Common Challenges in the Accounts Receivable Process and How to Overcome Them

The accounts receivable process plays a crucial role in the financial health of any business. Efficiently managing accounts receivable ensures timely collection of outstanding payments, reduces bad debts, and contributes to a steady cash flow.

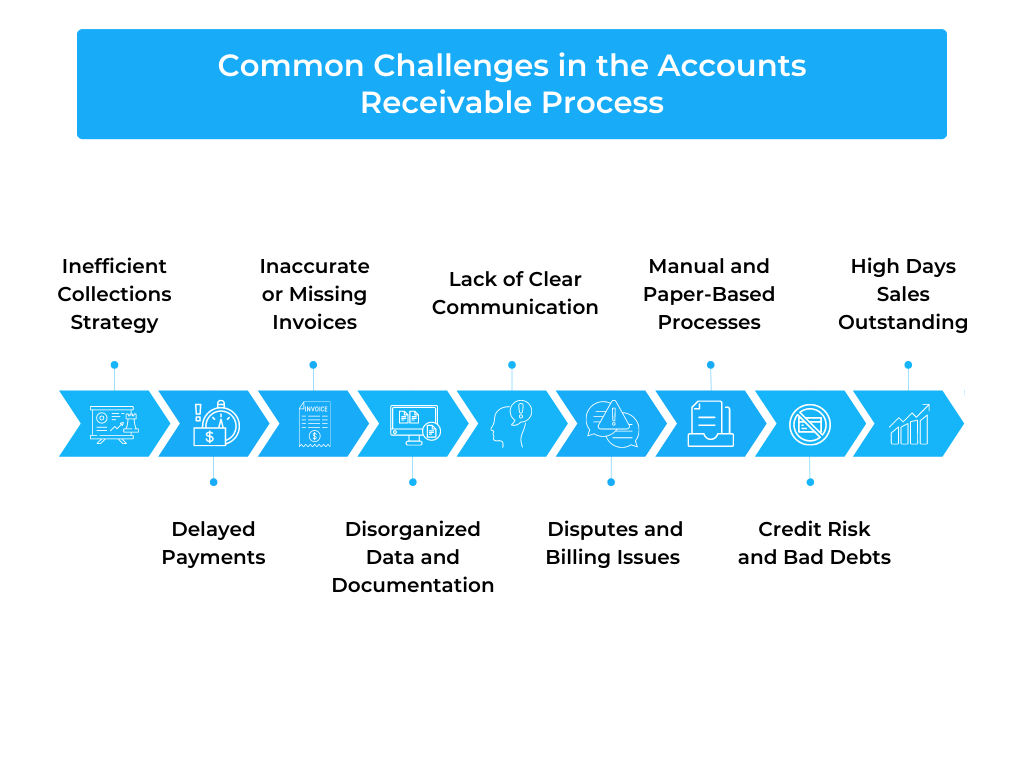

However, this critical process is not without its challenges, and businesses often encounter obstacles that hinder its effectiveness. In this article, we will delve into the common challenges faced in the accounts receivable process and explore practical strategies to overcome them.

Challenge 1: Inefficient Collections Strategy

Having a well-defined collections strategy is vital for successful accounts receivable management. A poorly executed collections process can result in delayed payments and increased bad debts.

1.1 Define a Clear Collections Strategy:

Develop a structured collections strategy that outlines the steps to be taken for overdue accounts. Include specific procedures for escalating collection efforts when necessary.

1.2 Set Collection Goals:

Establish clear collection goals to track the effectiveness of the collections process. Monitor metrics such as collection rate and aging reports to measure progress.

1.3 Prioritize Collection Efforts:

Prioritize collection efforts based on the age of outstanding invoices and the level of risk associated with each customer.

1.4 Consistent Follow-Up:

Maintain consistent follow-up with customers to ensure they are aware of their outstanding payments and the consequences of further delays.

Challenge 2: Delayed Payments

One of the most significant challenges in accounts receivable is dealing with delayed payments from customers. Slow-paying customers can strain a company’s cash flow, impacting its ability to meet financial obligations and invest in growth.

To address this issue, businesses need to establish clear credit policies and communicate payment terms effectively to customers. By setting expectations upfront, customers will have a clear understanding of when payments are due.

2.1 Establish Clear Credit Policies:

Clear credit policies are the foundation for managing delayed payments. Businesses should conduct a thorough credit assessment of potential customers to determine their creditworthiness and risk level. By setting appropriate credit limits based on financial history and industry norms, companies can minimize the risk of defaulting customers.

2.2 Communicate Payment Terms Effectively:

Transparent and timely communication of payment terms is vital. Clearly state the payment due date on invoices and any consequences for late payments. Ensure that customers are aware of these terms before making any purchase, so they can plan their payments accordingly.

2.3 Offer Incentives for Early Payments:

Encouraging customers to pay early can be achieved by offering incentives such as discounts or special offers. These rewards can motivate customers to settle their dues promptly, benefiting both parties involved.

2.4 Implement Penalties for Late Payments:

On the other hand, implementing penalties for late payments can serve as a deterrent and promote timely payments. Ensure that the late fee policy is clearly communicated and adheres to legal regulations to avoid any disputes.

Challenge 3: Inaccurate or Missing Invoices

Inaccurate or missing invoices can lead to confusion, disputes, and delays in payment processing. Efficient invoice management is essential to maintaining smooth accounts receivable operations.

