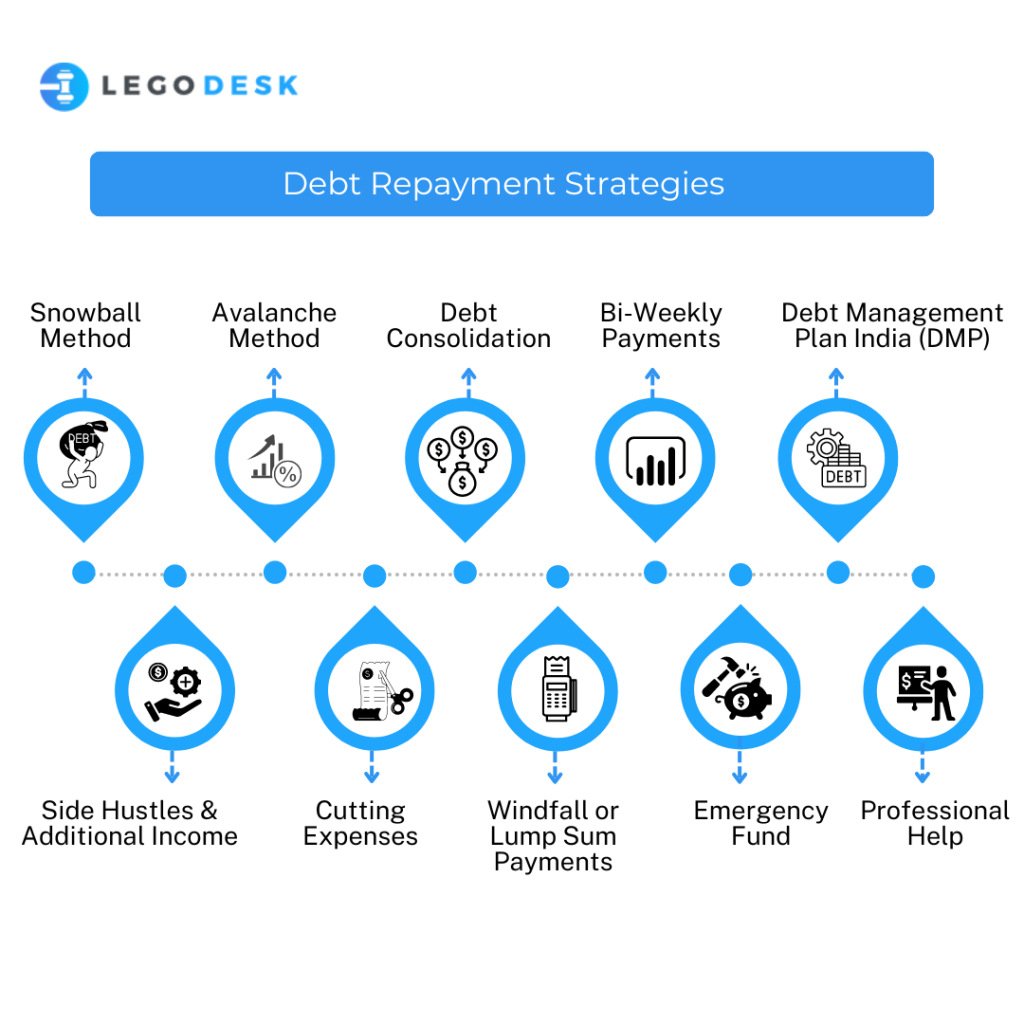

V. Debt Repayment Strategies

Debt repayment strategies are approaches individuals can use to effectively manage and pay off their debts. Here are several popular strategies:

Snowball Method:

How it works: List all your debts from smallest to largest balance, regardless of interest rates. Pay the minimum on all debts except the smallest one, to which you allocate as much as possible. Once the smallest debt is paid off, roll that payment into the next smallest debt.

Benefits: Provides a psychological boost from quick wins, which can motivate you to tackle larger debts.

Avalanche Method:

How it works: List debts from highest to lowest interest rates. Allocate extra payments to the debt with the highest interest rate while paying the minimum on the others. Once the highest interest debt is paid off, move on to the next highest, and so on.

Benefits: Saves more money in the long run by tackling high-interest debts first.

Debt Consolidation:

How it works: Combine multiple debts into one, often through a balance transfer to a single credit card with a lower interest rate or a debt consolidation loan.

Benefits: Simplifies payments and can reduce interest rates, making it easier to manage and potentially less costly.

Debt Management Plan India (DMP):

How it works: Set up a structured plan with a credit counseling agency. They negotiate with creditors for potentially lower interest rates, fees, and more manageable monthly payments.

Benefits: Provides professional guidance and can help individuals regain control of their finances.

