BNPL and its Impact on Loan Defaulting

What is BNPL?

Buy Now Pay Later (BNPL) is a concept that was created many years ago, starting with shopkeepers in your local area. The shopkeepers will keep an account or a ledger entry for each of their regular customers or clients. The amount will be paid at the end of the month. They can tally the purchases with the bill sent by the shopkeeper before making the payment.

This fintech-enabled payment option is popular in e-commerce platforms, and it has come into being to pay for larger purchases by extending it over several smaller payments. Though BNPL is popularly known for catering to individuals, it has also slowly moved into the business credit space.

The general trends show if shopkeepers offer credit, the chances of customer transactions are higher. People still go for credit when it comes to payment if, though, they have the money. A customer goes to the shop and wants to buy something. They are not carrying the cash, and if the shopkeeper lets them go, they might not return to buy the item. At this point, the shopkeeper can opt for Buy Now Pay Later (BNPL).

Many customers prefer the Buy Now Pay Later option because they are not required to pay immediately. Their bank balance looks good for a while, though eventually, it will go down. The constant cash exchange can be a bit hassling, and the Buy Now Pay Later is an excellent way to reduce that. Customers like the idea of paying in installments and having no interest rates. Since the amounts are small, it is easy for lenders to get their money back.

Defaulting Buy Now Pay Later Options

Though BNPL became popular during the pandemic, some customers defaulted on the loan payment.

The customers’ credit score decreases if the BNPLs report these defaults to the credit bureaus.

Defaulting Buy Now Pay Later can prevent customers from using their BNPL accounts for other new transactions.

There is no interest on defaulting Buy Now Pay Later, but there can be a charge of additional fees when loan defaulting happens.

Customers should remember to repay BNPL without delay so that defaulting Buy Now Pay Later does not happen.

BNPL options are usually available with Fintech companies and some banks and are the best way to borrow at a lower cost. It gives the borrowers flexibility when dealing with their short-term financial requirements.

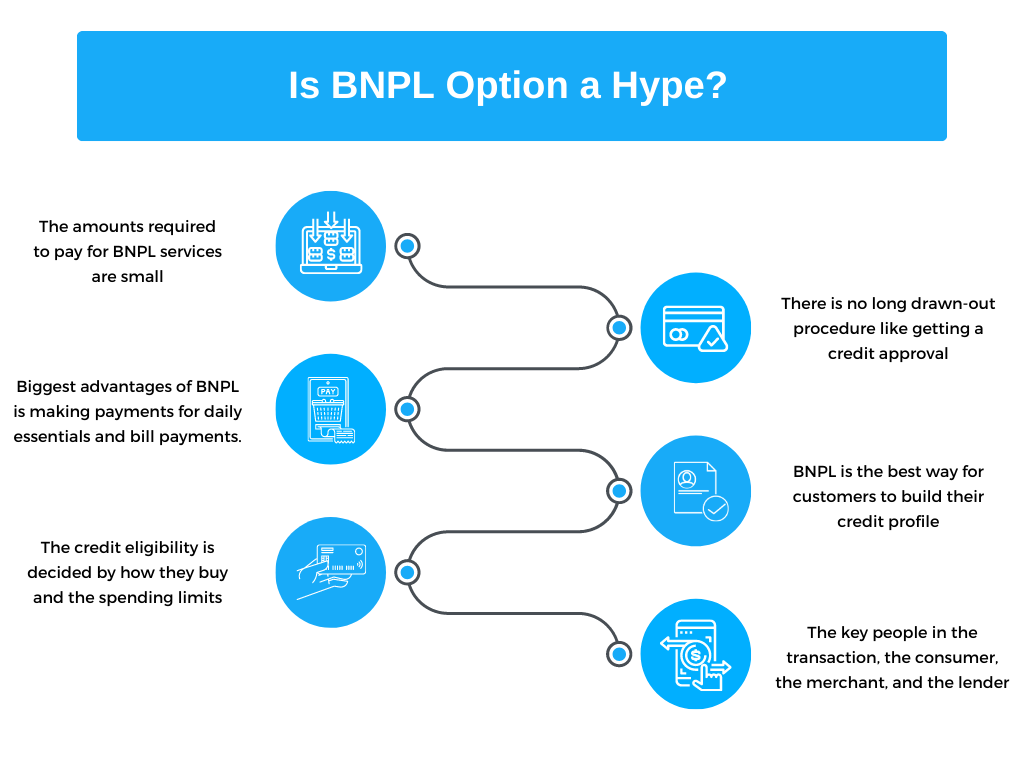

Is BNPL Option a Hype?

There is always a doubt surrounding BNPL options, whether it is hyped or the risks involved are significant.

There are two BNPL products: a small ticket credit with an interest-free period and the other for more significant purchases that use EMI options.

The amounts required for BNPL services are small and deducted from the borrower’s debit/credit card. Young consumers nowadays are smart enough to avoid high-interest credit lines. The borrowers plan better and avoid the credit mistakes of the past. People who belong to low-income groups, young workers, self-employed people, and those with a low credit score or no credit score will find BNPL helpful as the credit card companies find them not deserving of having a credit card.

