Section 269ST of Income Tax Act, 1961

Black Money is one of the biggest problems in the Indian economy. One of the root causes of this has been the cash transactions between parties in India. Cash transactions leaving no record behind are a very easy way to deal with black money. The Government in the past few years has taken important steps to impose a limit on cash transactions. From demonetization to promoting Digital payments, the government has tried to make things better.

Read Also – KNOW!! Why Do Lawyers Wear Black Coat??

Limit on Cash Transactions and Section 269ST

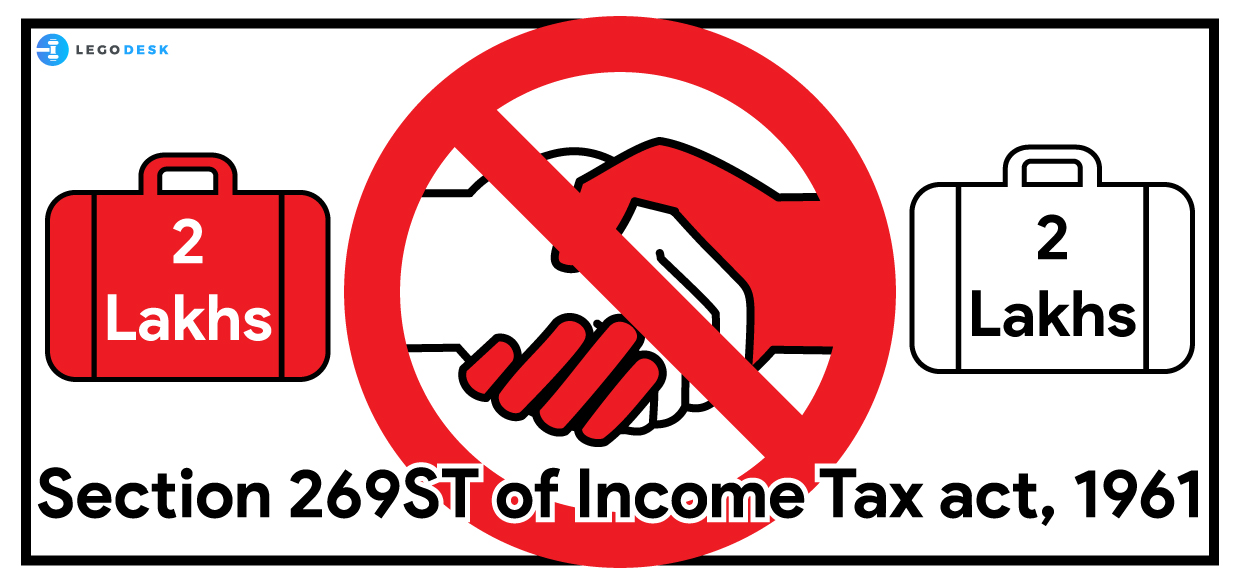

In pursuance of this, Section 269ST was added to the Income Tax Act, 1961 in 2017.[i] Section 269ST states that no person shall receive an amount of Rs 2 Lakh or more:

- In aggregate from a person in a day; or

- In respect of one transaction; or

- In pursuance of transactions related to one event or occasion from a person.

Though, the Central Board of Direct Taxes (CBDT) has said that this limit on cash transactions does not apply for withdrawals from Banks and Post offices. Also, the proviso to the section 269ST says that it is not applicable to:

- Cash received through an Account Payee Cheque or an Account Payee Bank draft or use of electronic clearing system (ECS) through a bank account.

- Any receipt by the Government, or a bank or a Post Office.

- Transactions referred to in section 269SS.

- Such other persons or class of persons or receipts, which the government may, by notification Official Gazette, specify.[ii]

Read Also – What is Current Account

Background of Limit on cash Transactions

Earlier, provisions under sections 269SS and 269T of the Income Tax Act, 1961 were included in the Act. It was done to disallow acceptance and repayment of loans/deposits/specified sums in cash for more than Rs. 19999. The purpose was to put a check on black money. However, that did not yield very good results. The Courts used to levy the punishment for contravention of these provisions because of the Legislative intent. The Courts when believed that a person acted in bona fide intentions and not for black money, the person was not held liable.[iii]

In a case,[iv] the Bombay High Court held that even when there is a technical violation of Section 269SS or 269T, no penalty is leviable;

- If the transaction under question is genuine

- When the transaction is recorded in books of the parties to the transaction

- If identity and confirmation of parties to the transaction are on record.

- If the transaction involves no black money, tax evasion or malafide intention.

Read Also – Legal Considerations When Buying & Selling Property

The penalty under Section 269ST

If a person receives an amount more than 2 lakhs, thus contravening the provisions of Section 269ST, he is liable to pay such amount as penalty.[v] However, if such person proves that there were sufficient reasons for the contravention, he will not be liable. Though, the Act does not clarify what would constitute good and sufficient reasons. The legislative intent behind Section 269ST is not to curb Black money but to promote the Digital economy. This makes the penalty under Section 271DA more functional than Sections 271D and 271E.

Meaning of Good and Sufficient Cause under Section 271DA

For Sections 271D, 271E, the exception was reasonable cause under Section 273B. However, the Finance Act, 2017 brought the exception to Section 271DA in its proviso only. The Law Lexicon defines Reasonable Cause as “as applied to human action, that which would constrain a person of average intelligence and ordinary prudence.”[vi] Also, the term ‘Good cause’ means a substantial reason or a legal excuse for failing to perform an act required by law.[vii] Also, the term sufficient means adequate or enough, in law.

Comparing these terms in accordance with the backdrop of the circumstances in which this provision was introduced, we see that even if there is a mere technical contravention of Section 269ST, without any bad intention, the person would still be liable under Section 271DA. Hence, even the casual and unintended contravention of the section may also result in a penalty.

Conclusion

Limit on Cash Transactions is an efficient way to create a two-fold opportunity for India. This has created an opportunity to curb Black Money, as well as help, develop India as a modern economy on the digital platform. Section 269ST has provided for a way to limit the perpetrator from involving in black money transactions. Also, the contravention of the same cannot be easily justified either. To prove the presence of good and sufficient cause is more difficult than proving reasonable cause. The Limit on Cash Transactions can be a way out for India from the nightmare of Black money which has terrorized the country for so long.

[i] The Finance Act of 2017.

[ii] ‘Cash Transactions – Limits and Liabilities – Income Tax’ (India Fillings) accessed 19 December 2018.

[iii] Hindustan Steel Ltd v State of Orissa 83 ITR 26.

[iv] CIT v Triumph International Finance 345 ITR 270.

[v] Income Tax Act 1961, s 271DA.

[vi] The Law Lexicon, 3rd Edn.

[vii] People v Gillet