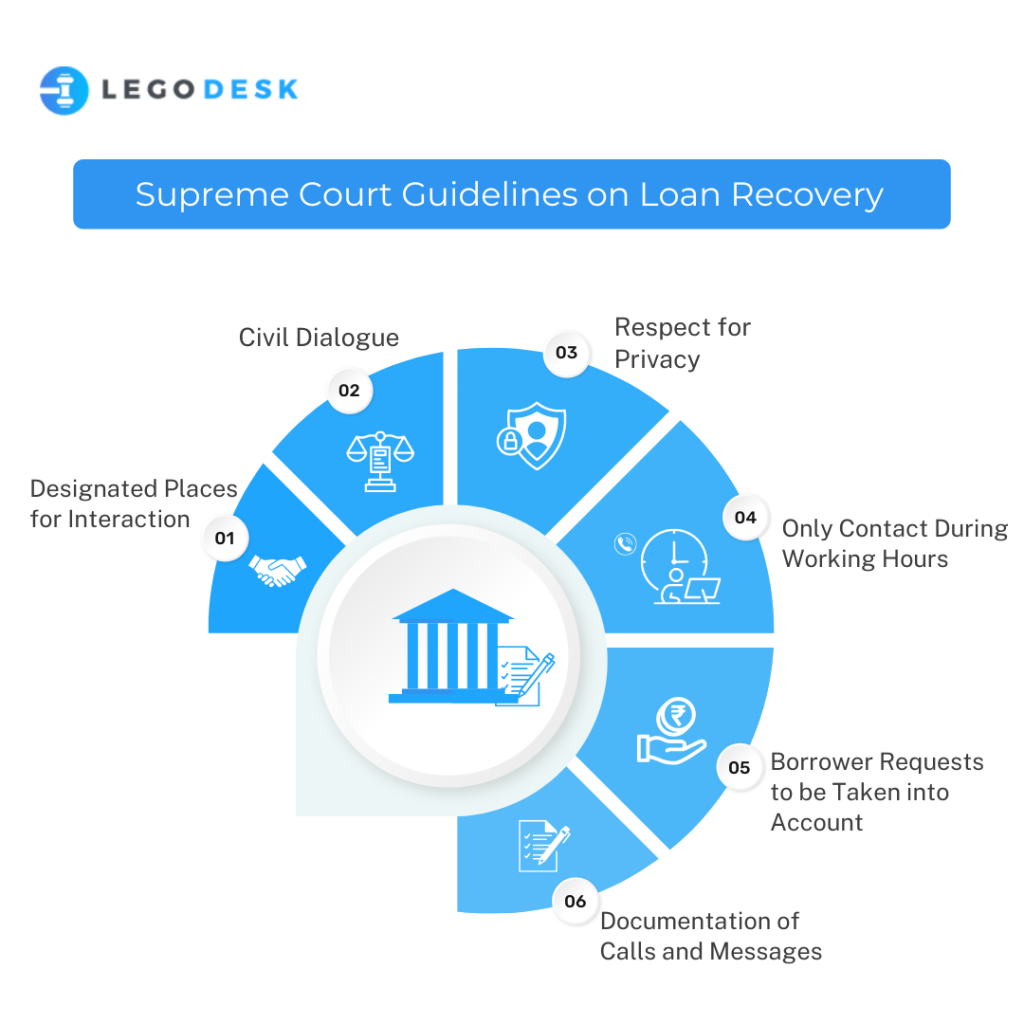

Supreme Court Guidelines on Loan Recovery

The loan recovery process is fraught with legal complications. Understandably so, since loan recovery tactics have resulted in numerous examples of adverse consequences in the past. The Reserve Bank of India as well as the Supreme Court have repeatedly reiterated that the existing guidelines for loan recovery need to be followed by both banks and non-banking financial institutions.

These guidelines are meant to provide guardrails within which lenders are expected to act. Lenders benefit from these guidelines since they provide direction and leadership and help lenders develop processes that are in the best interest of their long-term business goals and reputation in the market.

Here are some of the most important guidelines upheld by the Supreme Court of India on loan recovery.

