All About SCGST CGST and IGST

Goods and Services Tax (GST) is an indirect tax (or consumption tax) collected in India on the supply of goods and services. GST is levied at each step in the production procedure however is intended to be refunded to all parties in the different phases of production other than the last customer.

GST is a destination-based tax, an end-user consuming any goods or services is responsible to pay the Goods and Services Tax. The tax is received by the State in which the goods or services are consumed and not by the State in which such goods are manufactured. In instances of exports, the dealer of the goods or services is exempted from paying the tax.

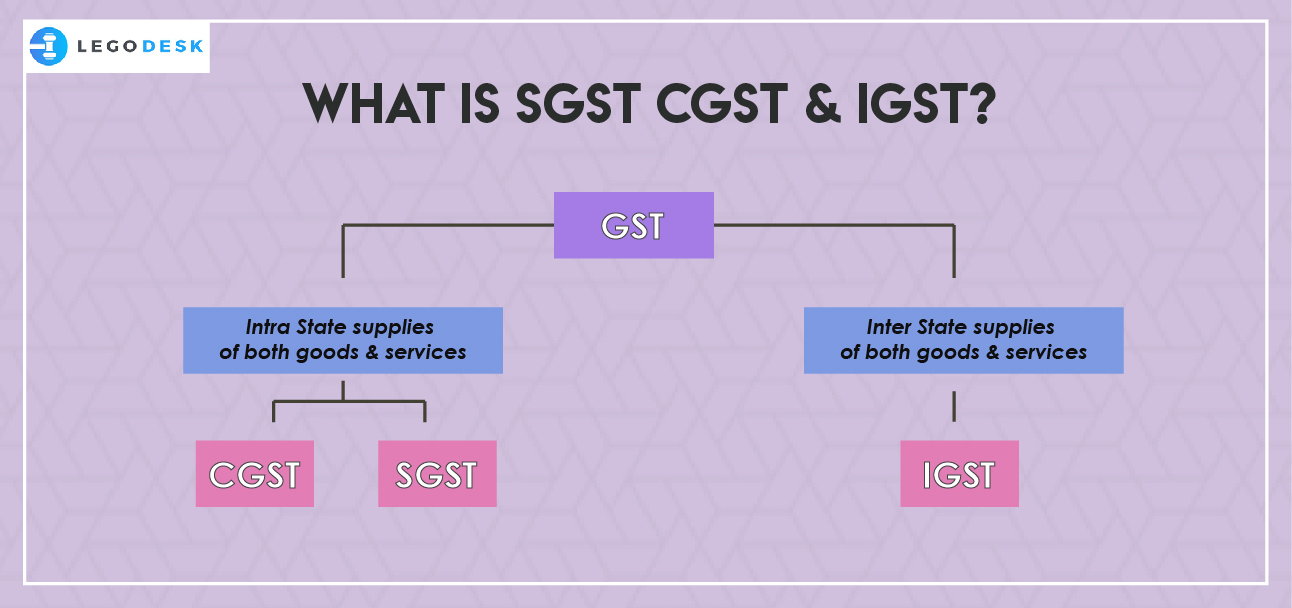

GST expels the falling impact of the tax, i.e., tax on tax. What’s more, this is the place the ideas of CGST, SGST, and IGST come into the image.

1. What are the taxes that got replaced by GST?

Dissimilar to prior when there were various taxes, for example, Central Excise, Service Tax, and State VAT and so forth., under GST, there is only one tax. GST is arranged into CGST, SGST or IGST relying upon whether the exchange is Intra-State or Inter-State.

2. What is Central Goods and Services Tax (CGST)?

Under GST, CGST is a tax collected on Intra State supplies of both goods and services by the Central Government and will be administered by the CGST Act. SGST will likewise be imposed on the same Intra State supply however will be governed by the State Government.

This infers both the Central and the State governments will concede to combining their levies with an appropriate proportion for revenue sharing between them. In any case, it is clearly referenced in Section 8 of the GST Act that the taxes be levied on all Intra-State supplies of goods as well as services yet the rate of tax will not be surpassing 14%, each.

3. What is State Goods and Services Tax (SGST)?

Under GST, SGST is a tax levied on Intra State supplies of the two goods and services by the State Government and will be governed by the SGST Act. As clarified above, CGST will likewise be collected on the same Intra State supply however will be governed by the Central Government.

Note: Any tax liability obtained under SGST can be set off against SGST or IGST input tax credit only.

4. What is Integrated Goods and Services Tax (IGST)?

Under GST, IGST is a tax levied on all Inter-State supplies of goods or services and will be governed by the IGST Act. IGST will be pertinent on any supply of goods as well as services in the two instances of import into India and export from India.

Note: Under IGST,

Exports would be zero-rated.

The tax will be shared between the Central and State Government.

5. What decides whether CGST, SGST or IGST is applicable?

To decide if Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST) or Integrated Goods and Services Tax (IGST) will be applicable in a taxable transaction, it is imperative to initially know whether the transaction is an Intra State or an Inter-State supply.

Intra-State supply of goods or services is the point at which the location of the provider and the place of supply i.e., the area of the purchaser are in the same state. In Intra-State exchanges, a merchant needs to gather both CGST and SGST from the purchaser. The CGST gets stored with Central Government and SGST gets saved with State Government.

Inter-State supply of goods or services is the point at which the location of the provider and the place of supply are in various states. Likewise, in instances of export or import of goods or services or when the supply of goods or services is made to or by an SEZ unit, the transaction is thought to be Inter-State. In an Inter-State exchange, a merchant needs to gather IGST from the purchaser.

6. Why split into SGST, CGST, and IGST?

India is a federal nation where both the Center and the States have been appointed the powers to impose and collect taxes. The two Governments have particular responsibilities to perform, according to the Constitution, for which they have to raise tax revenue.

The Center and States are simultaneously levying GST.

The three kinds of tax structure are implemented to enable taxpayers to take the credit against one another, in this way guaranteeing “One Nation, One Tax”.