One of the most significant advantages of BNPL is that you can use it in your daily life, like making payments for groceries, everyday essentials, electronic items, and bill payments. Since BNPL is digital, their operation cost is low, enabling them to offer more minor credits.

The credit eligibility for BNPL is decided by determining how they buy and the spending limits of the customers. In case of defaulting Buy Now Pay Later happens by the customer, then the impact on their credit profile is the same as any other loan.

There is no lengthy drawn-out procedure like getting a credit approval which works in favor of BNPL and makes it more attractive to customers. The application process is also not complicated, and the borrowers find it easy and optimist

BNPL is the best way for customers to build their credit profile if they are new or have no credit eligibility. Another advantage of BNPL is that the customer need not get credit from a lender or a credit card provider. In BNPL, the credit is given directly at the time of sale, and it can be said to be a POS (point of purchase) financing.

The key people in the transaction, the consumer, the merchant, and the lender, get a compelling value proposition in a BNPL. The lender is usually a fintech. Since many of these companies do not report if the payment is not made on time, the customer’s credit score remains intact, and they can build a good credit history.

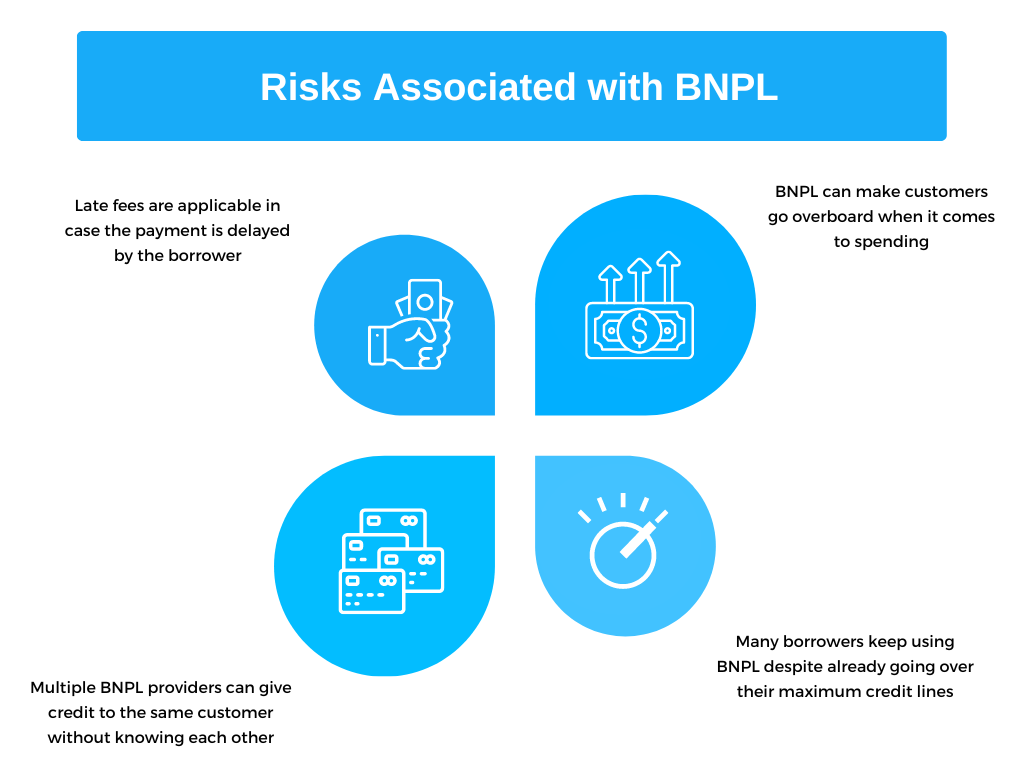

Risks Associated with BNPL

Late fees are applicable in case the borrower delays the payment. While the customers are given interest-free credit, they must pay on time, or it can affect their credit score. The nature of payment of BNPL as such gives customers a false sense of financial security and can encourage them to overspend.

BNPL, like the credit card, can make customers go overboard when it comes to spending, and the chances of defaulting on Buy Now Pay Later will be high if the customers overextend themselves.

Multiple BNPL providers can give credit to the same customer without knowing each other. All BNPL providers need not regularly report to the credit agencies; sometimes, consumers get an excess credit amount. Many of them might not even be able to repay the credit.

It is believed many borrowers keep using BNPL despite already going over their maximum credit lines, which might disqualify them if they use a credit card.

Summing it Up

This will give you an idea about defaulting Buy Now Pay Later, the advantages, and the risks associated with it. It is essential to understand how the BNPL loan system works to know how it can impact credit facilities in the future. You can assess the benefits, challenges, and disadvantages of BNPL before going for it. This short-term financing option suits the customer to buy something and pay it off later, and many of them are using the BNPL credit options nowadays, especially young consumers.