Read Also: Effect of Criminal Case for Government Job

Designated Places for Interaction

Ordinarily, the borrower has the ability to choose the place where he can be contacted. For example, if the borrower does not wish to be contacted at his home or his place of work, then he can set up an alternative place where he will be contacted. This allows for the borrower to maintain his privacy.

According to the landmark Supreme Court judgment Shanti Devi vs. ICICI Bank, in case the borrower has not specified any such location, then the lender or the lender’s representative is can contact him at the residence. If the borrower is not available at his residence, then attempts can be made to contact them at the place of work.

Civil Dialogue

The Supreme Court has reiterated time and again that coercive action cannot be taken to recover loans. In 2023, the Madras High Court has also observed that using “muscle power” for the recovery of loans is illegal, and necessary steps need to be taken by lenders to ensure that their agents are well-versed in the methods that can be used to collect overdue payments.

The RBI has released its Code of Conduct on loan recovery and it explicitly mentions civil dialogue as one of the basic tenets that need to be followed.

Respect for Privacy

The RBI in its guidelines has stated categorically that the privacy of borrowers needs to be respected by loan recovery agents. However, the exact meaning of this guideline can be a little vague. Lenders are allowed to use the KYC information provided by the borrower in their efforts to recover the loan. They can also provide this data to loan recovery agents who can use the data to call or visit the borrower in question.

In case the borrower has proven to be non-responsive and is successfully avoiding all chances of contact with loan recovery agents, then loan recovery agents are well within their rights to contact the closest members of family and friends in their efforts to trace the whereabouts of the borrower and get in touch with them.

Only Contact During Working Hours

The guidelines on loan recovery are explicitly clear that loan agents can only make contact with a defaulting borrower between the hours of 9 AM to 7 PM. No attempts to contact a defaulter can be made after or before these working hours. These guidelines have been put in place to avoid unnecessary harassment of borrowers.

Since the exact timings have been provided by the RBI, there is no room for interpretation. Agents are required to act accordingly otherwise they will be in direct violation of the code of conduct as implemented by the RBI that may result in adverse consequences for the lender.

Check this Article: Guide to Debt Recovery Laws in India

Borrower Requests to be Taken into Account

The borrower has the right to make certain types of requests from loan recovery agents according to the guidelines on loan recovery. The borrower can request that they should not be contacted during certain times and at certain places.

All attempts need to be made by loan recovery agents to respect these requests.

This rule has been put in place in order to avoid an invasion of the borrower’s time by loan recovery agents. However, it is also possible for borrowers to abuse this privilege by making unnecessary demands from loan recovery agents.

As it stands today, the Supreme Court has also observed that borrowers have the ability to ask loan recovery agents to make certain allowances.

Documentation of Calls and Messages

The Supreme Court has observed that all calls and messages that are sent to a defaulter need to be properly documented. There needs to be a complete record of all attempts being made to recover overdue payments and how these attempts are being made.

This guideline has been put in place since there is a high likelihood that a loan recovery matter can reach the courts of India. In such a scenario, it is helpful for adjudication to have access to the record of proceedings that occurred before the matter reached the court.

How Can Legodesk Help with Loan Recovery?

Legodesk understands how difficult the loan recovery process can be for lenders. The issue is further exacerbated by strict RBI guidelines on loan recovery. That’s why we have built Legodesk which has several features that can help lenders follow these guidelines.

We provide case management and contact management features that help lenders maintain the privacy of borrowers and also maintain records of all collection efforts. Further, we also provide a legal notice automation feature that helps escalate the issue in the event negotiations have broken down.

Overall, Legodesk can be an effective partner for loan recovery agents and help increase efficiency and deliver better results.

Read Also: 10 Ways To Make Debt Recovery Easier!

Wrapping Up

Loan recovery agents need to be careful of how they approach borrowers and handle delicate negotiations. A balance needs to be maintained when reaching out to borrowers between asserting the lender’s rights to receive due payments and respect for the borrower’s situation and the civility required in modern society.

The RBI and Supreme Court guidelines for loan recovery apply to all banks and NBFCs and are expected to ensure that they are followed when loan recovery attempts are made in India.