Bi-Weekly Payments:

How it works: Instead of making monthly payments, make half the monthly payment every two weeks. This results in an extra payment each year, reducing the total interest paid over time.

Benefits: Accelerates debt payoff and saves on interest.

Side Hustles and Additional Income:

How it works: Generate extra income through a part-time job, freelancing, selling items, or any other legitimate means.

Benefits: Provides additional funds that can be directed towards debt repayment, potentially speeding up the process.

Cutting Expenses:

How it works: Analyze your budget and identify areas where you can cut back on spending. This could involve cooking at home, canceling unnecessary subscriptions, or finding more affordable alternatives.

Benefits: Frees up money that can be redirected towards debt repayment.

Windfall or Lump Sum Payments:

How it works: Use unexpected financial gains, like tax refunds, work bonuses, or gifts, to make a lump sum payment towards your debts.

Benefits: Provides a significant boost to your debt repayment efforts.

Emergency Fund:

How it works: Establish an emergency fund to cover unexpected expenses. This can prevent the need to use credit cards or loans for unforeseen circumstances, which can lead to more debt.

Benefits: Acts as a financial buffer, reducing reliance on credit in emergencies.

Professional Help:

How it works: Consult with a financial advisor or debt counselor for personalized advice and strategies based on your specific situation.

Benefits: Offers expert guidance tailored to your unique financial circumstances.

Remember, the most effective strategy depends on your individual situation, including the types of debts you have, their interest rates, and your overall financial picture. Consider consulting a financial advisor or counselor for personalized advice.

VI. Monitoring and Reporting

A. Key Performance Indicators (KPIs)

Establishing relevant KPIs enables businesses to track the effectiveness of their Debt Management Plan India. Metrics like Debt-to-EBITDA ratio, Debt Service Coverage Ratio, and Interest Coverage Ratio are crucial indicators.

B. Periodic Reviews

Regular reviews of the Debt Management Plan India are essential to ensure its continued relevance in the evolving business landscape. Adjustments and refinements should be made as necessary.

VII. Tax Implications of Debt Management

Understanding the tax implications of different debt instruments and repayment strategies is essential for making informed financial decisions. In India, taxes play a significant role in debt management. Here are some key considerations:

A. Interest Deductibility

Interest paid on loans is generally tax-deductible as a business expense. However, there may be restrictions or limitations based on the purpose of the loan and the type of debt instrument. It’s important to understand these nuances to optimize tax benefits.

B. Thin Capitalization Rules

India has thin capitalization rules that limit the amount of interest that can be claimed as a deduction in cases where a company has an excessive level of debt compared to its equity. Understanding and adhering to these rules is crucial to avoid potential tax liabilities.

C. Withholding Tax on Interest Payments

In cases where a business has borrowed from foreign lenders, withholding tax may apply to interest payments. Knowing the applicable rates and ensuring compliance with withholding tax requirements is essential to prevent penalties and legal complications.

D. Capital Gains Tax on Debt Instruments

Different debt instruments may have varying tax treatments. For instance, capital gains tax implications can differ for government bonds, corporate bonds, and other debt securities. Being aware of these distinctions is vital for accurate financial planning.

E. Debt Restructuring and Tax Implications

In situations where debt is restructured, there may be tax consequences. Understanding how debt restructuring impacts the tax liability of the business is crucial for making well-informed decisions about when and how to pursue such strategies.

VIII. Ethical Considerations in Debt Management

Maintaining ethical practices in debt management is not only a legal requirement but also a fundamental aspect of building trust with stakeholders and ensuring the long-term sustainability of the business. Here are some key ethical considerations:

A. Transparency and Disclosure

Transparent communication with stakeholders about the company’s debt situation, risks, and mitigation strategies is essential. Misleading or withholding information can erode trust and lead to reputational damage.

B. Fair Treatment of Creditors

Treating creditors fairly and equitably is a cornerstone of ethical debt management. Prioritizing payments based on contractual obligations and ensuring timely communication about any challenges demonstrates integrity.

C. Avoidance of Predatory Lending Practices

Engaging in predatory lending practices, such as excessively high interest rates or unfair terms, is ethically unacceptable. Businesses should seek mutually beneficial lending arrangements that promote sustainable financial relationships.

D. Responsiveness to Financial Distress

In times of financial difficulty, acting responsibly and ethically is paramount. This may involve open communication with creditors, exploring restructuring options, and making genuine efforts to meet obligations.