3.1 Adopt Automated Invoicing Systems:

Transitioning to automated invoicing systems can significantly improve accuracy and efficiency. These systems can automatically generate and send invoices to customers, reducing the risk of human errors and ensuring timely delivery.

3.2 Conduct Regular Reconciliations and Audits:

Regularly reconciling accounts receivable records with financial statements is crucial to identify discrepancies. Conducting audits can help identify and rectify any inaccuracies in invoices and payments.

3.3 Ensure Accurate Data Entry and Management:

Meticulous data entry and management are essential for accurate invoicing. Standardize data entry procedures to avoid mistakes and maintain a centralized repository for easy access to invoice records.

Challenge 4: Disorganized Data and Documentation

Disorganized data and documentation can lead to lost invoices, missed payments, and inefficient accounts receivable management. Establishing proper data organization is essential for seamless operations.

4.1 Utilize Robust Accounting Software:

Investing in robust accounting software can streamline data organization and management. Modern accounting systems offer features such as data categorization, report generation, and easy retrieval of information.

4.2 Standardize Data Entry Procedures:

Implement standardized data entry procedures across the organization to ensure consistency and accuracy. This reduces the likelihood of errors in customer information, invoice details, and payment records.

4.3 Maintain Organized Records:

Maintaining well-organized records is critical for efficient accounts receivable management. Organize data based on customer names, invoice numbers, and payment dates for easy tracking and reference.

Challenge 5: Lack of Clear Communication

Effective communication is pivotal in accounts receivable management. Lack of clear communication with customers can lead to confusion and payment delays.

5.1 Establish Open Lines of Communication:

Encourage open and transparent communication with customers. Make it easy for them to reach out with any payment-related queries or concerns.

5.2 Send Regular Payment Reminders:

Sending regular payment reminders to customers can be an effective way to prompt timely payments. Utilize email notifications, text messages, or automated reminders to keep customers informed about upcoming due dates.

5.3 Balance Persistence and Customer Relations:

While it is essential to follow up on overdue payments, maintaining a positive customer relationship is equally vital. Strike a balance between persistence and understanding to avoid alienating customers.

Challenge 6: Disputes and Billing Issues

Disputes and billing issues can arise due to various reasons, such as discrepancies in invoicing or dissatisfaction with delivered goods or services. Handling these situations effectively is crucial for maintaining customer satisfaction.

6.1 Resolve Disputes Promptly and Professionally:

Promptly address customer disputes with a professional approach. Actively listen to their concerns, investigate the issue, and work towards an amicable resolution.

6.2 Encourage Customer Communication:

Encourage customers to communicate their concerns openly. Make it easy for them to reach out through various channels, such as phone, email, or online portals.

6.3 Address Disputes with a Positive Approach:

Maintain a positive and helpful attitude when dealing with disputes. Customer satisfaction can be enhanced by the manner in which issues are resolved, even in challenging situations.

Challenge 7: Manual and Paper-Based Processes

Relying on manual and paper-based processes in the accounts receivable process can be time-consuming, error-prone, and resource-intensive. Embracing digital solutions can significantly improve efficiency.

7.1 Transition to Digital Solutions:

Explore and implement digital solutions for managing accounts receivable processes. This may include adopting cloud-based accounting software or using online payment gateways.

7.2 Embrace Automation:

Automate repetitive tasks such as invoice generation, payment processing, and reminders. Automation reduces human errors and frees up time for staff to focus on more strategic tasks.

7.3 Reduce Manual Intervention:

Minimize manual intervention in the accounts receivable process by streamlining workflows and leveraging digital tools. This leads to increased accuracy and efficiency in managing receivables.

Challenge 8: Credit Risk and Bad Debts

Extending credit to customers always carries an inherent risk of bad debts. Mitigating this risk is essential to maintaining a healthy financial position.

8.1 Implement Thorough Credit Screening:

Conduct a thorough credit screening process before offering credit to customers. Analyze credit history, financial statements, and other relevant data to assess creditworthiness accurately.

8.2 Set Credit Limits Based on Financial History:

Set appropriate credit limits for customers based on their financial history and risk profile. Avoid overextending credit to minimize the potential for bad debts.

8.3 Regularly Review Customer Creditworthiness:

Customer financial situations can change over time. Periodically review customer creditworthiness and adjust credit limits or terms accordingly.

Challenge 9: High Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) is a critical metric that measures the average time it takes for a business to collect payment after a sale. A high DSO indicates slow payment collection, which can impact cash flow negatively.

9.1 Improve Invoicing Efficiency:

Streamline the invoicing process to ensure invoices are generated and sent promptly after a sale. Prompt invoicing encourages customers to make timely payments.

9.2 Enhance Communication with Customers:

Maintain consistent communication with customers to remind them of upcoming payment due dates and address any questions they may have.

9.3 Offer Flexible Payment Options:

Providing customers with multiple payment options, such as online payments, credit cards, or Automated Clearing House (ACH) transfers, can facilitate faster payment processing.

Conclusion:

Effectively managing the accounts receivable process is essential for maintaining a healthy cash flow and financial stability. By addressing the common challenges discussed in this article and implementing the suggested strategies, businesses can enhance their collection efforts, reduce DSO, and foster positive relationships with customers.

Embracing digital solutions, setting clear credit policies, improving communication, and implementing an efficient collections strategy will lead to a more streamlined and effective accounts receivable process, ultimately contributing to the overall success of the business.