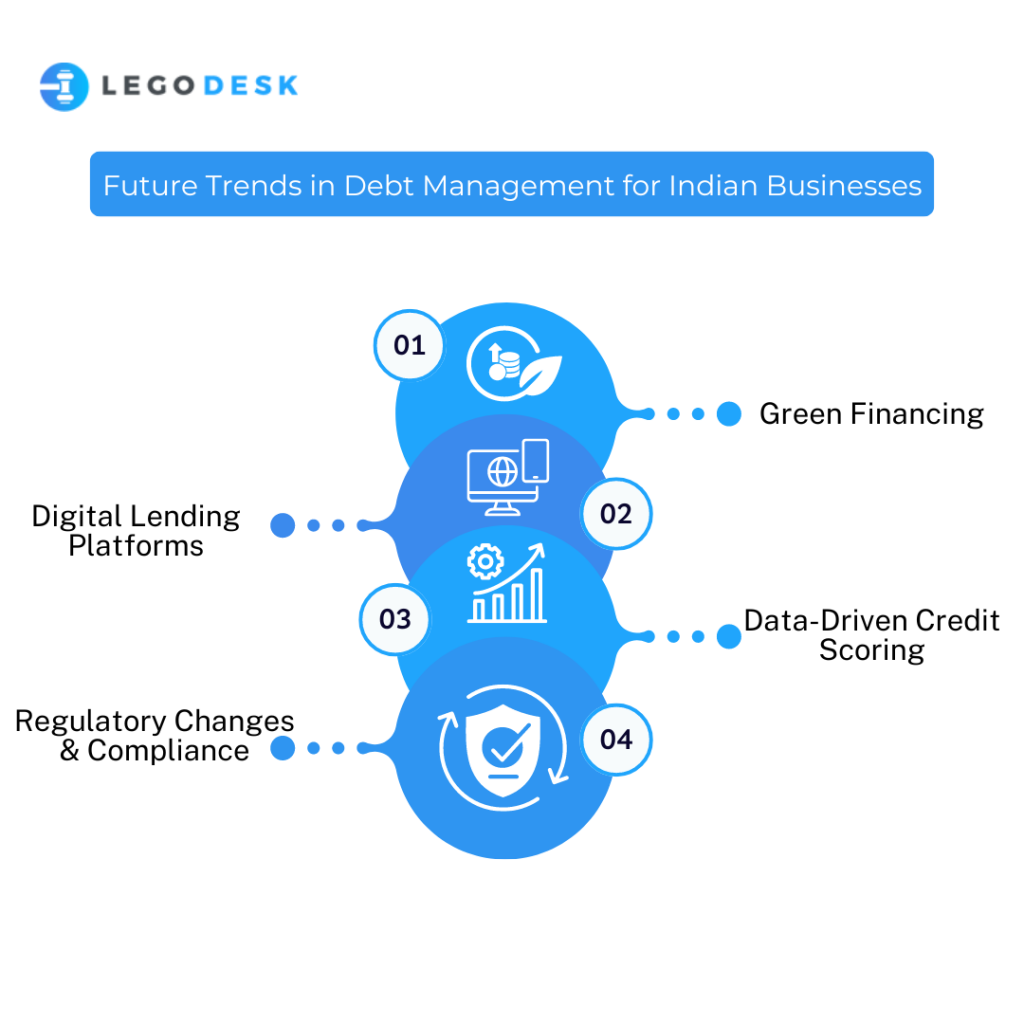

IX. Future Trends in Debt Management for Indian Businesses

Anticipating and adapting to emerging trends in debt management can give businesses a competitive edge in the evolving financial landscape of India. Here are some noteworthy trends:

A. Green Financing

With an increasing focus on sustainability, green financing options like green bonds and loans tied to environmental performance are gaining traction. Businesses that incorporate environmentally-friendly practices may find it easier to access capital.

B. Digital Lending Platforms

The rise of digital lending platforms and peer-to-peer lending is reshaping the lending landscape. Businesses can benefit from faster access to funds and more diverse lending options, but should also be vigilant about understanding the terms and risks associated with digital lending.

C. Data-Driven Credit Scoring

Advancements in technology and data analytics are leading to more sophisticated credit scoring models. This can provide businesses with more accurate assessments of creditworthiness, potentially opening up new financing opportunities.

D. Regulatory Changes and Compliance

Staying abreast of evolving regulatory frameworks is crucial. Changes in policies related to debt instruments and lending practices can have a significant impact on a business’s debt management strategy.

By considering these emerging trends and incorporating them into their debt management plans, businesses can position themselves for success in the evolving financial landscape of India.

Conclusion

In an increasingly competitive business environment, effective debt management is a cornerstone of long-term success. This comprehensive guide equips businesses operating in India with the knowledge and strategies necessary to develop and implement a Strategic Debt Management Plan India tailored to their specific needs and goals.

By understanding the economic context, regulatory framework, and risk factors, and by leveraging various debt instruments and repayment strategies, businesses can navigate the complexities of debt management with confidence and resilience.

Try our Debt Resolution solutions today Request a Demo